Bitcoin‘s (BTC) price is making steady progress northward, approaching the $80,000 target with just weeks before the halving. The influx of new capital into the market through spot BTC exchange-traded funds (ETFs) is creating an atmosphere where the bull market is gaining momentum and the timing of the leading cryptocurrency’s peak remains unpredictable. At this stage, Bitcoin ETFs could even surpass Gold ETFs in the coming days.

BTC ETFs Attract Attention

While Bitcoin’s price fluctuates amidst uncertainty, it continues its upward trend. The Crypto Fear and Greed Index remaining at 81 indicates that investors are exhibiting extreme greed, not wanting to miss out on the opportunities presented by price movements.

There are two main themes driving the market. First, BTC’s halving is about 39 days away, which is expected to initiate the next bull cycle. Secondly, the ETF narrative is still ongoing, with the latest investment product being praised for bringing BTC to Wall Street and triggering a wave of institutional interest.

Battle Between Bitcoin ETFs and Gold ETFs Begins

According to data from Kaiko Research, the liquidity depth in the BTC market, when measured as 2% of the risk in order books, shows that bids significantly exceed asks, reaching a record level of $600 million.

This situation indicates that investors are taking profits as Bitcoin prices rise. However, the data also points to persistent refinancing rates that indicate high demand for BTC. Recent reports associate the increasing demand with institutional and retail interest in spot BTC ETFs, while data shows this investment product steadily gaining ground against Gold ETFs.

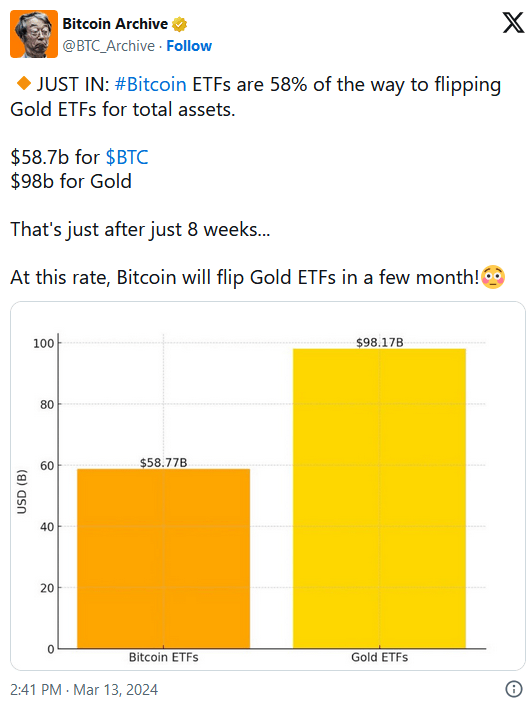

Total Figures for Bitcoin ETFs and Gold ETFs

While the AUM, or assets under management, of BTC ETFs has reached nearly $60 billion, Gold ETFs are still hovering around $98 billion. Thus, Bitcoin ETFs have managed to catch up to approximately 58% of Gold ETFs in just eight weeks since their launch. If this pace continues, Bitcoin could surpass Gold ETFs in a few months.

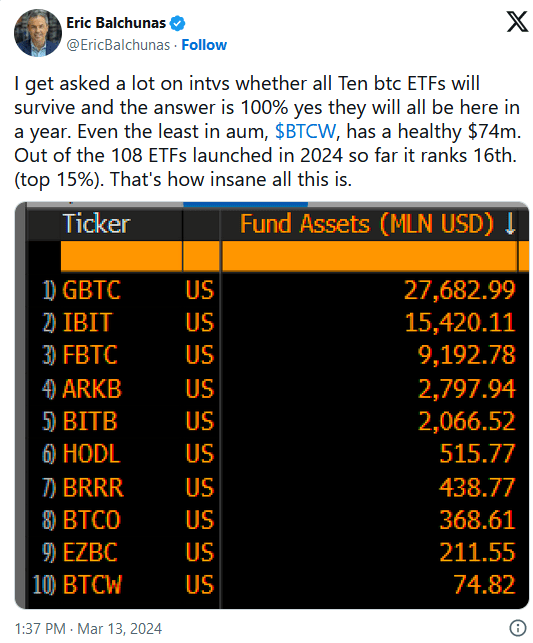

Eric Balchunas, an ETF analyst at Bloomberg Intelligence, believes that all 10 BTC ETFs will achieve this milestone. The lowest-ranked Bitcoin ETF in terms of AUM, WisdomTree’s BTCW, manages a solid $74 million and ranks among the top 15% of the 108 ETFs launched in 2024.

Outlook for Bitcoin Price

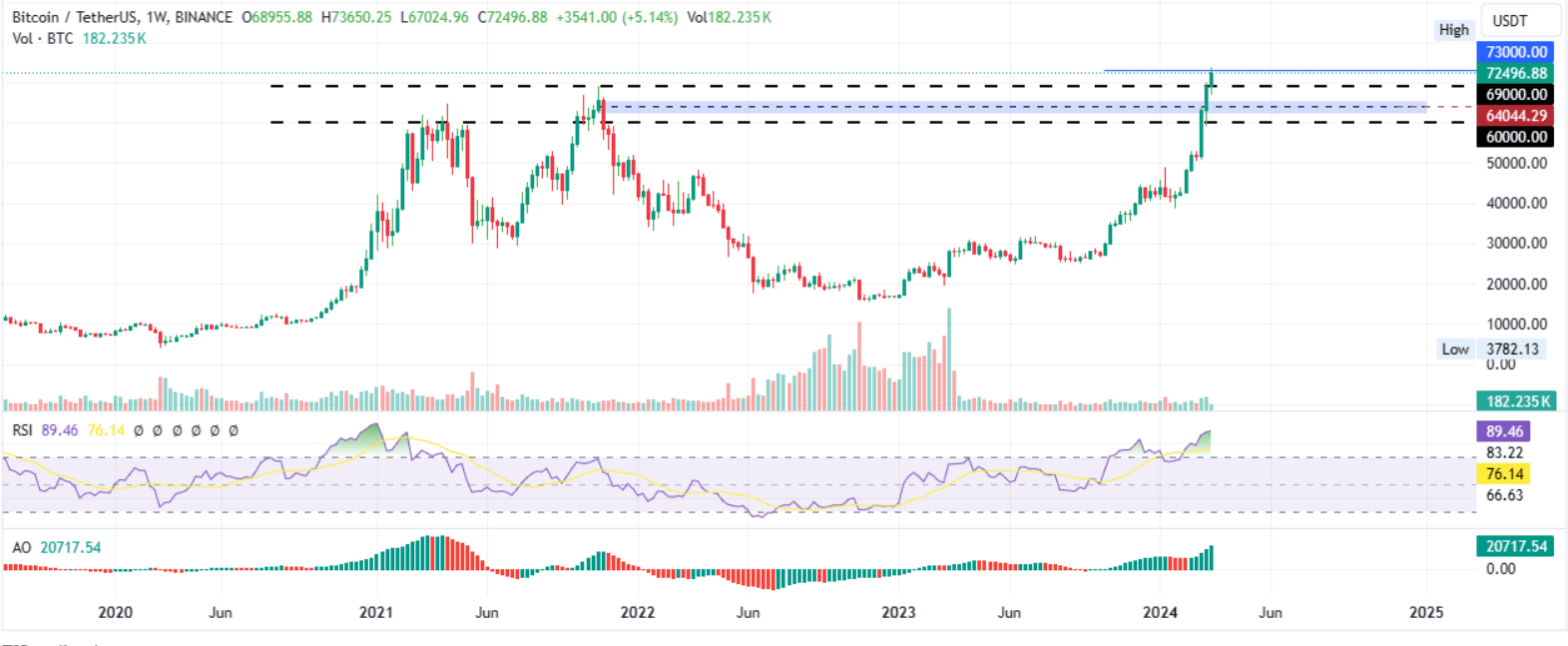

Bulls see every correction as a “buy the dip” opportunity, indicating Bitcoin’s price is not ready to halt. With this successful momentum, BTC’s price is recording new highs. Yesterday, Bitcoin reached a new record of $73,650.

As BTC bulls continue to dominate the stage, everything seems to be moving northward. The three technical indicators shown in the weekly chart below all indicate this. First, the Relative Strength Index (RSI) is moving up to show rising momentum.

Bulls also maintain a strong presence in the BTC market with increasing volume of green histogram bars in the positive zone. Moreover, the rising volume indicator seems to show that the uptrend is strengthening.

The increase in buying pressure could lead to Bitcoin reclaiming the $73,000 level. Further up, BTC could break through the significant $75,000 resistance or, if the rally continues, test the $80,000 psychological level. This would mean a 10% increase from current levels.

If a Sell-Off Occurs in BTC

If investors start to convert their gains into cash, the Bitcoin price could pull back. Investors looking to take short positions in BTC should wait for a break and close below the $64,044 level, which is the midpoint of the supply zone between $62,278 and $65,618.

If this area turns from support to resistance, then BTC could offer another buying opportunity at the $60,000 psychological level.

Türkçe

Türkçe Español

Español