Bitcoin price has descended to the $42,000 zone again instead of aiming for new peaks above $44,000. Overly optimistic forecasts had focused on the start of interest rate cuts in March. Yesterday at this time, we had warned to be prepared for possible delayed interest rate cut announcements that the Fed would take this bubble away.

Current Status of Spot Bitcoin ETFs

January was a turning point for the crypto markets, and the approval of US-based products opened the way for investment in Bitcoin through ETFs worldwide. These approvals, which allowed more investors to invest in a way isolated from crypto storage risks, were also crucial as they led to the SEC and the US legitimizing Bitcoin.

Although BTC approached the $49,000 limit with the start of ETF trading last month, the accelerated GBTC sales had fueled panic. However, investors breathed a sigh of relief as GBTC outflows weakened day by day (with some exceptions).

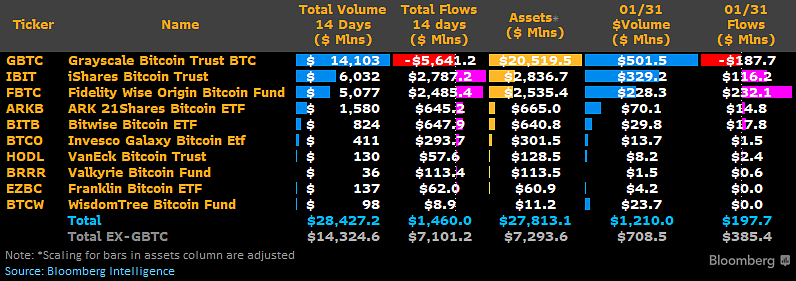

Since the launch of the ETFs, the products still host a net inflow. Even though the 1-month trading period has not yet been completed, the total inflow to all ETFs was $1.46 billion.

BlackRock’s reserves have exceeded $2.8 billion, forming the second-largest reserve after GBTC’s $20.5 billion. The fact that it can attract demand of up to $3 billion in just a few weeks is a significant achievement. Excluding GBTC, the total reserves of all ETFs are around $7.3 billion, and the total assets of 10 ETFs are $27.8 billion.

Current Situation of Bitcoin (BTC)

On the daily chart, BTC is maintaining support at $40,400, but as mentioned at the beginning, Fed pressure has prevented surpassing $44,000. If BTC can close above $42,200, it may target resistance again. Otherwise, a strengthening of sales towards $41,440 and $40,400 is likely.

In the scenario where the downturn continues, we could see a sell-off wave that could have devastating consequences for altcoins towards $38,500 and $36,600. For now, the employment data coming out tomorrow is of critical importance. The Fed Chairman had said that if we see an unexpected relaxation in employment, we could start cutting interest rates (early).