Bitcoin price recovered the key region after falling below $62,000 a few hours ago, but altcoins are fluctuating. Cryptocurrencies experienced a loss of about 5% due to $600-700 BTC price movements, and we all know what could happen in a major correction. So, in both an optimistic scenario and a potential price correction, which price regions should we pay attention to for this trio?

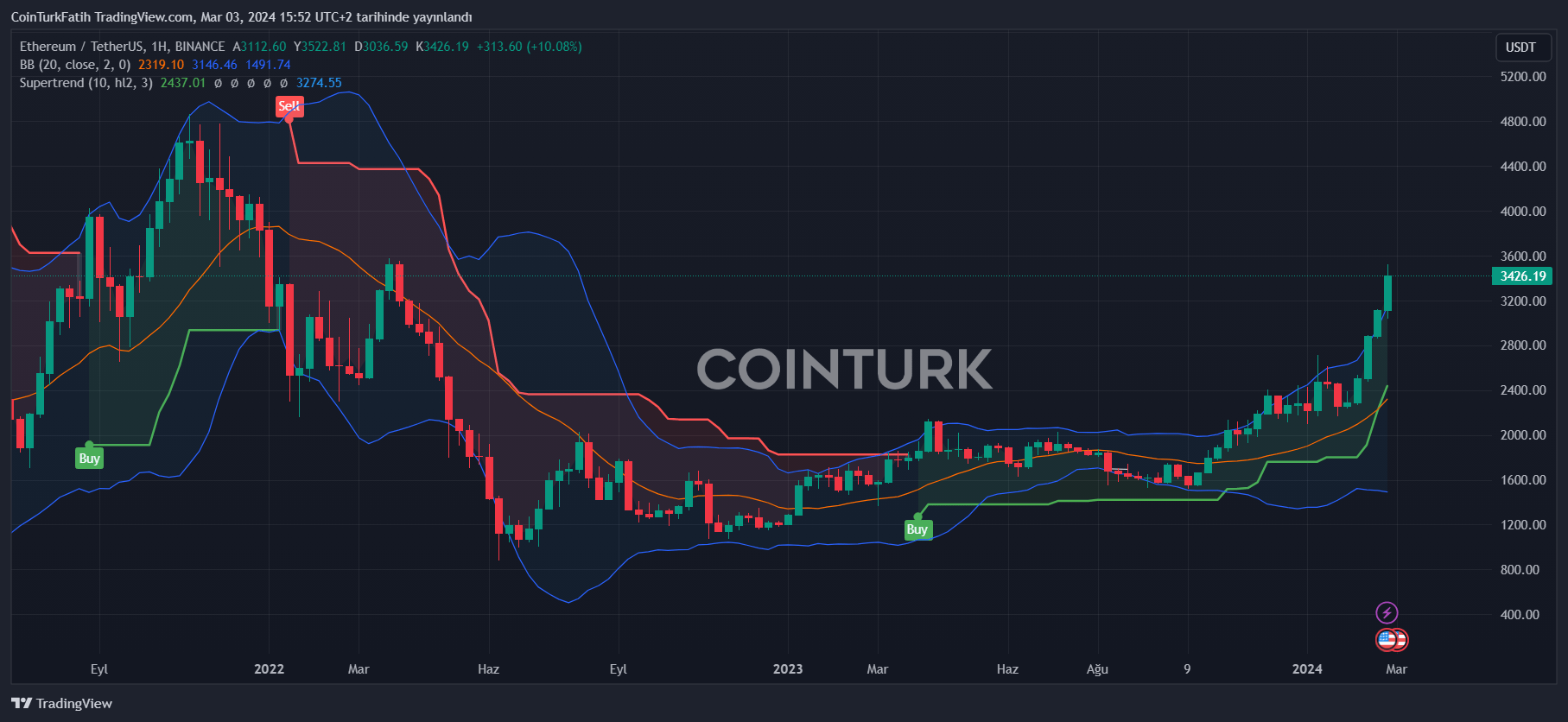

Ethereum (ETH)

The largest altcoin by market value, Ethereum, is currently finding buyers at $3,425. Short-term fluctuations down to $3,200 are not a disaster scenario, but the ETH price needs to turn $3,586 into support soon. There is a significant update on March 13, and transaction fees are expected to improve. Ethereum layer2 solutions should support the ETH price along with the token prices of this update.

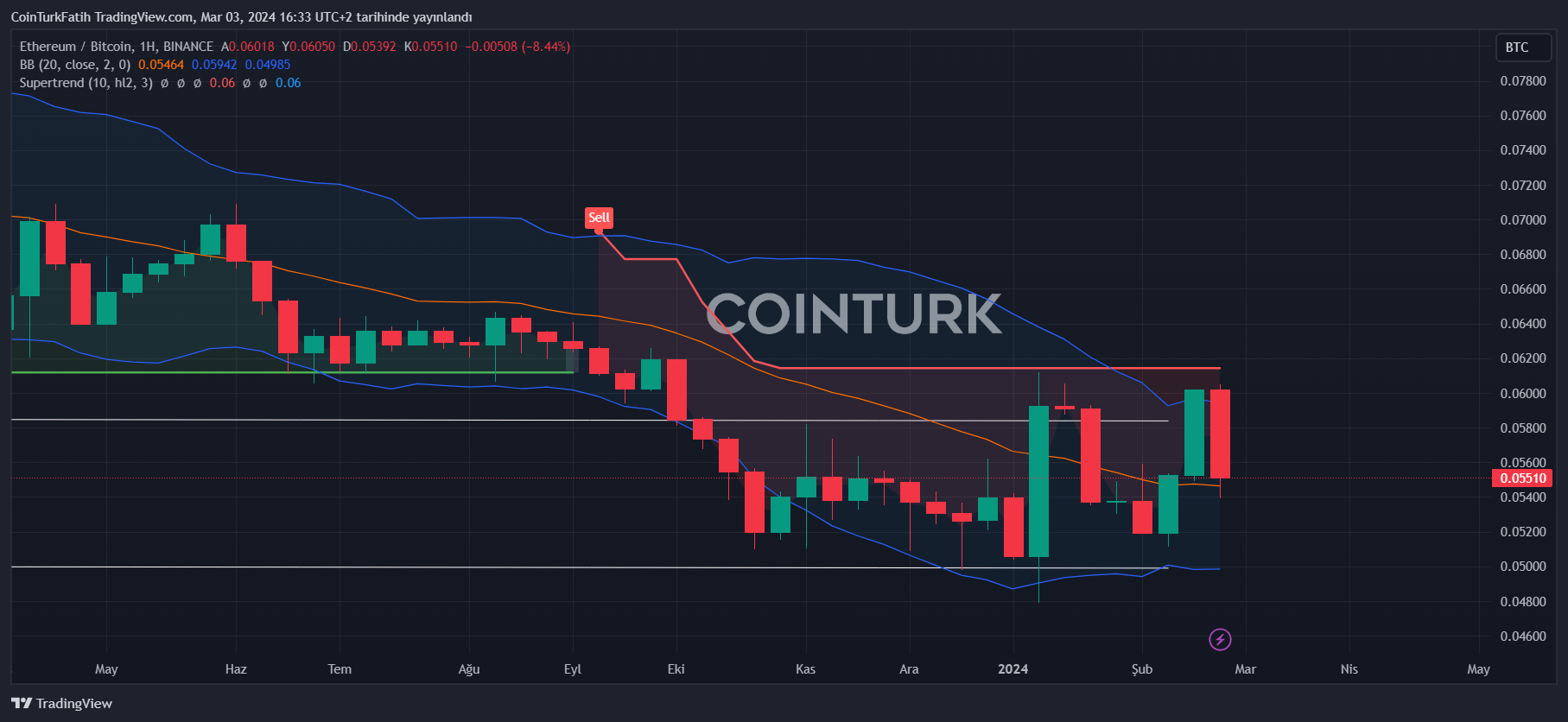

Another important chart is the ETHBTC ratio, where we recently saw a breakout above 0.06BTC, but it was rejected at resistance. For now, the previously mentioned 0.053 support is strong, and we could see the 0.06 level again if closes above 0.056 occur. If closes above 0.061BTC occur, it will target the peaks of 0.064 and 0.07BTC.

If Ether can positively diverge with the Dencun update and run towards peak targets, it could increase up to the $4,340 target if BTC lingers at current levels.

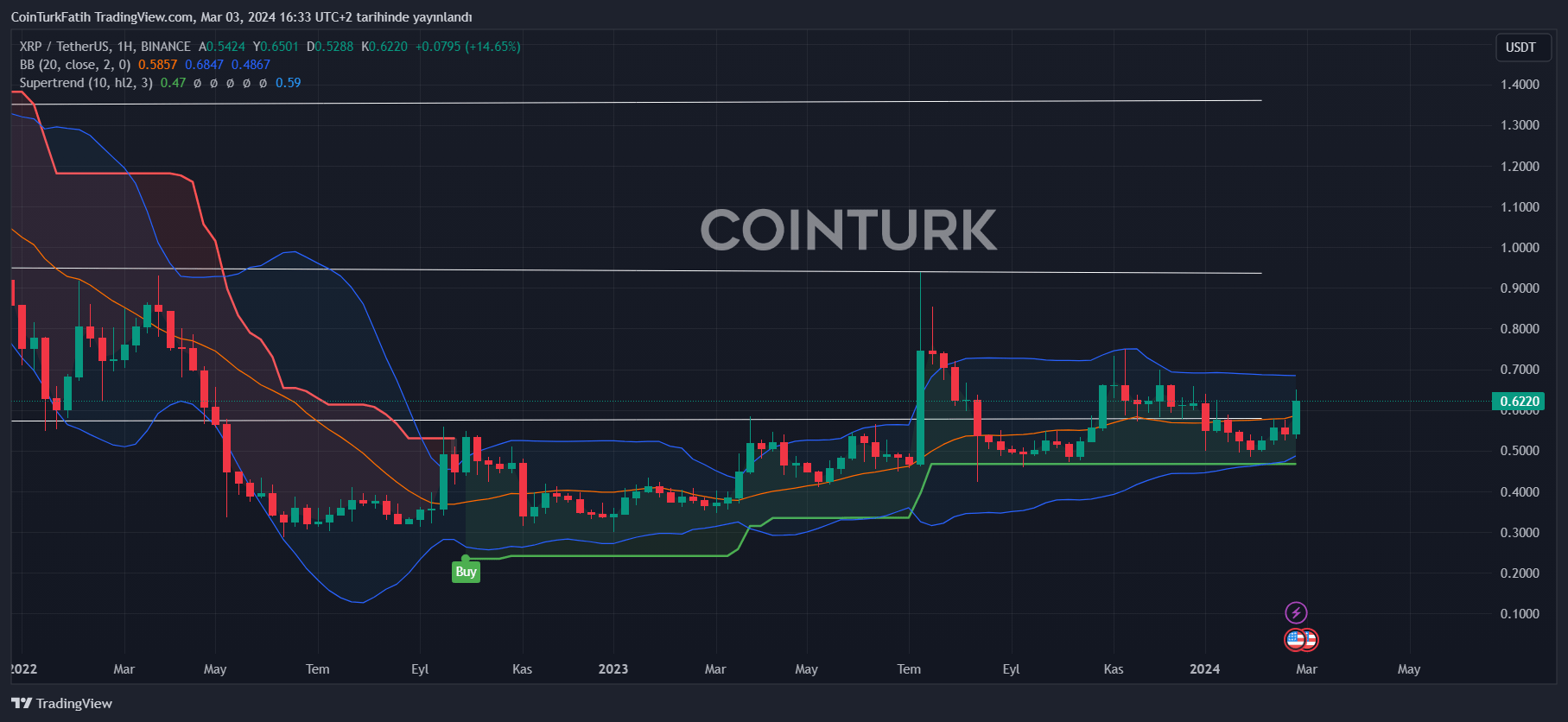

XRP Coin Commentary

The long-standing support of the parallel channel at $0.58 has finally been breached. XRP Coin price is now at $0.62, and if the recovery continues, it could move towards the familiar targets of $0.67 and $0.73. However, a rapid decline in altcoins could surprisingly push it back to $0.58 and then to $0.46.

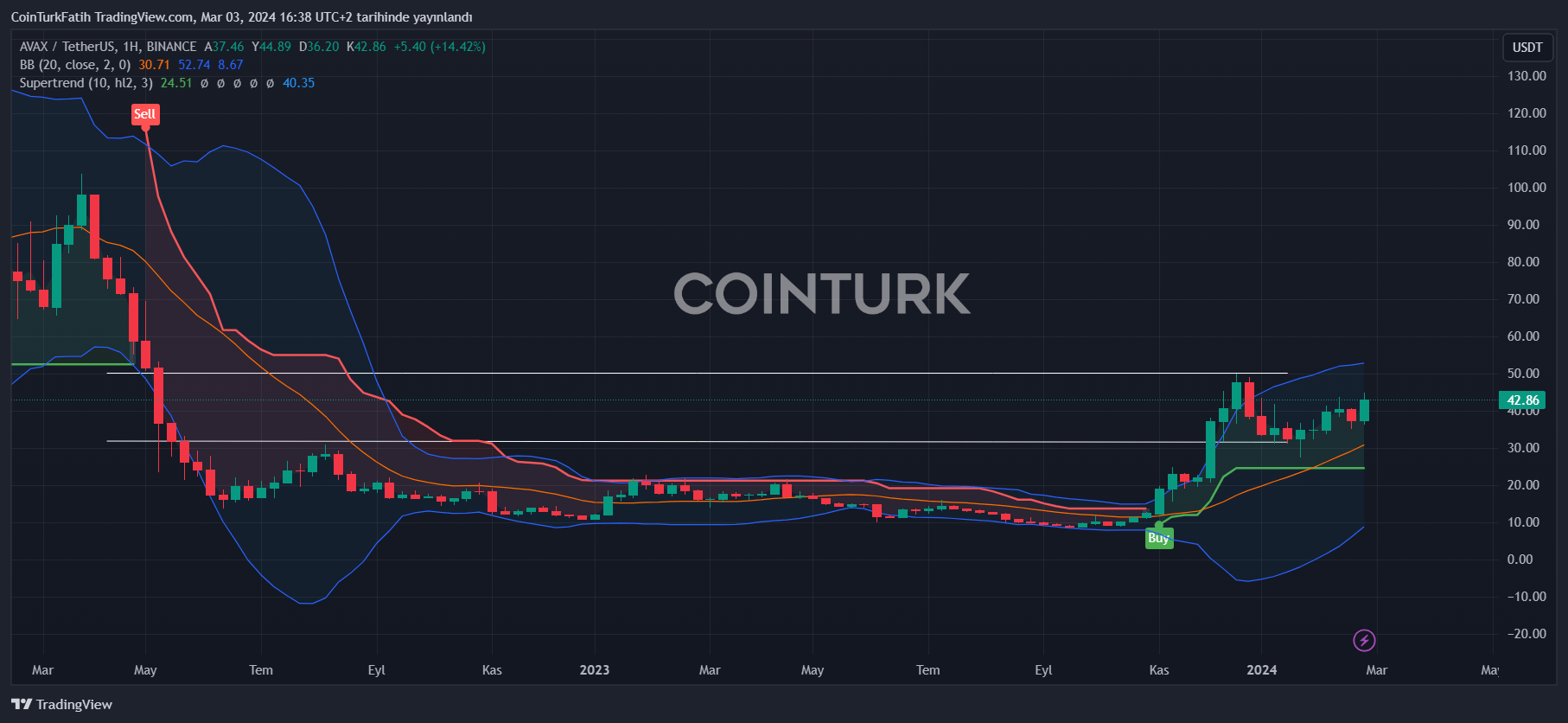

AVAX Coin Price Prediction

The popular smart contract platform keeps its community engaged with new partnerships. And the AVAX price has successfully surpassed $0.42, now it needs to overcome the $48-50 barrier. We need to see AVAX price closes above $50 for the rally to become parabolic.

After 574 days, the price turned the parallel channel for an uptrend but failed to make the expected breakout since the week of December 4. If it succeeds, we should see a rapid rally to $69 and $73.5, followed by $81. In the opposite scenario, a pullback to $31.5 could be expected.