Bitcoin price recovered after dropping to $55,280. However, despite favorable data for crypto, the price remains low. Days ago, we mentioned that closures below $61,700 could trigger a new test of $55,000, and it happened. This situation led to greater losses for altcoins. For example, the targeted $0.097 test for DOGE also occurred. So, what happens next?

Expectations of Crypto Analysts

After the data came in, Michael Poppe expressed his satisfaction. As we have always stated here, the Fed has two main tasks. As Powell has often stated, the institution’s primary job is employment and inflation. While the Fed grows employment and protects it during tough times, it must also keep inflation at a reasonable level. We can liken this to a balance scale.

For the past few years, the inflation side has remained high, leading to rapid interest rate hikes without considering the other side of the scale. For over a year, rates have been kept at their peak. According to historical data, cuts should start 9-12 months after reaching the peak. So, what will force the Fed to do this? Of course, the deterioration of employment on the other side of the scale, and the latest data confirm this.

Poppe also wrote:

“- JOLTS Job Openings -> worst in the last 3 years.

– ADP Non-Farm Employment Change -> worst in the last 3 years.

– Non-Farm Employment Change -> second worst in 3 years (last month was worse).

So, what is the result?

As uncertainty about the strength of the US economy increases and the likelihood of the FED cutting rates significantly rises, Gold is moving up. Since rate cuts are clearly expected to happen in the upcoming period, bond yields are reaching their lowest levels of the new year. So, Bitcoin?”

Yes, Bitcoin needs to rise in this environment.

Comments from Kyledoops and Daan Crypto Trades

Two popular analysts focused on different topics. Kyledoops is interested in the percentage of Bitcoin UTXOs and what it means. Daan pointed out important levels with the Bitcoin (BTC)  91,081 chart he shared while the article was being prepared. Kyledoops wrote the following in his evaluation sharing the graph below:

91,081 chart he shared while the article was being prepared. Kyledoops wrote the following in his evaluation sharing the graph below:

“The percentage of Bitcoin UTXOs in profit has fallen to 68.5%, the lowest level since October 2023. This decline indicates selling pressure from profit-taking investors. Historically, such declines have occurred before significant price increases; Bitcoin price previously rose by 273% after a similar decline.”

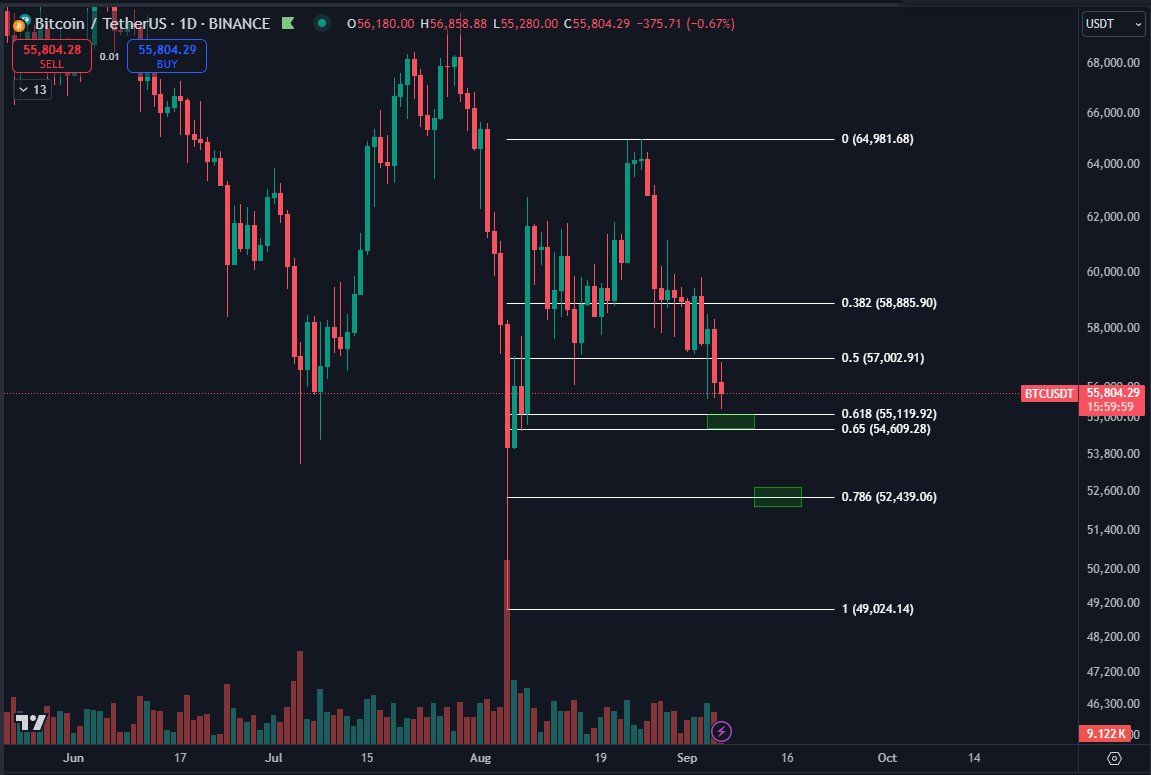

If history repeats itself, Bitcoin should exceed $150,000. Daan, on the other hand, indicated that he expects a bounce from the green areas with the price chart he shared. The expert, who drew attention to Fib levels, wrote the following:

“The green boxes are the main areas where I am looking for at least a bounce. In the previous cycle, .618 was incredible. In this cycle, we have made numerous solid rebounds from .786. Whatever happens, these are the last places to make a ‘higher low’.”