Bitcoin‘s price surged today, exceeding $47,000 at the time of writing, reaching its highest levels in the last 21 months. The rally continues to highlight the bullish sentiment among investors who are keen on the continuation of the positive price trend for Bitcoin over the past four months. So, why did Bitcoin’s price rise today? Let’s examine.

ETF Wars Continue

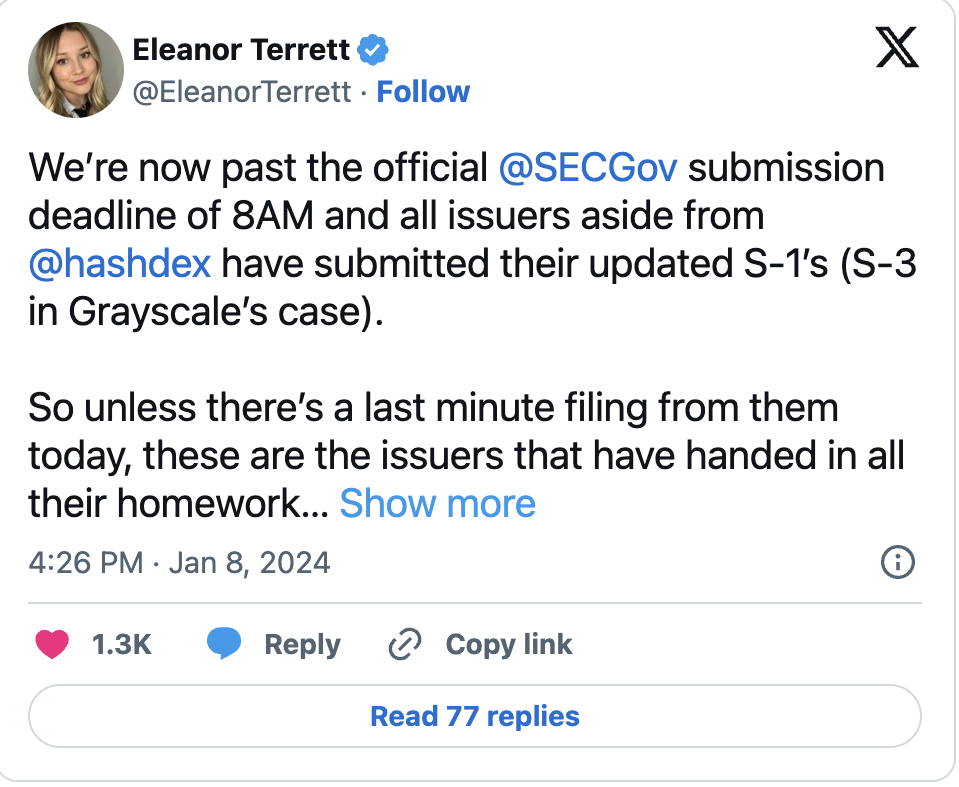

While macroeconomic data is anticipated in the US, Bitcoin’s price continues to rise, and both volatility and the number of open positions are increasing. On January 8th, all spot Bitcoin ETF applicants officially took the last step in the process. Now, the Securities and Exchange Commission (SEC) is free to potentially approve spot Bitcoin ETF applications.

While some analysts believe that the Bitcoin price is indicating a breakout towards $50,000, Bitcoin has doubled the 2023 returns of gold, and the momentum continued into the early days of 2024. MicroStrategy CEO and Bitcoin bull Michael Saylor believes that a spot Bitcoin ETF would be the biggest event for the entire financial sector since the launch of the S&P 500.

The positive atmosphere on the Bitcoin front led to Bitcoin’s market value surpassing Berkshire Hathaway on December 5, 2023, and it remained as the 10th largest asset according to this data. Despite Bitcoin’s strength, the SEC continues to proceed cautiously, reissuing a crypto FOMO warning on January 6th.

Reports suggest that an approval could create a new demand worth $600 billion in Bitcoin. CryptoQuant analysts believe that an ETF approval could lead to a $1 trillion increase in Bitcoin’s market value. Galaxy Digital predicts a 74% price increase in the first year following the launch of a spot Bitcoin ETF. Even traditional banks seem to be bullish on Bitcoin’s price, with one predicting a $200,000 price tag for Bitcoin by the end of 2025.

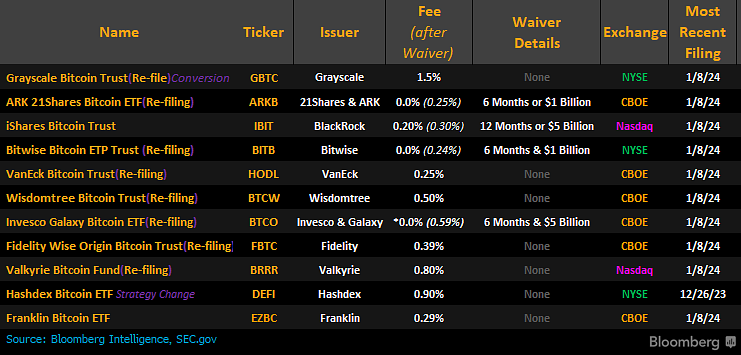

The final applications requested by spot Bitcoin ETF applicants highlighted a potential commission war among all institutions for the lowest commission fees. The lowest fee was set at 0.25% on January 8th.

Noteworthy Data on Bitcoin

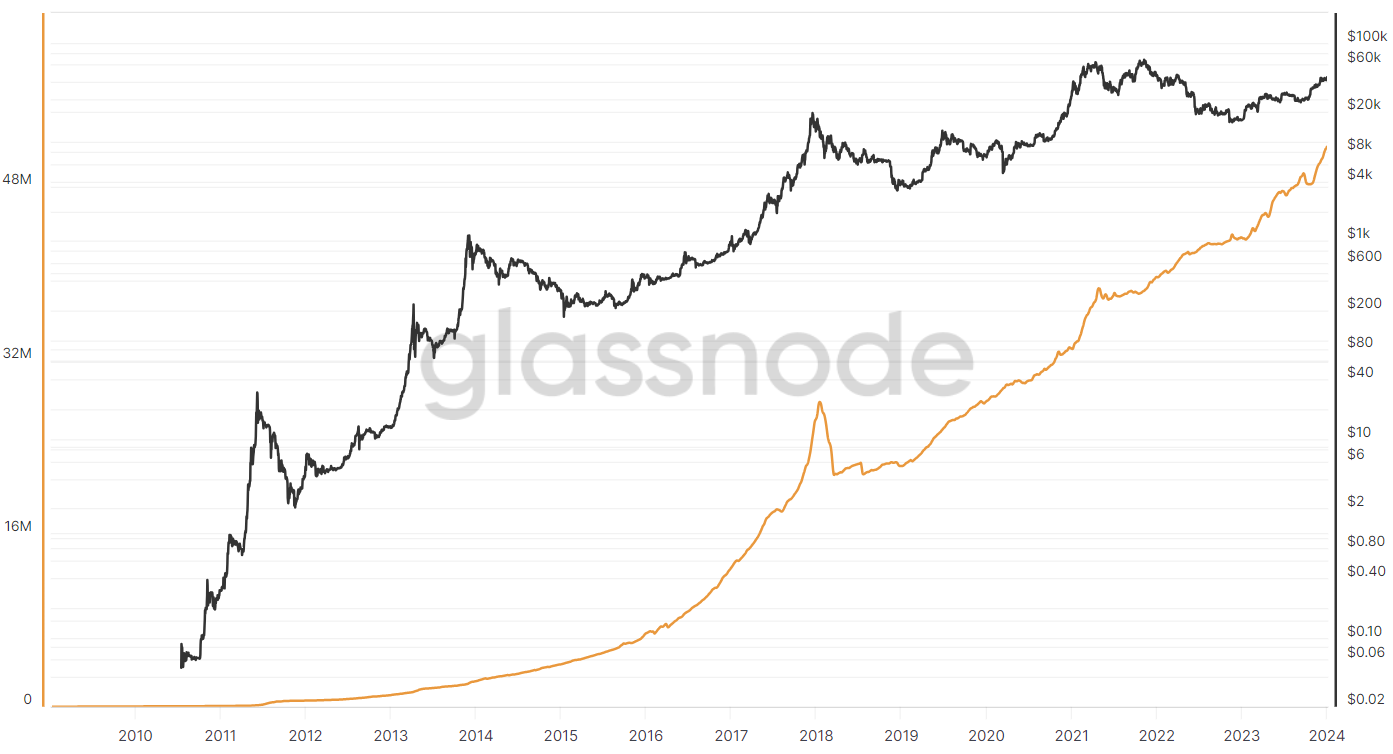

Institutional investors are not the only group showing increased interest in Bitcoin. The number of Bitcoin wallets holding a non-zero balance reached an all-time high on January 2nd, with over 51.6 million wallets.

Not only are there more Bitcoin wallets than ever, but the realized value of Bitcoin has also increased due to the steady price rise month over month. The realized value was $436 billion on January 8th, only 7% below the all-time high. The increase in non-zero balance wallets and the rising realized cap highlight renewed bullish optimism.