Bitcoin price continues its mission to liquidate rapidly accumulated short positions over the last 24 hours. However, there is also bad news. Even though the price is currently stable, the excuse for potential rapid declines in a few hours is clear and just arrived. The DCG investigation is deepening, and the extent of losses has been updated.

Cryptocurrencies May Face a Downturn

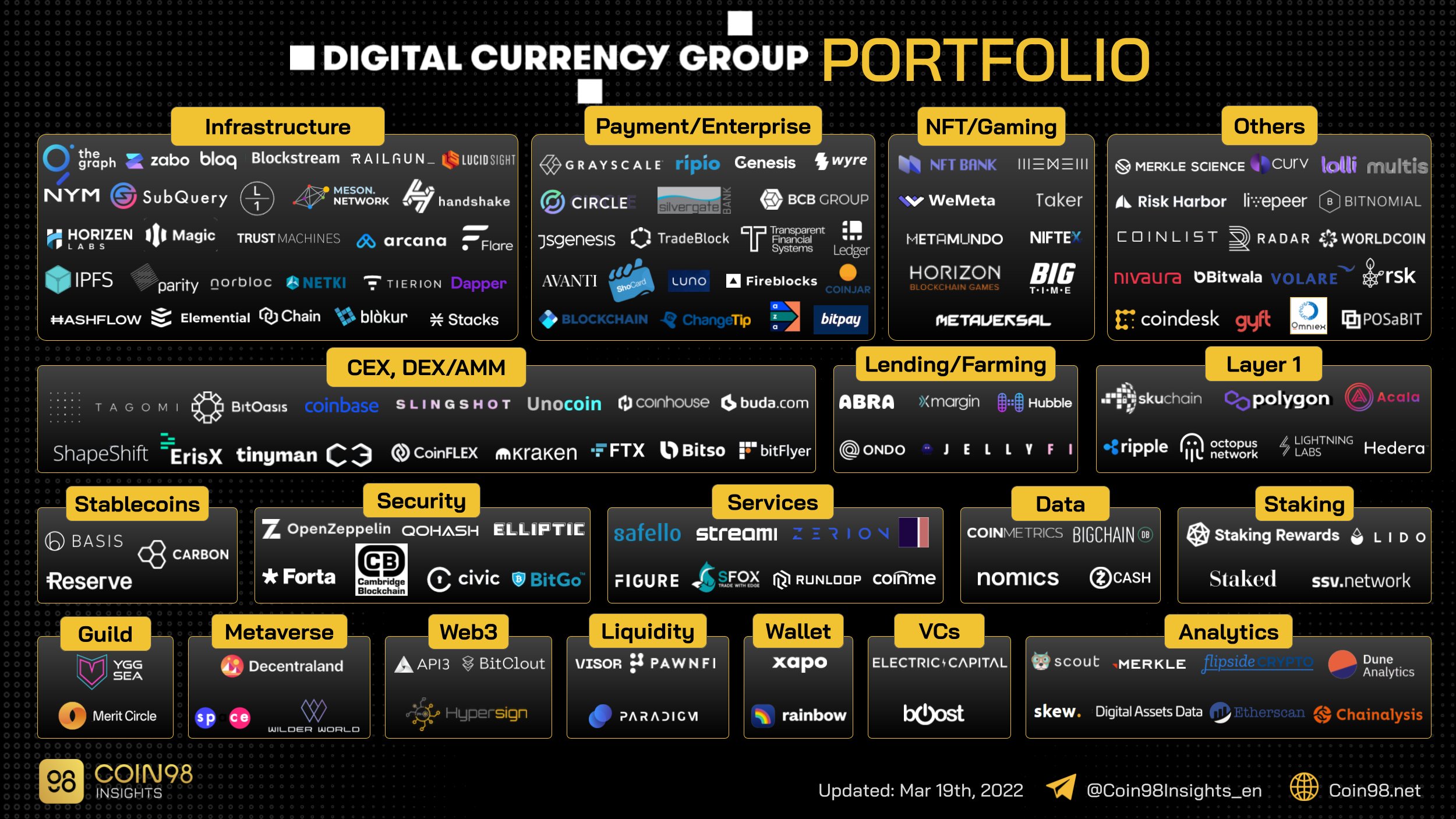

There is no downturn yet, but according to the latest news served by Reuters, the NY Prosecutor has intensified the DCG investigation, and the scale of the fraud has climbed up to $3 billion. What does this mean? It shows us the collapse of the large crypto lending wheel that triggered the 2021 bull run and its effects to date during the 2022-2023 period. If DCG is fined billions of dollars in such a large case, it will be a clear negative for the overall market.

Moreover, this expanded investigation that could accelerate GBTC sales (Grayscale is also a subsidiary of DCG) poses extra risk for the market. The potential risk of DCG bankruptcy could trigger panic among investors, leading to GBTC sales. However, it should be noted that since GBTC reserves have also been reported to the SEC, the assumption that customer assets are secure could make investors less affected by speculations.

The lawsuit filed by New York Attorney General Letitia James at the end of last year covered $1.1 billion in fraud and targeted the faulty crypto lending wheel, which we have discussed in detail previously.

Türkçe

Türkçe Español

Español