Bitcoin price soared to $69,990 (Binance Spot) following the opening of the U.S. market, establishing a new historical high. It is currently difficult to speak of a true peak for Bitcoin, as it has only recently surpassed $20,000, and the $69,000 target is still some distance away. So, what will the historical peak of this cycle be?

Bitcoin (BTC) and High Demand

On the last trading day of the week, the Bitcoin price experienced a delightful rise before redirecting towards the $67,000 region. Despite a slight push down due to intense profit-taking at the peak, this is a story we have seen many times before. It is likely that Bitcoin will gather strength for new highs above $80,000 and strive to reach its true annual peak.

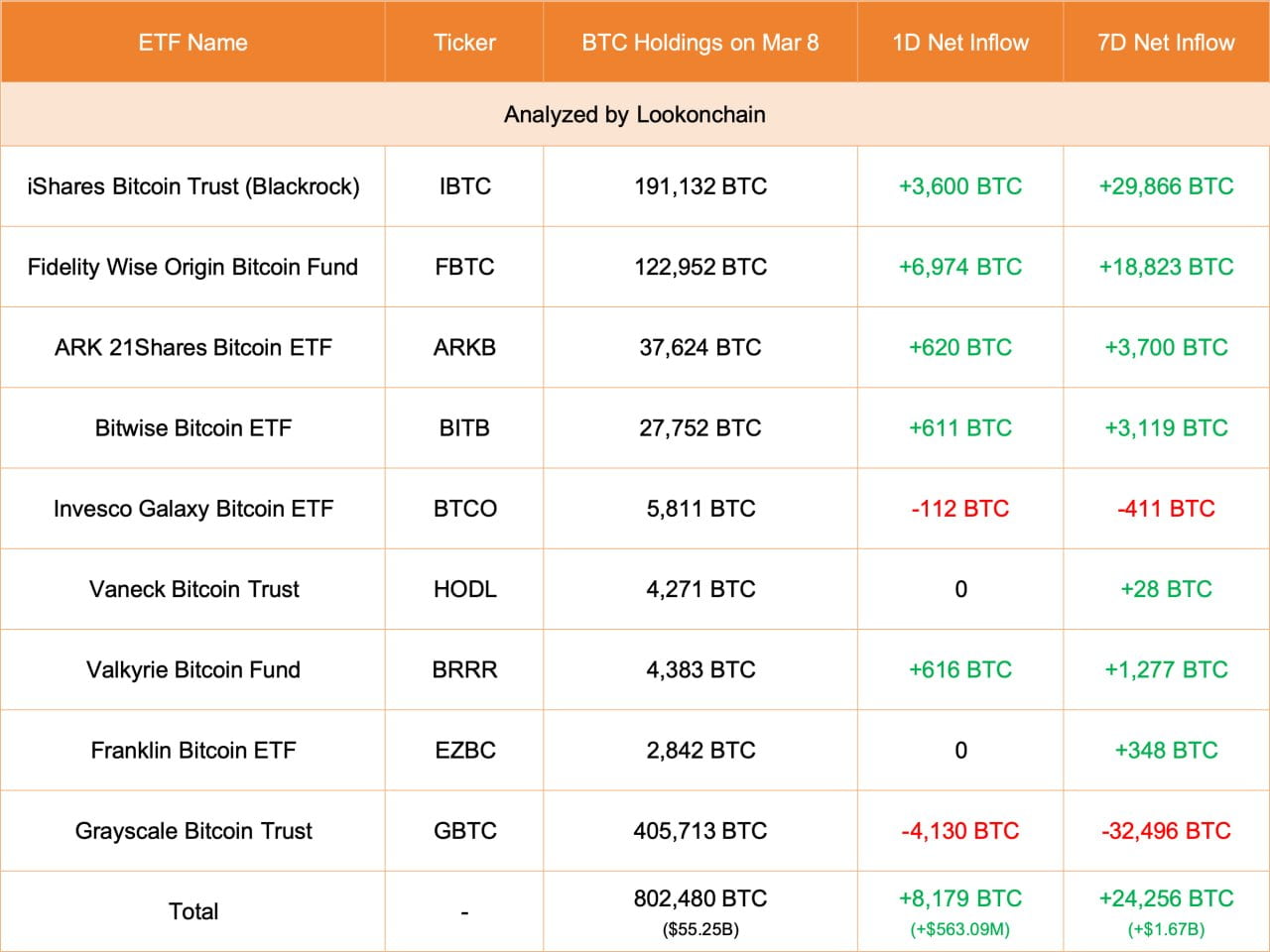

Demand is high, and in the last 7 days, spot Bitcoin ETFs have seen a total net inflow of 24,256 BTC. The total BTC reserve size of all ETFs has risen to 802,480 BTC. This currently indicates assets worth $55.25 billion.

Matthew Howells-Barby, Vice President of Growth at Kraken, said;

“The approval of a spot Bitcoin ETF was a milestone in the history of Bitcoin. The structural impact on liquidity and overall trading volume cannot be overstated… From a regulatory perspective, this represents a significant step forward, especially for the U.S., and can be seen as a major victory for crypto as an asset class.”

As you may recall, this was precisely the scenario we discussed in COINTURK articles since June 2023.

Will Bitcoin Reach 100 Thousand Dollars?

The current outlook suggests this is possible. For instance, there is only about $140 billion worth of BTC supply ready for sale on exchanges. In April, the daily output from miners will also drop by half. Spot Bitcoin ETFs have accumulated close to $25 billion in BTC reserves in just two months, with an estimated net inflow of over $10 billion.

When we put all these factors together, if the current pace continues, we should expect a scenario where the ready-for-sale supply cannot keep up with the demand from ETF issuers. Economist Timothy Peterson suggests that if this pace continues, the price of BTC could exceed $100,000 by October 2024.

Türkçe

Türkçe Español

Español