Bitcoin price continues to linger around the $52,000 region, with consolidation in the resistance zone looking hopeful for a rise. On the other hand, in the last 24 hours, significant volume has been seen in altcoins like SOL, FIL, and BNB, excluding stablecoins. The growing interest indicates that price volatility could increase. Therefore, it might be useful to look at the current price targets.

Solana (SOL) Price Target

SOL’s price has surpassed the neckline of an inverse head and shoulders (IHS) formation. This pattern is often seen after a decline, and a break above the neckline suggests an acceleration in price increase. If the price of Solana (SOL) remains above $107, it is expected to continue its rise.

The current target is $126, and a close above this could pave the way for a higher peak. The next resistance is at $135, and since this area has not been seen for a long time, a return to the previous area due to profit-taking could be considered normal.

The RSI supports the price increase. However, if the BTC price reverses from its consolidated level and attracts sellers with a deep dip target, sales could continue down to the strong support at $80 with closures below $107. At the time of writing, the SOL Coin price was at $112.2, while BTC was finding buyers at $51,913.

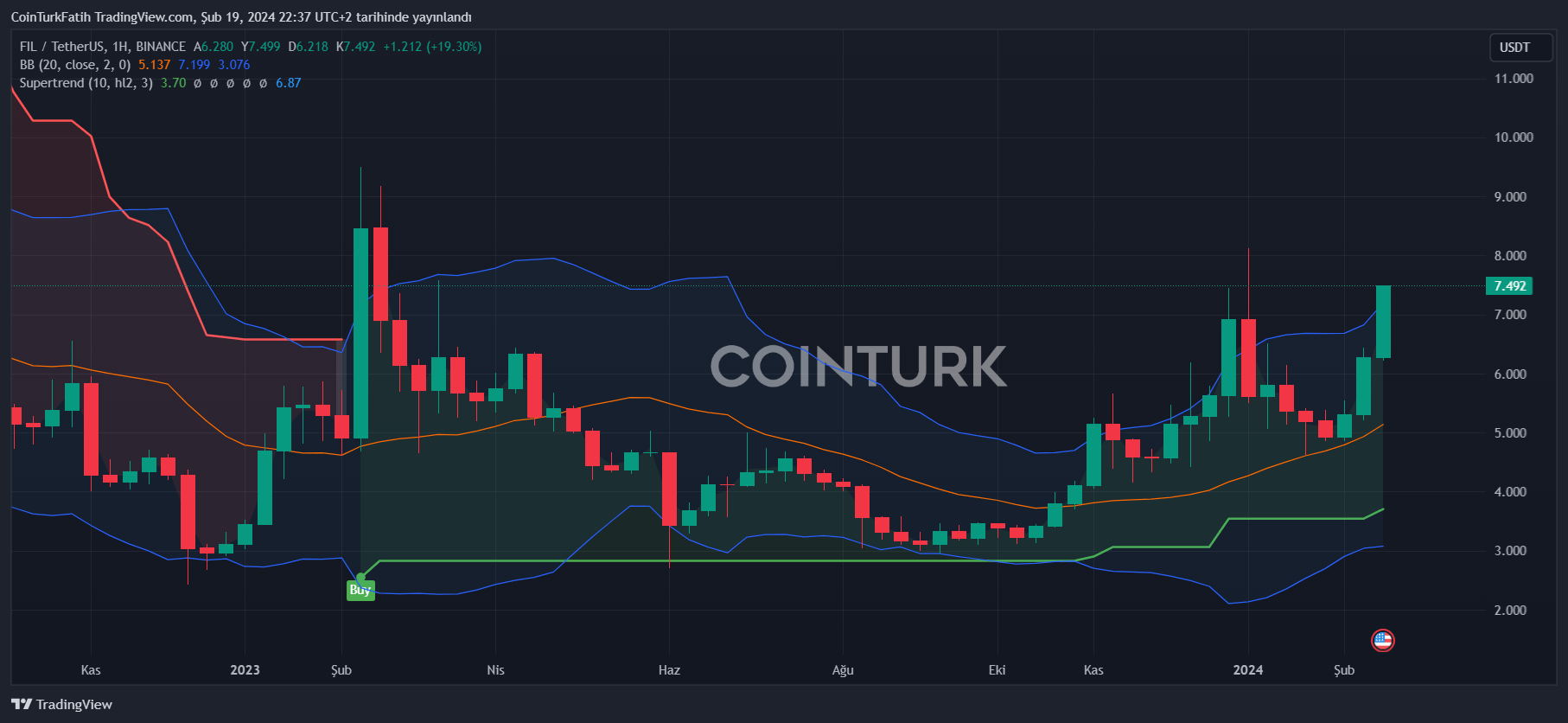

FIL Coin Price Target

FIL Coin saw a daily volume of $644 million, which is much more than other altcoins like ADA, AVAX, MATIC, DOGE, LINK, SEI, ARB. FIL Coin’s price increased by 37% weekly and saw gains of nearly 20% in the last 24 hours.

We saw a similar situation in the first week of January, and it could reach the same peak at $9.17. For this, the bulls need to keep the FIL Coin price above $7. The most optimistic medium-term target is the August 2022 peak of $11.35.

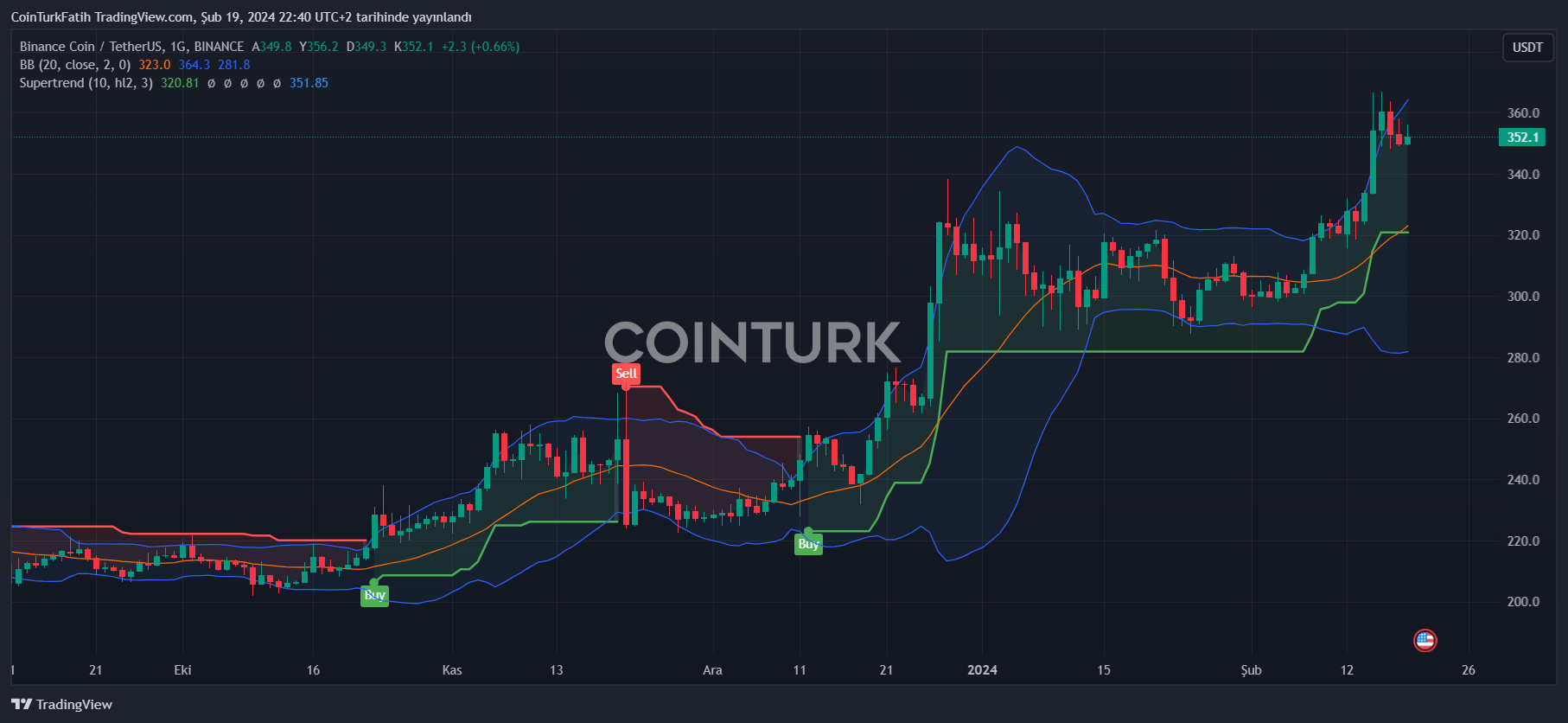

BNB Coin Price Target

The Binance-backed altcoin FIL Coin saw even more volume. This is relatively normal as BNB Coin is accustomed to strong volume data. The altcoin, which has seen an increase of nearly 80% since October, has underperformed most cryptocurrencies. Now, it is targeting new highs with closures above $321.

On the weekly chart, $370 is an important resistance, and a close above it could trigger a new rally up to the early 2022 peak of $460.