The past day saw the Bitcoin price fall below $65,000, triggering a wave of liquidations in the futures market. This event caused significant chaos in the cryptocurrency market. The sharp decline affected investors with long and short positions in the futures market, erasing approximately $565 million from the market.

Significant Losses in the Futures Market

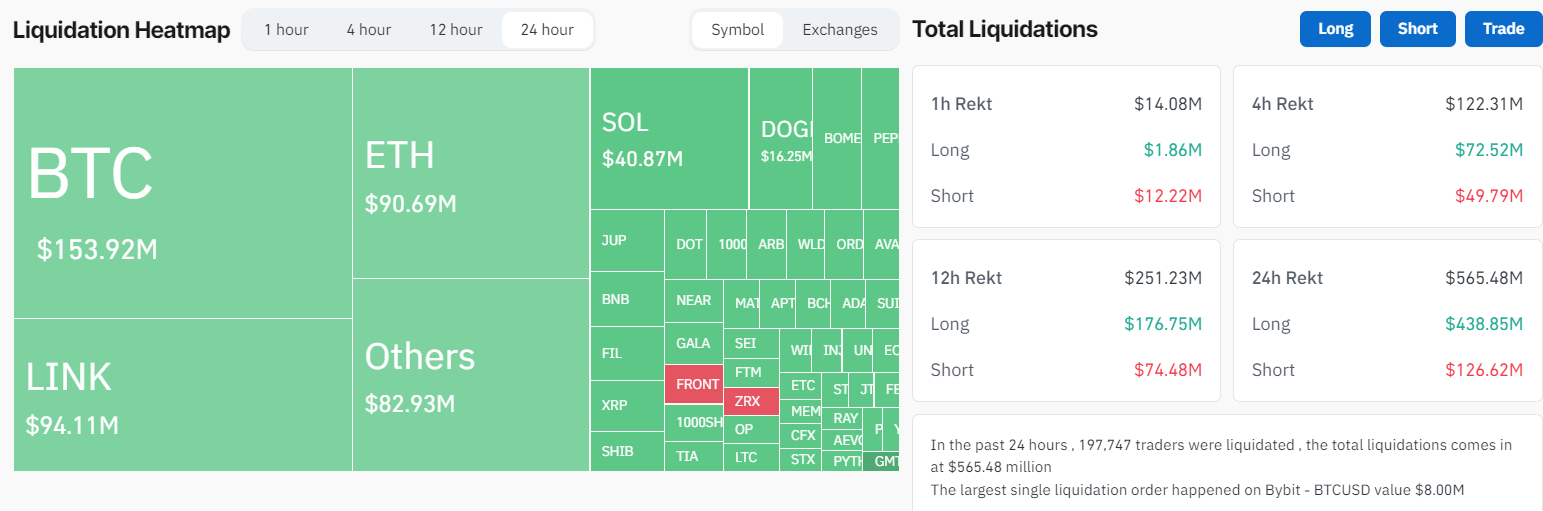

The downturn in the crypto market caught investors off guard, resulting in losses exceeding $400 million for this group in just one day. According to data from blockchain data analytics platform CoinGlass, price speculators suffered a total loss of $565 million during this period. Investors with long positions bore the brunt of the losses, totaling $438 million, while those with short positions faced $126 million in liquidations.

Specifically, investors in Bitcoin long contracts took the most significant hit, losing $153 million, followed by Chainlink investors with a loss of $94 million. Investors in Ethereum and Solana also suffered combined losses of over $130 million. This process affected more than 200,000 traders, with over 50% of them operating on the Binance and OKX exchanges.

Prominent Figure Makes Noteworthy Statement

The drop can be linked to the Bitcoin price reaching its lowest level since the beginning of March, falling below $65,000. As a leading crypto asset, Bitcoin’s price movements often set the tone for the overall market direction. Consequently, major cryptocurrencies like Ethereum, Avalanche, BNB, Cardano, and Chainlink experienced significant price drops.

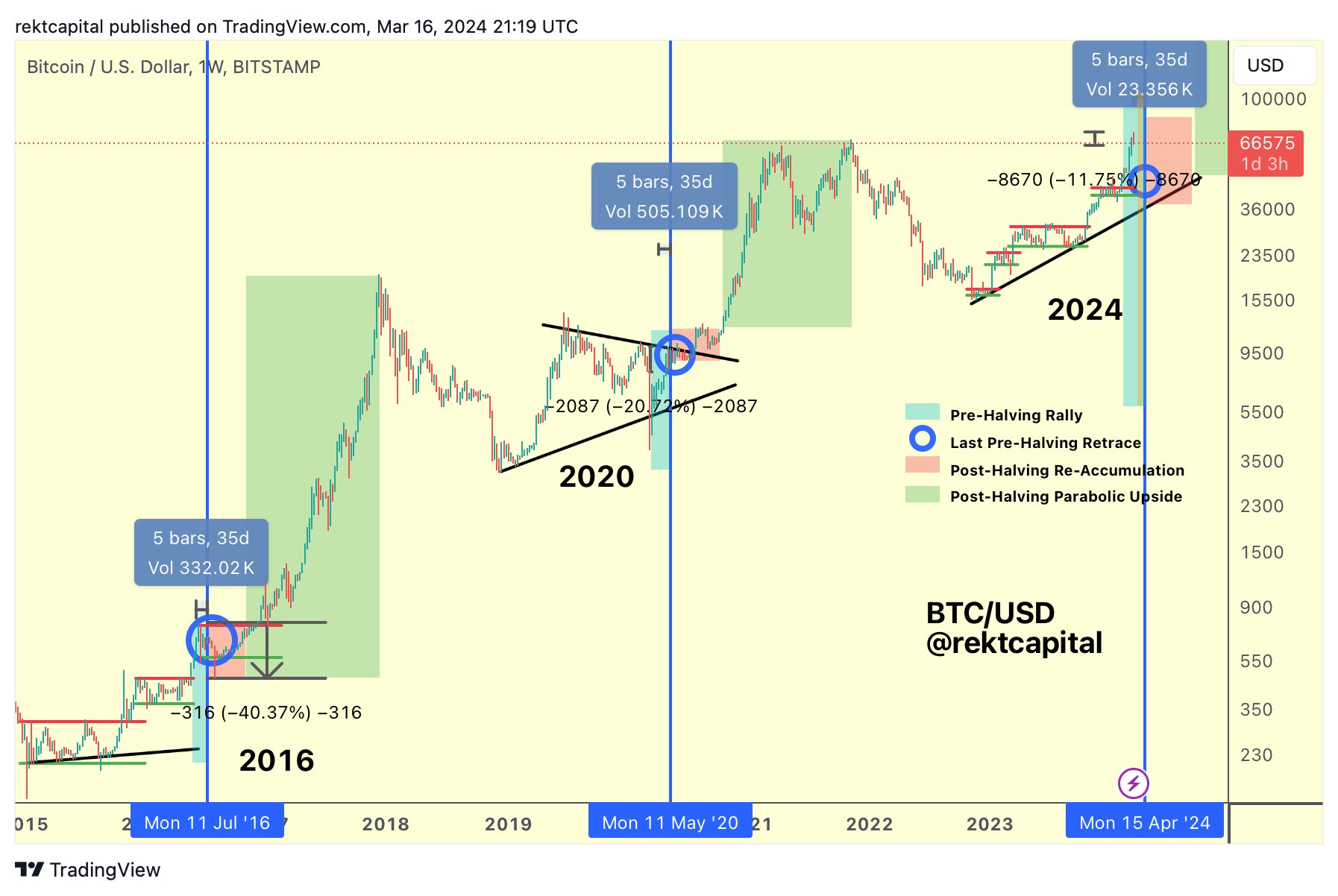

Meanwhile, several crypto analysts have interpreted this downturn as a predictable market behavior. According to Rekt Capital, despite the introduction of spot Bitcoin exchange-traded funds, the current bull market remains sensitive to a pullback before the halving. These pullbacks typically occur 14-28 days before the Bitcoin halving event.

Comparing previous cycles, the analyst noted that the current 11% pullback within 31 days following the Bitcoin halving event is similar to the past models that saw deep retracements of 20% and 40% in 2020 and 2016, respectively. The analyst commented on the matter:

“Bitcoin will experience a deep enough pullback to convince you that the bull market has ended, and then it will continue its upward trend.”

Türkçe

Türkçe Español

Español