Cryptocurrency markets have experienced significant volatility in recent days, with Bitcoin‘s price fluctuating rapidly, especially in the past 24 hours. This volatility has drawn the attention of analysts and investors, increasing uncertainty about the future of the cryptocurrency markets. Many reports and analysts have made striking predictions about the price of Bitcoin.

Bitcoin Remains Strong Despite Data

Data from TradingView shows that Bitcoin’s price, 24 hours ago, indicated a comeback that some investors refer to as a classic pump and dump. During this surge, Bitcoin saw a daily gain of nearly 3% before experiencing a loss in value, ultimately breaking the long-awaited resistance level of $27,000 that many analysts were eagerly anticipating.

Following these events, there was a gradual rise, and at the time of writing, Bitcoin’s price reached $27,140. It can be said that Bitcoin has responded well to US macroeconomic data and Federal Reserve pressures. According to the data released in the US, the second-quarter GDP growth was below expectations at an annual rate of 1.7% compared to the expected 2.0%. The August Personal Consumption Expenditures (PCE) index data, however, aligned with expectations.

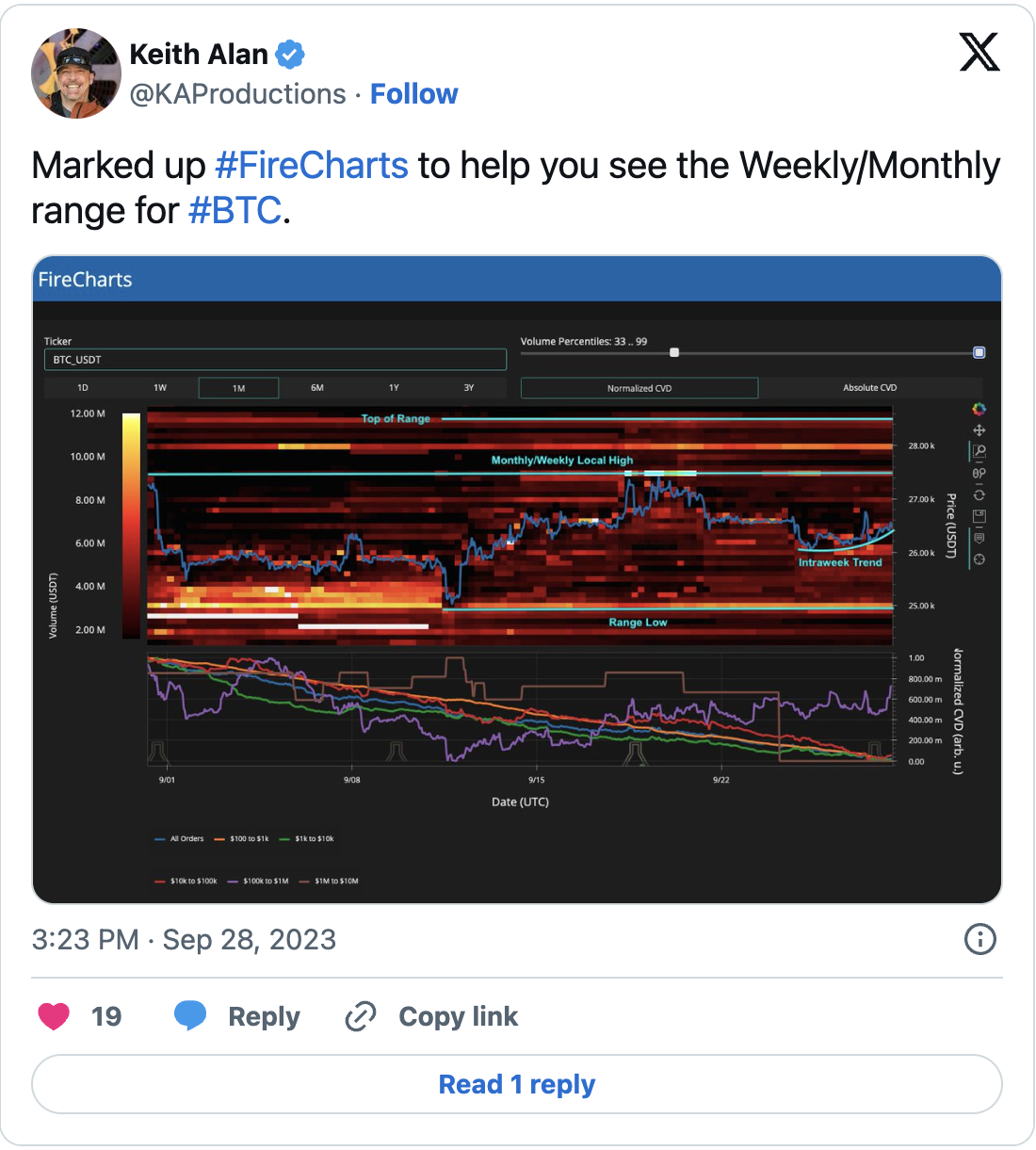

Keith Alan, co-founder of data tracking source Material Indicators, called for the return of volatility in a tweet, after which he shared data from the Binance BTC/USD order book indicating that the resistance below the $27,000 level weakened.

Meanwhile, Federal Reserve Chairman Jerome Powell has not yet made a statement, and his speech at the “Conversation with the Chair” event will determine the focus of the day. Powell’s recent statements did not create significant volatility in the cryptocurrency markets.

Bitcoin’s Target Revealed

Cryptocurrency market commentator, popular trader, and analyst Daan Crypto Trades was more optimistic about the strength of the day’s movement compared to September 27th and made the following statement to his followers:

“We returned to yesterday’s high levels, but the number of open positions has significantly decreased. There is no doubt that there are long positions chasing here, but weaker compared to yesterday. Nevertheless, we would like to see the weakening of long positions to avoid experiencing a complete pullback later.”

As the BTC/USD pair rallied, a chart accompanying the rise caught the attention of investors. Another trader and analyst, Rekt Capital, shared with his followers the resistance levels that Bitcoin needs to overcome in order to achieve a more significant trend reversal.

In another analysis, Rekt Capital shared with his followers that the $29,000 level could re-emerge and that this rise could be part of a broader decline for Bitcoin:

“It is important to remember that Bitcoin can create a new Lower High (Stage A-B) by rising up to $29,000.”