Bitcoin price has dropped 24% since reaching $71,758 in early June. As sentiment continues to grow, the next direction of the leading cryptocurrency depends on three critical ongoing processes. Individual investors adjust their trading strategies based on market sentiment, explaining the highly volatile nature of the cryptocurrency.

Excitement Peaks for ETF Process

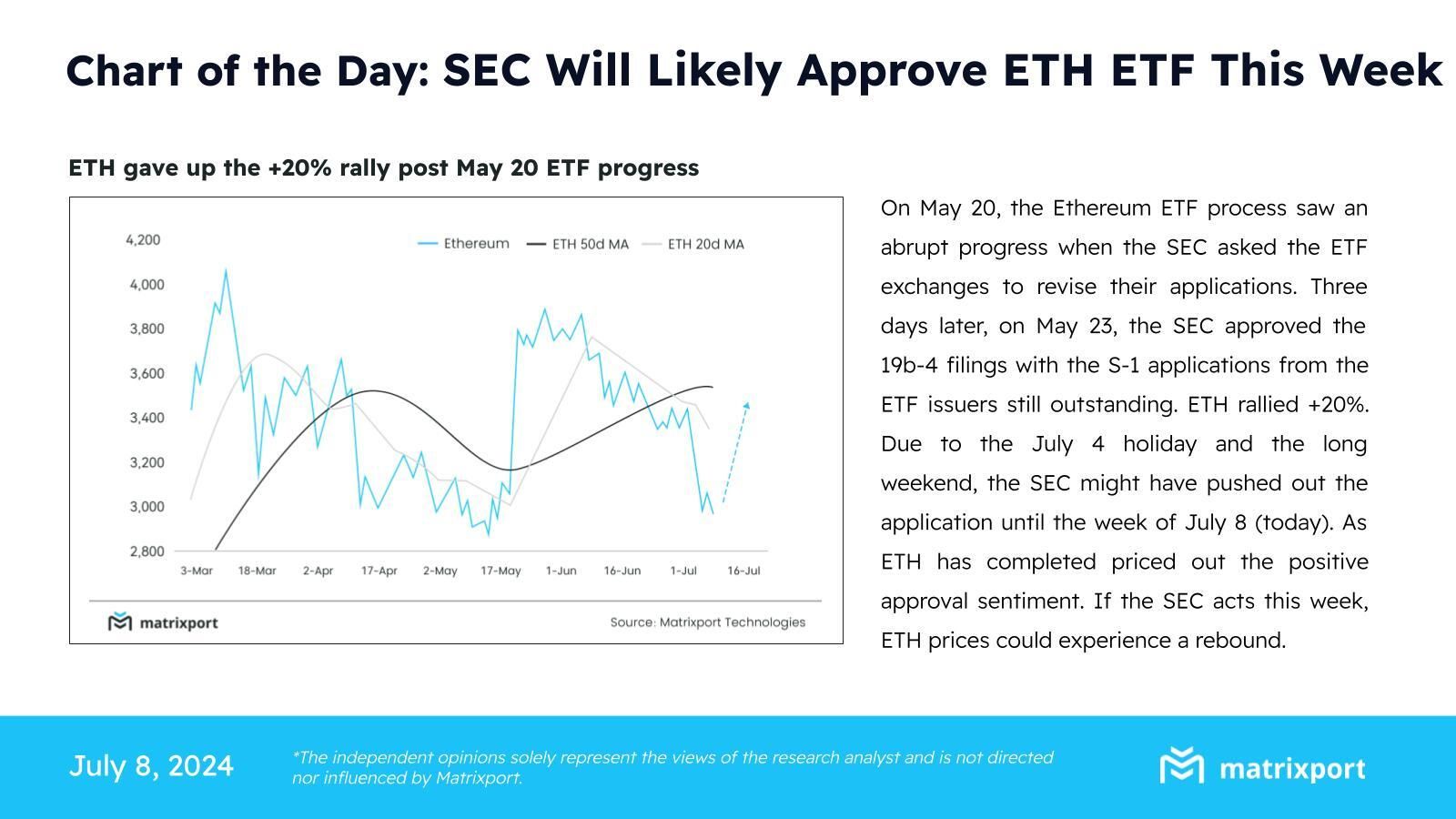

Crypto supporters join Ethereum investors to see if spot Ethereum ETF funds will start trading this week. The U.S. Securities and Exchange Commission (SEC) collected final S-1 Forms from potential ETH ETF issuers on July 8. This indicates progress in the approval process for these financial instruments.

Crypto financial services platform Matrixport also shares optimism about the process. The firm expects possible launches this week as the deadline for issuers to submit amended S-1 applications approaches. According to the report, progress could be as fast as in May when the regulator gave the green light to 19b-4 forms just three days after applications.

Matrixport’s report predicts Ethereum’s price could rise by 12% to $3,400 with the expected launch. This speculation emerged after Ethereum’s price increased by 20% following the approval of 19-b applications in May. The bullish sentiment from the approval is also expected to spread to Bitcoin and support its rise.

Mt. Gox Payments Continue

Concerns about Mt. Gox’s repayments continue to diminish. The Mt. Gox team started repayments for Bitcoin and Bitcoin Cash (BCH) last week. Bitstamp exchange announced an agreement with Mt. Gox to ensure investors receive compensation as soon as possible. A 60-day timeline for token distribution was highlighted, and some creditors have already confirmed receipt. Kraken, one of the five exchanges the trustee will use for repayment, has a 90-day timeline.

Japan’s Bitbank and SBI VC Trade exchanges have already received and distributed the allocated funds. By doing so, they effectively surpassed the 14-day timeline. As the trustee of the defunct exchange continues to repay creditors, market optimism continues to revive.

German Government and Bitcoin Transfers

Since June 19, the German government has moved over 10,000 Bitcoins. Nearly $1 billion worth of Bitcoin has been moved to various crypto wallets and exchanges, catalyzing recent Bitcoin sales due to potential supply shock concerns among investors. However, Arkham data indicates that the government’s reserves are depleting.

There is speculation that the German government will eventually slow down Bitcoin transactions, which could benefit the flagship crypto asset. Joana Cotar, a member of the country’s parliament and a well-known crypto activist, said that the German local media caught this call and expressed the anger of investors in the country.

Türkçe

Türkçe Español

Español