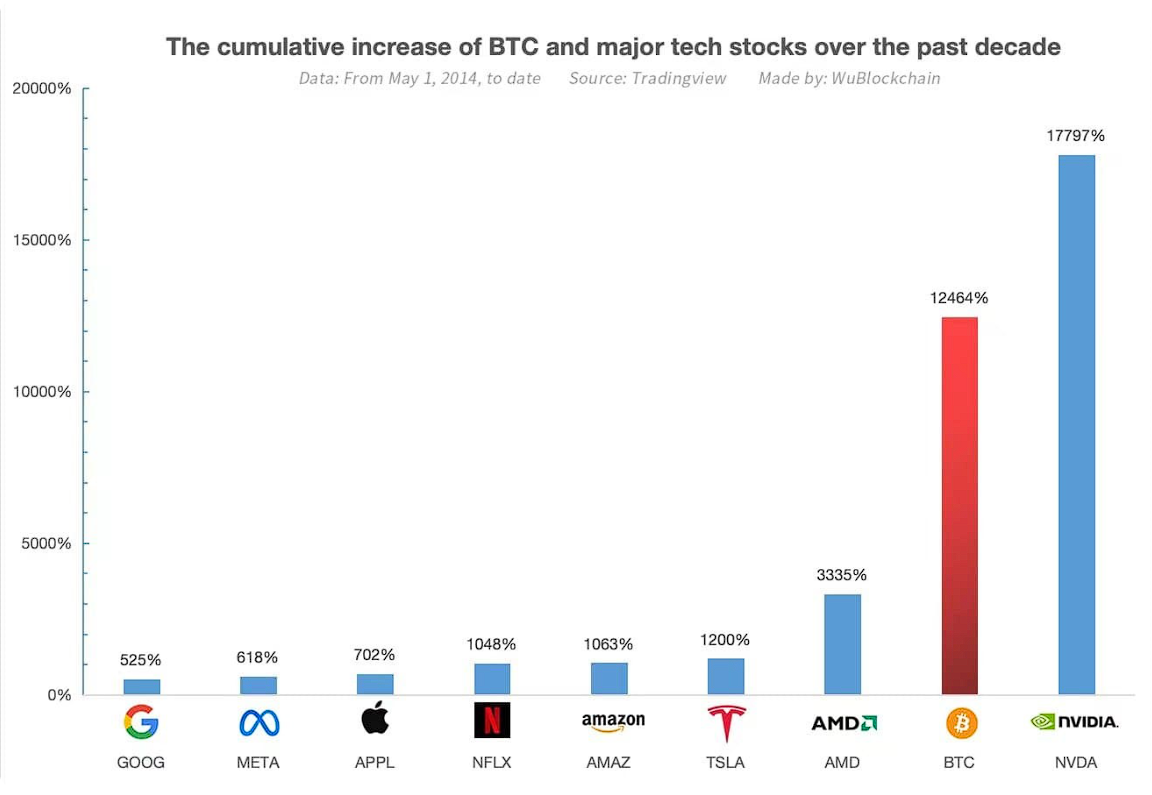

In the last decade, Bitcoin (BTC) experienced a massive increase of 12,464%, surpassing tech giants such as Amazon (NASDAQ: AMZN), Alphabet Inc (NASDAQ: GOOGL), and Netflix (NASDAQ: NFLX).

Comparison Between Bitcoin and Tech Giants

WuBlockchain shared an analysis on May 3rd on X (formerly Twitter), highlighting Bitcoin’s performance compared to nine major tech stocks. The analysis showcased Bitcoin’s rise from the past to the present against these companies.

According to the research, Nvidia (NASDAQ: NVDA) was particularly notable for its massive rise of 17,797% recently.

With the latest technological advancements, Nvidia’s GPUs and semiconductor products are seen as leading in value within the tech sector.

Despite Nvidia’s rise, Bitcoin’s position as second, especially in such a strong market, indicates significant impacts in the ever-changing financial world and reflects its potential.

The WuBlockchain team compiled the cumulative gains of BTC and nine major tech stocks like Google, META, Apple, Netflix, and Amazon over the last decade. BTC ranked second with a 12,464% increase, while Nvidia was at the top with a 17,797% increase.

Bitcoin and Investments

Cryptocurrencies have always shown volatile price movements within four-year cycles. Despite this volatility, Bitcoin’s growth over the last decade demonstrates its solid structure and potential to investors.

Diversifying portfolios is a known method for investors to mitigate future risks. The analysis shows that Bitcoin, alongside various tech giants’ stocks, could be considered a potential investment vehicle.

Bitcoin Price and Its Future

As of this writing, Bitcoin was finding buyers at $63,532 after a daily correction of 0.86%. A weekly review showed that Bitcoin had risen by more than 1%.

Despite recent market downturns and significant reductions in miner revenues post-halving, investors and analysts remain optimistic about Bitcoin’s long-term outlook.

Moreover, concerns about centralization and regulatory challenges continue to grow.

Despite these challenges, the scarcity of Bitcoin, capped at 21 million tokens, continues to be a notable factor driving its value increase.

Industry leaders predict short-term bidirectional price movements in the market, but believe that Bitcoin could move to much different points in the long term.

Many analysts have shared price targets for Bitcoin reaching $150,000 and even $1 million in previous periods.

Due to Bitcoin’s solid stance, it has surpassed the stocks of major tech companies, potentially playing a very different role in the investment world in the future.

Türkçe

Türkçe Español

Español