Bitcoin price had a fantastic end to 2023 and beginning of 2024, but the continuation of January has not been as spectacular. Investors accustomed to prices over $40,000 have been surprised by the ongoing decline, although a few months ago, the current price was even considered a challenging target. So what’s next, what awaits crypto?

Bitcoin (BTC)

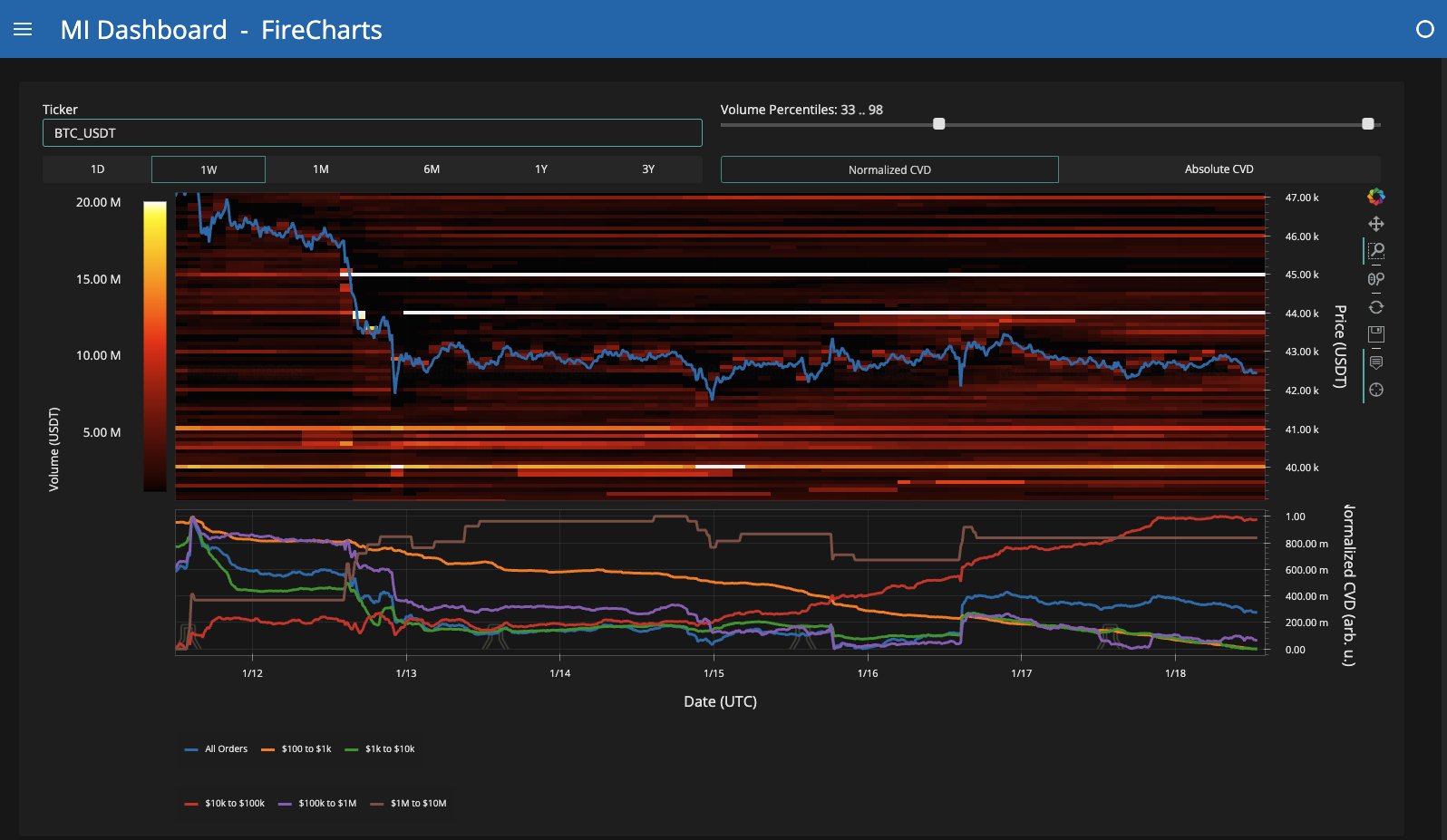

Material Indicators, as always, commented on the current situation in the market order books. In a recent assessment, they wrote;

“This is exactly why BITCOIN has been trading sideways with fixed prices between $41,500 and $44,000 since Saturday. In the weekly view of the Binance order book, we can see that BTC bids have risen over $10 million above $42,000, but resistance strengthens above $43,500.”

The current bid density draws attention to the concentrated seller interest around the $45,000 region. Considering that the bulls are already worn out by billion-dollar sales, the current weakness should not be so meaningless.

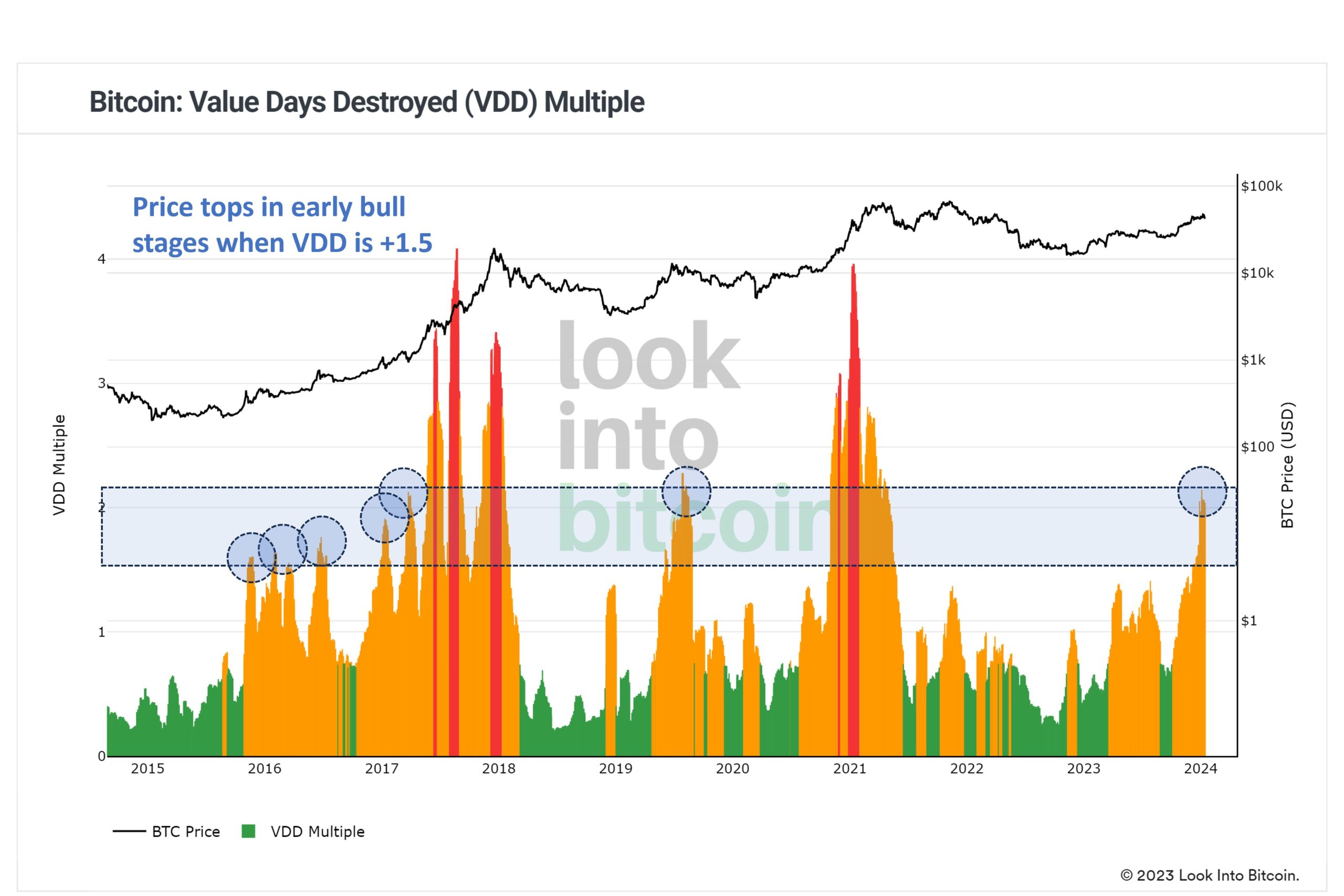

Philip Swift, the founder of Look Into Bitcoin, in his assessment today, pointed out the VDD metric, warning that it indicates a local peak. We see that warnings confirming excessive froth are justified, as investor profitability has also exceeded 95% for a while.

“It’s not surprising that the Bitcoin price needs to cool down.”

Chiliz (CHZ) Chart Commentary

CHZ Coin has made significant gains over the past three days. It finally broke free from the resistance line. However, after reaching a near peak of $0.112, the process of confirming resistance as support began due to the negative sentiment in the overall market. If the negativity on the BTC front continues, a pullback to $0.085 is likely. Closures below this could push the price to the $0.072 bottom.

However, if it can maintain the $0.092 level, there is potential for a rise targeting $0.13 and $0.142. The targeted scenario for Bitcoin is the loss of the $41,500 support and a local bottom seen after a long search down to $38,000.

But if GBTC sales weaken, ETF volumes increase, and optimistic developments occupy the agenda, this correction could end sooner.