The Bitcoin price has once again dropped to the $28,800 region, which doesn’t come as a surprise to investors. It is expected that the support levels at $28,300 and $27,500 will be tested in the coming hours. The fear dominating the market is once again linked to Tether. The largest stablecoin, which was targeted by the CEO of Binance for no apparent reason, is now trading slightly below $1.

What’s Happening in the Crypto Market?

PayPal has launched a new stablecoin called PayPal USD (PYUSD), which is backed by the US dollar and issued by Paxos Trust Co. This new stablecoin, backed by US dollar deposits, short-term Treasury bonds, and similar cash equivalents, will be issued by the company that used to issue BUSD stablecoin.

The Chairman of the House Financial Services Committee in the US commented on this announcement:

“PayPal’s announcement shows that stablecoins hold promise as a part of our 21st-century payment system, provided they are issued under a clear regulatory framework.”

Spark Protocol

Spark Protocol, a lending platform recently launched by MakerDAO, faced criticism after preventing users from accessing its website through VPN. Users are unable to access the protocol’s website while their VPN is turned on.

Chris Blec, a DeFi analyst, expressed his disgust with this decision in a tweet on August 6th, emphasizing that it is a general ban on VPNs, not only in the US but worldwide.

Coinbase Challenges SEC Lawsuit

According to Coinbase’s legal counsel, the Securities and Exchange Commission (SEC) violated the legal process by suing Coinbase. In its filing to the New York District Court on August 4th, Coinbase stated that the SEC “abused its discretion and abandoned its previous interpretations of securities laws” while pursuing the exchange.

The SEC filed a lawsuit against Coinbase approximately three months after the crypto exchange received a Wells notice from the securities regulator on June 6th. The SEC is also taking legal action against Binance and Richard Heart, the founder of Hex.

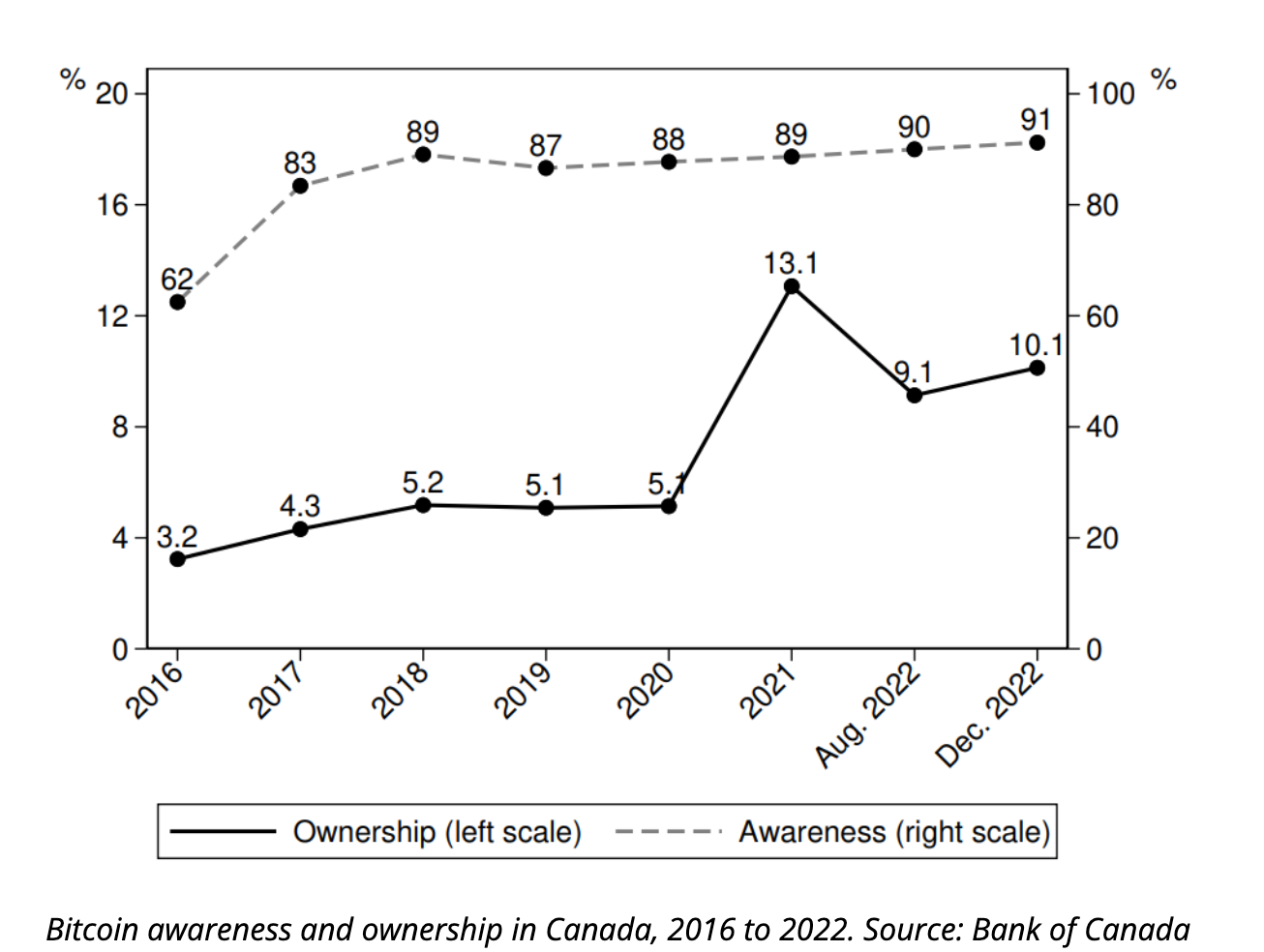

Crypto Ownership Declines in Canada

According to a Bank of Canada (BoC) survey published on July 26th, there has been a decline in Bitcoin and cryptocurrency ownership in the country in 2022, as neither market conditions nor regulations have been favorable for Canadian crypto investors.

The study includes data from the annual Bitcoin Omnibus Survey conducted by the Bank of Canada, which shows a decline following the significant crypto adoption witnessed in 2021. The losses suffered by the Canadian pension fund due to the FTX collapse also made headlines.

Coinbase: We Will Win the Lawsuit

Paul Grewal, the Chief Legal Officer of Coinbase, expressed their firm belief in winning the lawsuit during the second-quarter earnings announcement on August 3rd. This statement came alongside the announcement of $663 million in net revenue for the second quarter of 2023.

Interestingly, the exchange’s non-trading revenue surpassed its trading revenue in the quarter, with $335.4 million in net revenue from subscriptions and services compared to $327 million in trading revenue. Coinbase is now aiming to further diversify its revenue with the BASE network.