Bitcoin price is currently finding buyers at $64,000, while all altcoins have turned red. The market’s appetite is waning due to macroeconomic negativity, strong sales in the ETF channel, and now, war anxieties. Investors have increased their selling following the escalation of tensions between Iran and Israel.

Spot Bitcoin ETF

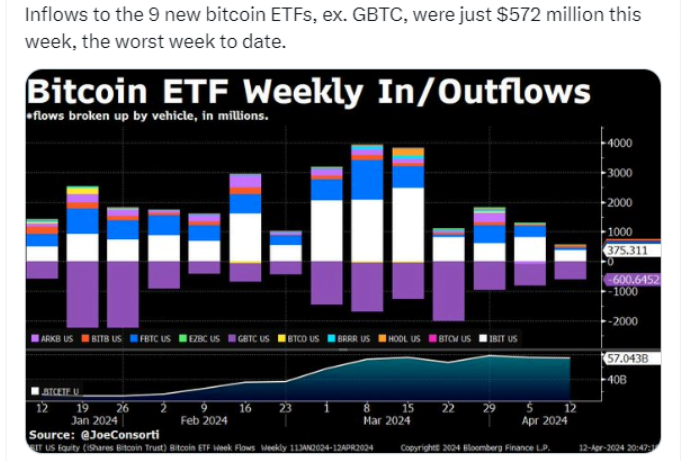

Grayscale Bitcoin Trust (GBTC) saw an outflow of $166 million on Friday. According to Farside Investors data, since the approval of the spot Bitcoin ETF in January, there has been a net sale of $16.2 billion in GBTC. This figure is massive for GBTC, which started the year with a reserve worth over $25 billion.

Fortunately, ETFs from Fidelity and BlackRock have seen strong interest from buyers, significantly offsetting the sales. BlackRock alone has reached a BTC reserve size of over $17 billion. There are two main reasons for this. The first is that investors who bought six months before the launch to benefit from the negative premium had the opportunity to sell at a very profitable rate.

The other reason is GBTC’s attempt to turn the process into a profit by charging a much higher transaction fee of 1.5%, compared to the 0.30% average fee applied by its competitors. Grayscale was already expecting quick sales from investors benefiting from the negative premium and maintained high transaction fees to maximize gains from the massive volume.

Throughout April, daily outflows from GBTC remained between $75 million and $300 million. While inflows to other ETFs slowed down in the last week, GBTC experienced a net outflow of $767 million weekly.

Have GBTC Sales Ended?

Grayscale CEO Michael Sonnenshein stated on April 10th that outflows from the Grayscale Bitcoin Trust would now subside. This comment, based on the optimism among investors and the melting away of assets that bankrupt companies needed to sell, boosted morale. However, data from Friday and the anxiety caused by the war suggest that the time for GBTC bears may not be over yet.

GBTC was launched as a trust in 2015 and won its ETF rejection lawsuit against the SEC last year. The court forced the SEC to act impartially, leading to the approval of GBTC as an ETF (conversion from trust to ETF) in January this year, along with other applications.

Türkçe

Türkçe Español

Español