As the article is being prepared, the king of cryptocurrencies, Bitcoin, is holding above $27,000. The expected extreme selling pressure did not materialize. Concerns among investors for September had increased with the price drop at the end of August. However, in the recently concluded month of September, we did not witness significant drops. Moreover, the BTC price is approaching the monthly close in a relatively good range.

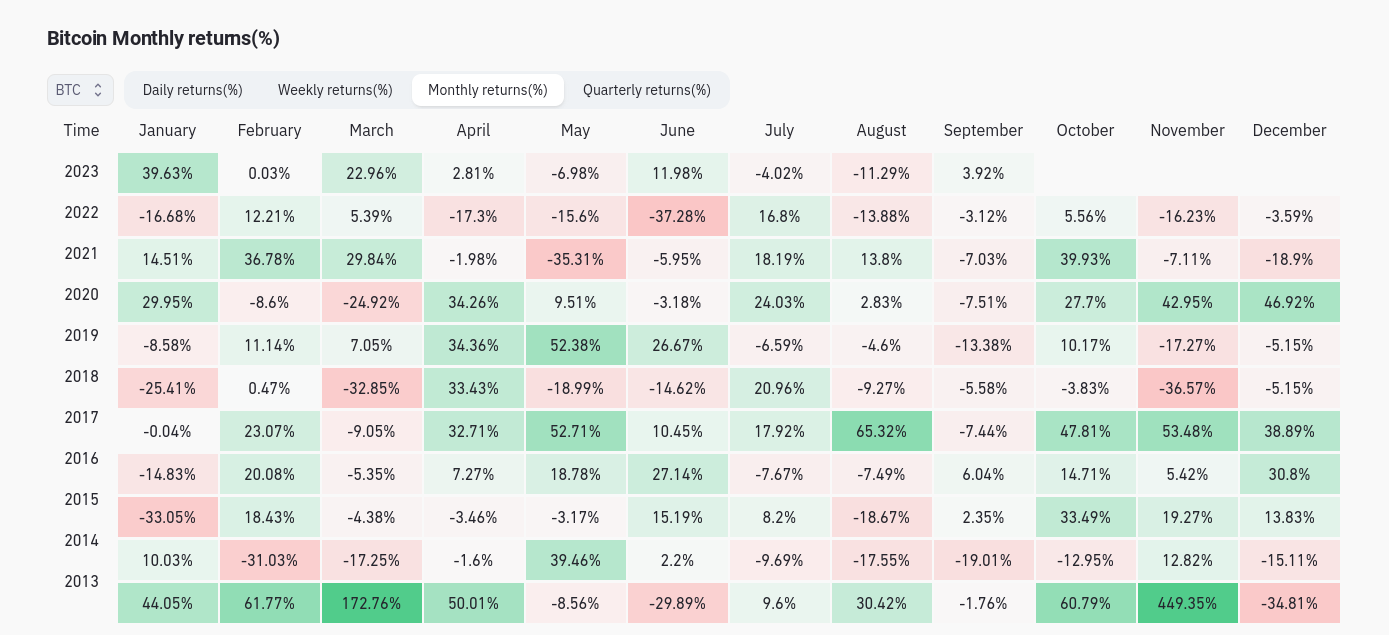

Bitcoin Historical Data

According to CoinGlass data, Bitcoin price experienced its best September since 2016. The price increased by approximately 4%. Historically, September has been a relatively negative month and has witnessed significant losses. However, even with this weak increase, it turned around in the challenging market environment of 2023.

On the other hand, in the third quarter, the BTC price decreased by 11.5%. This can be considered a reasonable rate amidst the signals that the Fed will tighten more than expected. Moreover, the performance in the last quarter has been mostly positive in the past, which is promising. Especially October and November are periods when cryptocurrencies have the opportunity to recover.

We must also mention that the famous “sell in May and go away” period has passed. At this stage, if we do not see larger negatives on the macro front, it is possible for prices to continue to rise.

Experts’ Bitcoin Price Predictions

Popular crypto analyst Jelle stated in one of today’s X analysis segments, “In the past, a green September resulted in a green October, November, and December.” If September passes positively and historically takes us to green days in November and December, we may finally see Bitcoin testing the $36,000 levels before the end of the year.

Just a day before, Jelle had predicted better conditions for the fourth quarter, including a breakthrough that surpassed $30,000 for the first time since the beginning of August.

Keith Alan, co-founder of Material Indicators, was more cautious. He says that weakening open interest after the recent rise could lead to a delayed but similar decline.

“There is a high probability of killer whales increasing their weekend whale games around daily, weekly, and monthly candle closes. Don’t fall into a trap.”