Bitcoin (BTC) continues to linger in the $70,000 region at the end of March, trapped in a narrow range. Investors are now expecting a breakout, with the upcoming halving event in April indicating that it could happen soon. Meanwhile, the BTC price increase over the past approximately 7 months is also impacting MicroStrategy shares.

MicroStrategy (MSTR)

Led by Michael Saylor, MicroStrategy holds a massive amount of BTC. The company, which recently purchased an additional 9,245 BTC, maintains its position among the largest whales. Even during the most intense days of bear markets, Saylor’s company was generating cash to buy Bitcoin by issuing debt securities.

Michael Saylor didn’t amass billions of dollars in reserves out of love for Bitcoin. He made these accumulations aiming to benefit from the consistent rise in BTC prices, a strategy he’s known for since the dotcom bubble era.

At the same time, MSTR shares, which have long acted as a proxy for a spot Bitcoin ETF, are informally treated as an ETF due to their large BTC reserves. Investors were buying MSTR shares thinking that the price of BTC would rise, and since MicroStrategy’s fate is tied to Bitcoin, Saylor, a former crypto skeptic turned Bitcoin maximalist, has found a good profit opportunity this time.

MSTR Shares Rise

The company, holding 214,000 BTC, has seen its shares benefit from the rise in BTC price. Holding roughly 1% of the BTC supply, and considering the 4% accumulation seen through ETF channels, the company offers significant insights into the mid to long-term performance of BTC price. Currently, only 5% of the supply is in institutional hands, and there are 21 million (maximum supply) Bitcoins for the 8 billion people in the world. A significant portion of this is not moving and is in dead wallets.

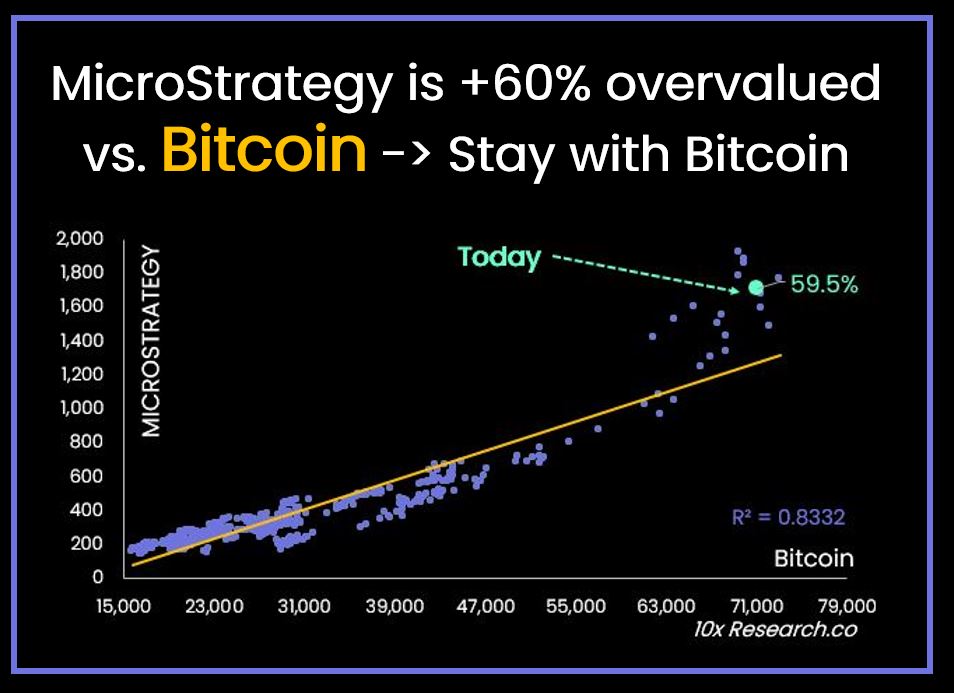

In 2024, MSTR shares showed an increase of approximately 170%. However, according to 10X Research, MSTR has been overvalued for a while. This can be likened to the state of GBTC when it once had a positive premium. Or we saw a positive premium exceeding 100% for GSOL. This was later balanced with sales.

According to an assessment by Markus Thielen, when comparing the company’s BTC reserves with the share value, the share price is over 100% higher than it should be. This is certainly due to the demand from investors who now think they are engaging in a leveraged transaction due to the process leading to ETF approval.

In summary, even if the BTC price continues to rise for a while, we may see a decline in the overvalued MSTR share price.

Türkçe

Türkçe Español

Español