In a year characterized by economic uncertainty, persistent high inflation, and rising interest rates, Bitcoin (BTC) emerged as a standout performer, surpassing other traditional asset classes. Despite the overall consolidation and narrow trading range of cryptocurrencies, Bitcoin’s performance has garnered the satisfaction of its investors.

Bitcoin: The Most Profitable Investment Asset

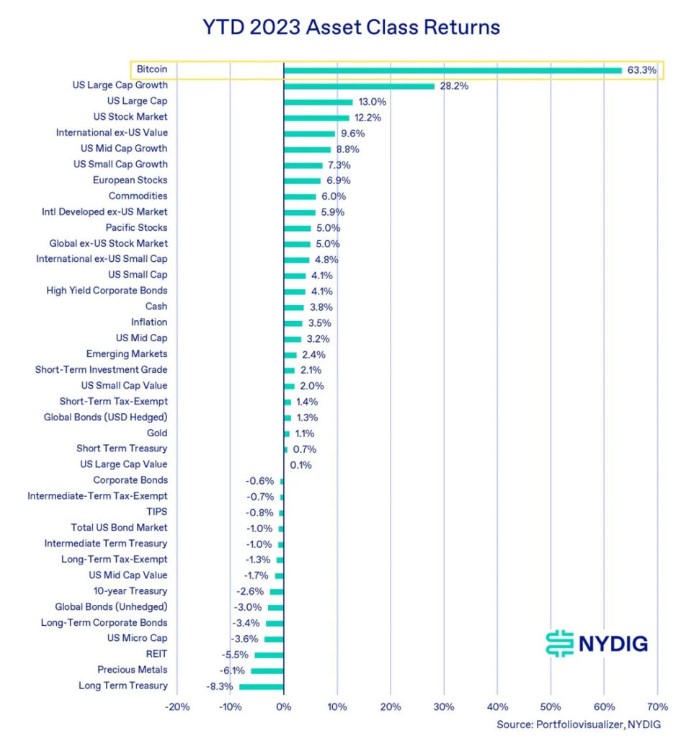

NYDIG released some data on October 6th, highlighting Bitcoin’s remarkable performance with a 63.3% increase, making it the best-performing asset in 2023. It is worth noting that Bitcoin achieved this feat among 40 other asset classes. The second-best performing asset class, with a 28.2% gain, was the high-cap growth of the United States.

The most remarkable aspect of Bitcoin’s performance is its ability to withstand adverse economic conditions and maintain its value within a relatively narrow trading range despite significant external pressures. The cryptocurrency settled in the range of $25,000 to $31,000 after its initial surge at the beginning of the year.

Subsequently, it resisted potential breakouts in both directions. Despite a 11.1% decline in the third quarter, investors remained satisfied with the gains achieved since the beginning of the year.

Factors Driving Bitcoin’s Rise

As stated in the company’s report, it is useful to emphasize that Bitcoin always has the potential to rise due to various factors such as interest rate decisions, court rulings, approval of ETF applications, etc.

However, it is important to acknowledge that Bitcoin is largely influenced by its unique factors. Looking ahead, we are optimistic that significant industry developments, such as the potential introduction of a spot ETF and the upcoming halving, will play a more prominent role in increasing Bitcoin’s value.

Market participants are also researching potential price levels that could indicate the start of a bullish move. Those following this process continue to closely monitor ETF news as well as macroeconomic conditions that may arise.

At the time of writing, Bitcoin’s price had experienced a nearly 1% daily increase and was trading at around $28,000. On a weekly basis, Bitcoin saw an approximately 4% increase.

Türkçe

Türkçe Español

Español