There will be many developments this week that will trigger volatility in the Bitcoin price. The first was the data announced a short while ago. The Consumer Inflation data coming tomorrow, Wednesday, could trigger a major break. So why do PPI and CPI data affect crypto investors so much?

Latest News in Cryptocurrencies

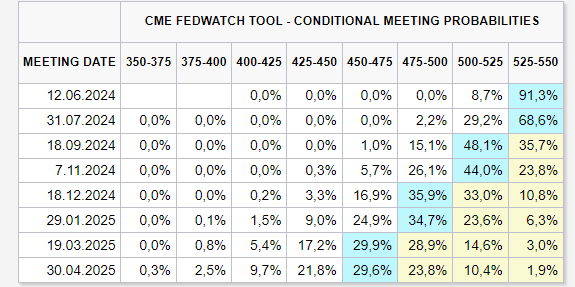

Market expectations for the Fed‘s monetary policy at the end of last year were for a 150bp rate cut in 2024. It was expected that the first cut would be made in March and that rates would drop rapidly by around 150bp before the end of the year, reducing the cost of money and loosening tight policy. So, did the Fed cut rates in March? Did it cut rates in the last May meeting? The answer to both is no, and if CPI does not fall, there is a risk that no rate cut will be made even in September. In fact, additional tightening measures may even come to the table.

In this situation, the only way out for investors in risk markets is for the decline in inflation to continue. Since Producer Inflation directly affects the CPI data, the importance of the data that just came in was significant. However, the real big bomb will explode when the PPI data comes in at this time tomorrow. If April inflation comes in low, it could be a period of rise for risk markets, starting the process of buying the expectation.

Core PPI was announced above expectations, coming in at 0.05 instead of the expected 0.02 monthly. This situation may delay concerns for tomorrow. The data received is negative for crypto. Investors have lowered their predictions that the Fed will cut rates in September.

Türkçe

Türkçe Español

Español