On March 22, a significant batch of Bitcoin options are set to expire, potentially increasing market volatility. Bitcoin and the crypto markets have had a volatile week. After dropping to $61,500 on March 20, Bitcoin showed a slight recovery. The large options expiry event happening today, with about 25,300 Bitcoin contracts set to expire on March 22, could lead to further volatility.

Bitcoin and the Futures Market

This week’s expiry event is slightly lower than last week’s, but a significant event worth nearly $10 billion will occur at the end of the month. The nominal value of Bitcoin derivatives expiring today is $1.8 billion. Additionally, the put/call ratio for these Bitcoin options is 0.57, meaning nearly twice as many long contracts have been sold compared to short contracts.

According to Deribit, there is nearly $1 billion worth of open interest or unsettled contracts at the $65,000 strike price. Other high OI strike prices for calls include $60,000, $70,000, and $75,000.

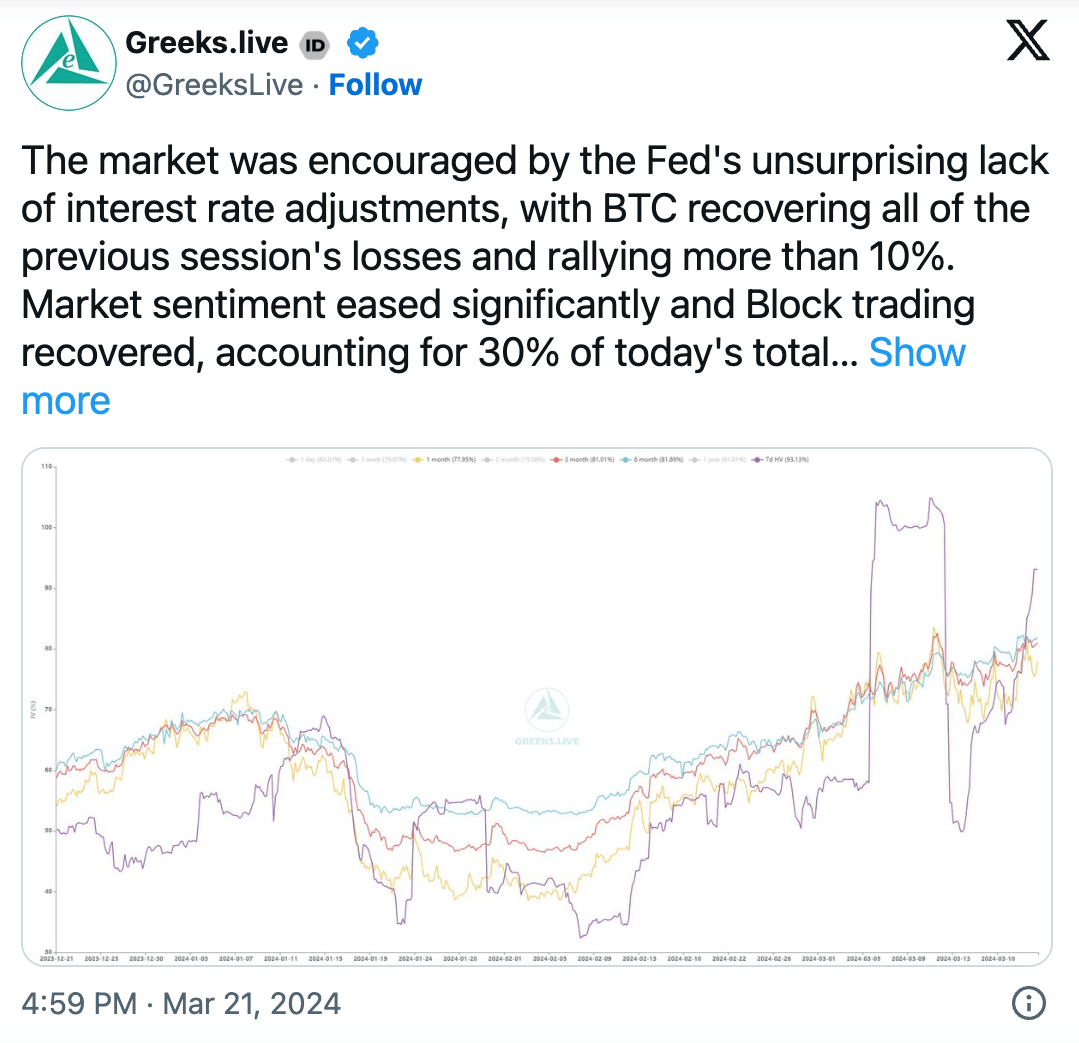

The crypto derivatives data provider Greeks Live stated that the market is emboldened by the lack of surprising interest rate adjustments from the Fed and that Bitcoin has recovered all its losses from previous sessions, sharing the following comments:

“While high realized volatility maintains its upward level, option data shows a more balanced long and short power, indicating the market’s bullish foundation remains intact.”

What’s Happening in the Crypto Market?

In addition to a large amount of Bitcoin options, about 253,000 Ethereum contracts are also set to expire today. These contracts have a nominal value of $885 million, and the put/call ratio is 0.51. The largest open interest is worth approximately $659 million at the $4,000 strike price for Ethereum, but there is also $564 million OI at $3,000.

As the correction in the crypto market continues, the total market value has fallen by 2.5%, dropping to $2.6 trillion. According to CoinGecko, approximately $236 billion has exited the crypto markets since the total capital reached its peak on March 13. At the time of writing, Bitcoin has fallen nearly 0.31%, trading at $65,352, while Ethereum has dropped 1.05%, falling to $3,455. Apart from marginal gains by Binance Coin (BNB) and XRP, all other altcoin projects were in the red.

Türkçe

Türkçe Español

Español