Bitcoin (BTC) price continues to decline, and since it fell below the $65,000 level, there has been a noticeable drop in the general sentiment around BTC, the undisputed leader of the market.

Current Status of Miners

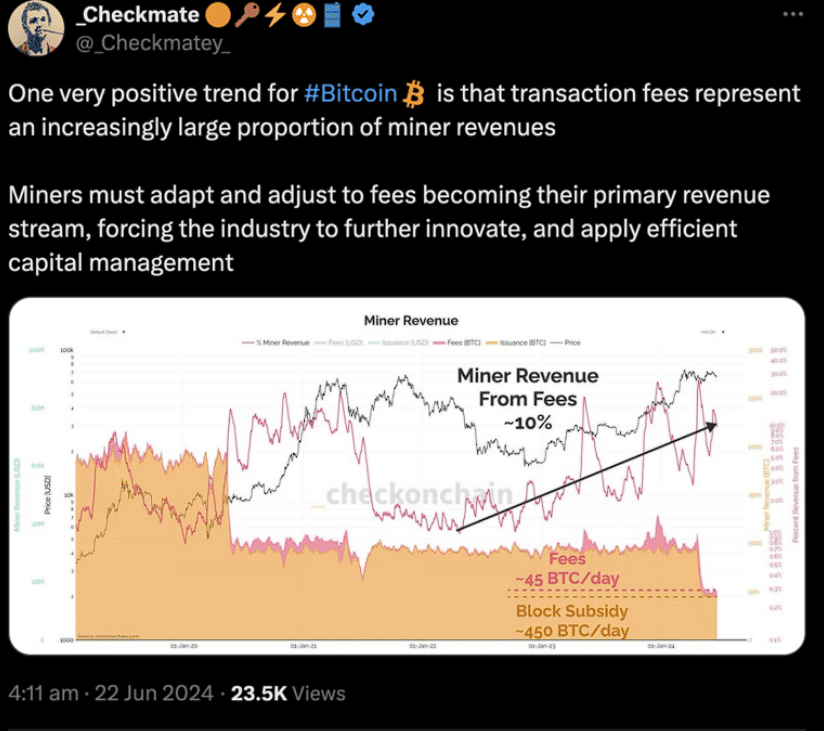

There is a positive outlook in the BTC mining process. Transaction fees are becoming a more significant part of miner revenues day by day.

This increase in revenues can be attributed to the decreasing Bitcoin supply due to halving and the rising number of transactions since the beginning of the year. Following recent developments, miners are seen to gain more value from transaction fees.

This change in revenues necessitates adaptation to the evolving ecosystem. They will need to make specific plans regarding the fees, which have become their primary source of income. This situation will push the sector towards more innovation and efficient capital allocation.

Decline in Bitcoin Activities

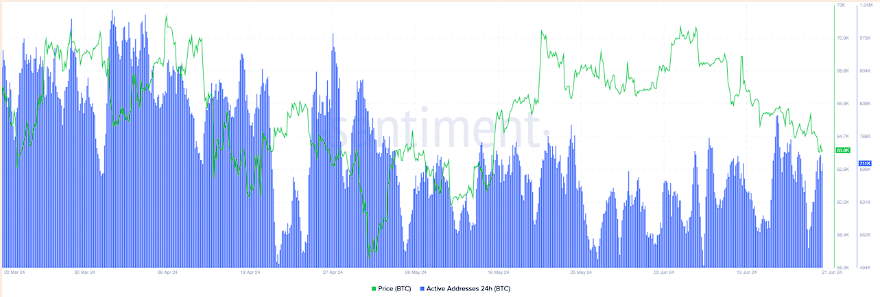

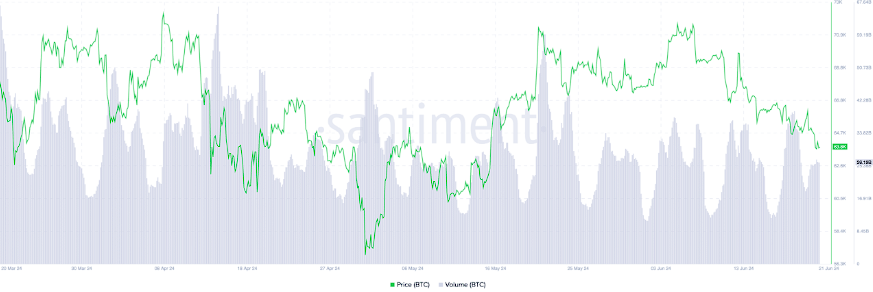

However, the current activities on the Bitcoin network could lead to problems for miners in the future. Analyzing the data provided by Santiment, it was observed that the daily active addresses conducting transactions on the Bitcoin network have significantly decreased over the past few months.

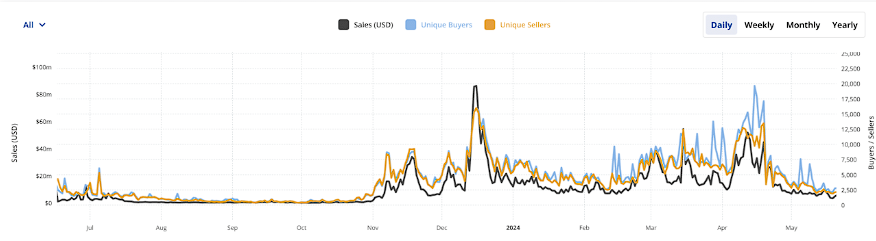

If the declines in the network continue, it would not be wrong to say that miners’ earnings from this process could decrease. Moreover, the NFT volumes that marked the past months on the Bitcoin network have also visibly declined.

Recently, Bitcoin has relinquished its top spot in NFT sales back to Ethereum. At the time of writing, Bitcoin has fallen to third place in the NFT sales process, with Polygon surpassing Bitcoin as another network.

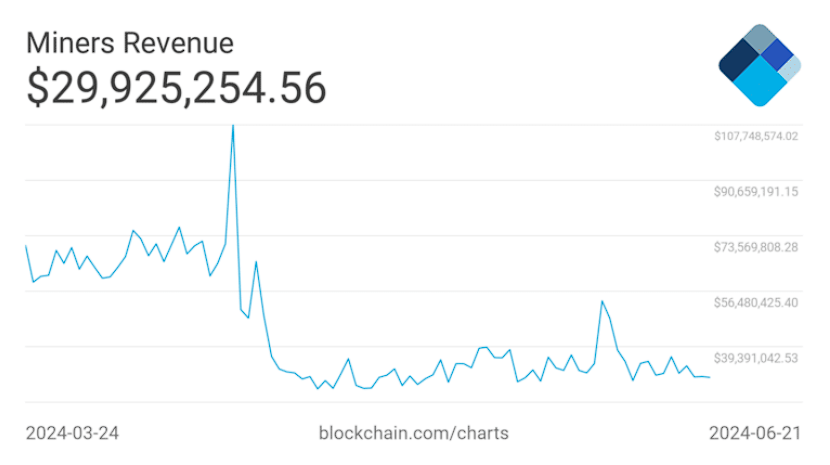

Bitcoin ecosystem’s declining interest has also led to a drop in miner revenues. In recent weeks, there has been a noticeable decline in daily miner revenues, falling from $50 million to $30 million.

If this decline in miner revenues continues, the mentioned group of miners may need to sell BTC to maintain their profitability. Consequently, a potential selling pressure on BTC could lead to further price drops.

At the time of writing, BTC was trading at $64,358, with no noticeable price movement in the last 24 hours.

Türkçe

Türkçe Español

Español