Bitcoin price increase is positive and opens more room for altcoin growth, but some still fall short of expectations. Avalanche (AVAX) experienced a roughly 15% increase, yet it remains stuck in a narrow range. How long will this continue? What does the current outlook indicate?

Avalanche (AVAX)

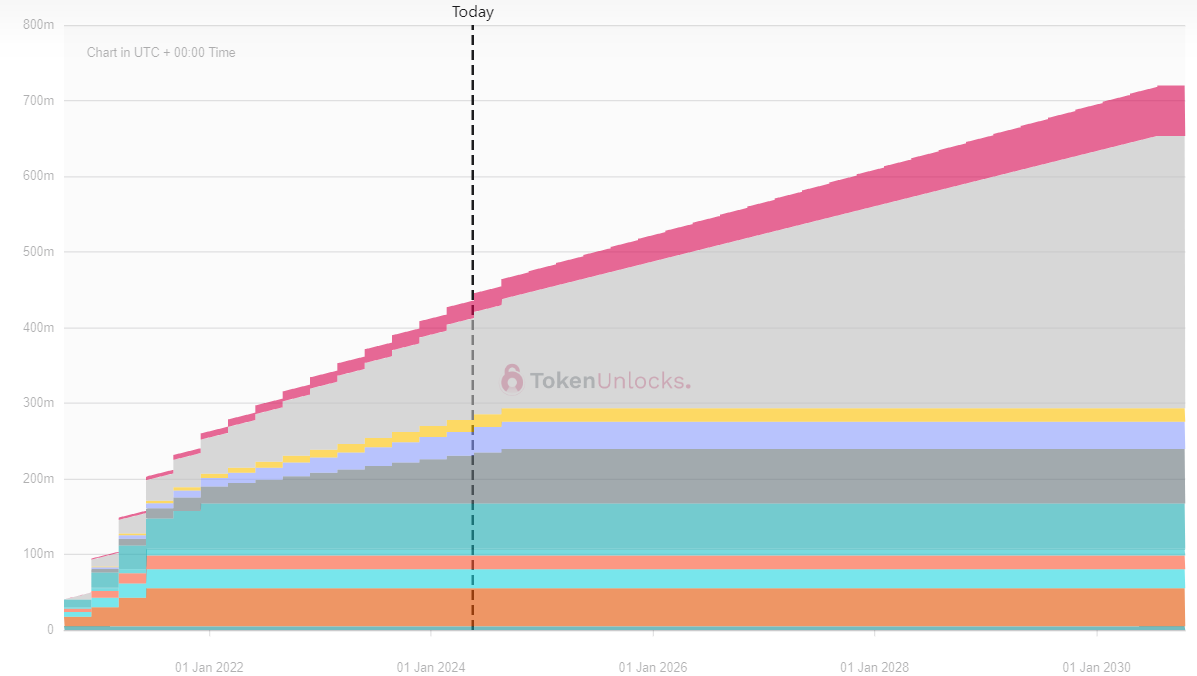

Avalanche‘s price, despite the recent 15% increase, is still unable to break out of a 1-month consolidation period. There are many reasons for this, but the rapidly increasing circulating supply is at the forefront. The release of hundreds of millions of dollars worth of new AVAX into the market, no matter how strong the demand, cannot bring the desired rise in the middle of bull markets.

For example, on May 22, nearly 10 million AVAX, valued at $347 million, will enter circulation. The unlock will occur exactly 4 days later at this time. After the unlock on May 22 (12:00 AM UTC), gradual unlocks will continue.

By the end of August 2024, there will be another similar unlock. The current circulating supply is 382 million 502 thousand. By the end of 2024, this figure will be 478.8 million. This means that an additional 96 million AVAX will enter the market for the remainder of the year. This roughly translates to an increase of $3.5 billion in circulating supply. Considering the current market value is $14 billion, this figure is definitely significant.

The fact that these unlocks, made for strategic partnerships, team, and staking returns, create selling pressure that limits appetite for AVAX cannot be ignored.

AVAX Predictions

Looking at the short-term outlook, the price cannot break out of the 1-month consolidation period. Investors who have held AVAX for less than a year and more than a month view price increases as opportunities to sell at reasonable profit-taking levels. The $3.5 billion worth of coins yet to be unlocked, as mentioned in the first section, motivates them to buy at lower levels. This group constitutes 40%, which is not negligible.

The altcoin tried to break out of the $39 consolidation range ceiling about three times last month. It was unsuccessful and is still finding buyers below this level. If medium and short-term investors can curb their urge to take profits, a new attempt at the $50 level could begin in the scenario where $39 turns into support.

Türkçe

Türkçe Español

Español