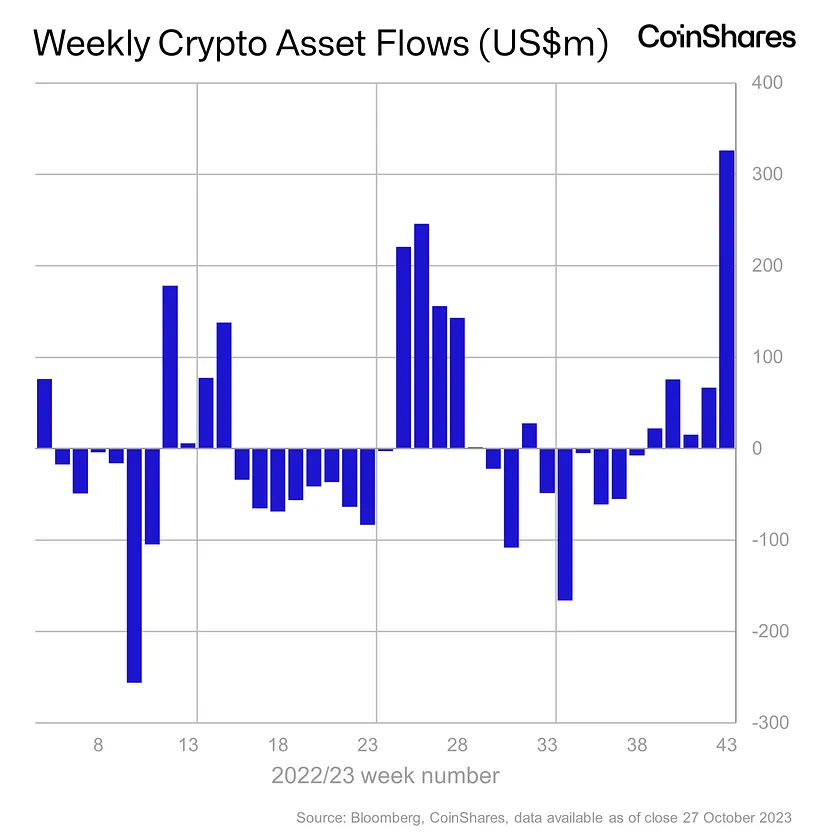

Bitcoin price surged up to $34,856 as the latest news brought positive developments that are highly significant for the markets. Our previous warnings for the past few days indicated that we would witness a significant demand in the CoinShares report, which was released today (Monday). The increasing demand for CME BTC products by institutional investors gave us the first signal of this.

Why is Bitcoin Rising?

As we have been warning for days, today’s report reflects a substantial demand from institutions. The latest report from CoinShares reveals that crypto investment products have seen the largest inflow since July 2022. The weekly inflow reached $326 million, signaling a potential trend reversal in the markets.

According to CoinShares’ recent report:

“Cryptocurrency investment products saw the largest single-week inflow of $326 million since July 2022, as investor optimism grew amid the US Securities and Exchange Commission’s preparations to approve a spot-based Bitcoin ETF in the US. Monthly inflows are now approaching half a billion dollars.”

Regionally, only 12% of the inflows were based in the US. Investors from Canada, Germany, and Switzerland, where the demand is concentrated, made inflows ranging from $50 million to $134 million. This suggests that if the demand for BTC remains strong, we could see more inflows in the US.

Solana (SOL) also emerged as the star altcoin in the institutional sector this week. The weekly inflow into Solana investment products amounted to $24 million.