The price of Bitcoin (BTC), the leading cryptocurrency, has been on the rise in recent days, attracting the attention of many individual investors. However, it was not just individual interest that drove up the price of BTC. Institutional investors were also showing interest in the leading cryptocurrency.

On-Chain Data for BTC

In addition, the options market for BTC has been quite active in recent days. After the expiration of options on Friday, there were $2.75 billion worth of Bitcoin options on Deribit. The open interest (OI) was at levels seen in 2021, and at the time of writing, it was $12.5 billion. Amberdataio revealed that call options saw changes in specific strike prices, with the highest strike prices initially ranging from 29,000 to 32,500, but now reaching 40,000.

The highest short gamma level was 36,000 at the time of the news release and continues up to 40,000. In finance, especially in options trading, “short gamma” can mean that if you sell options, you are sensitive to price changes in the underlying asset, such as Bitcoin.

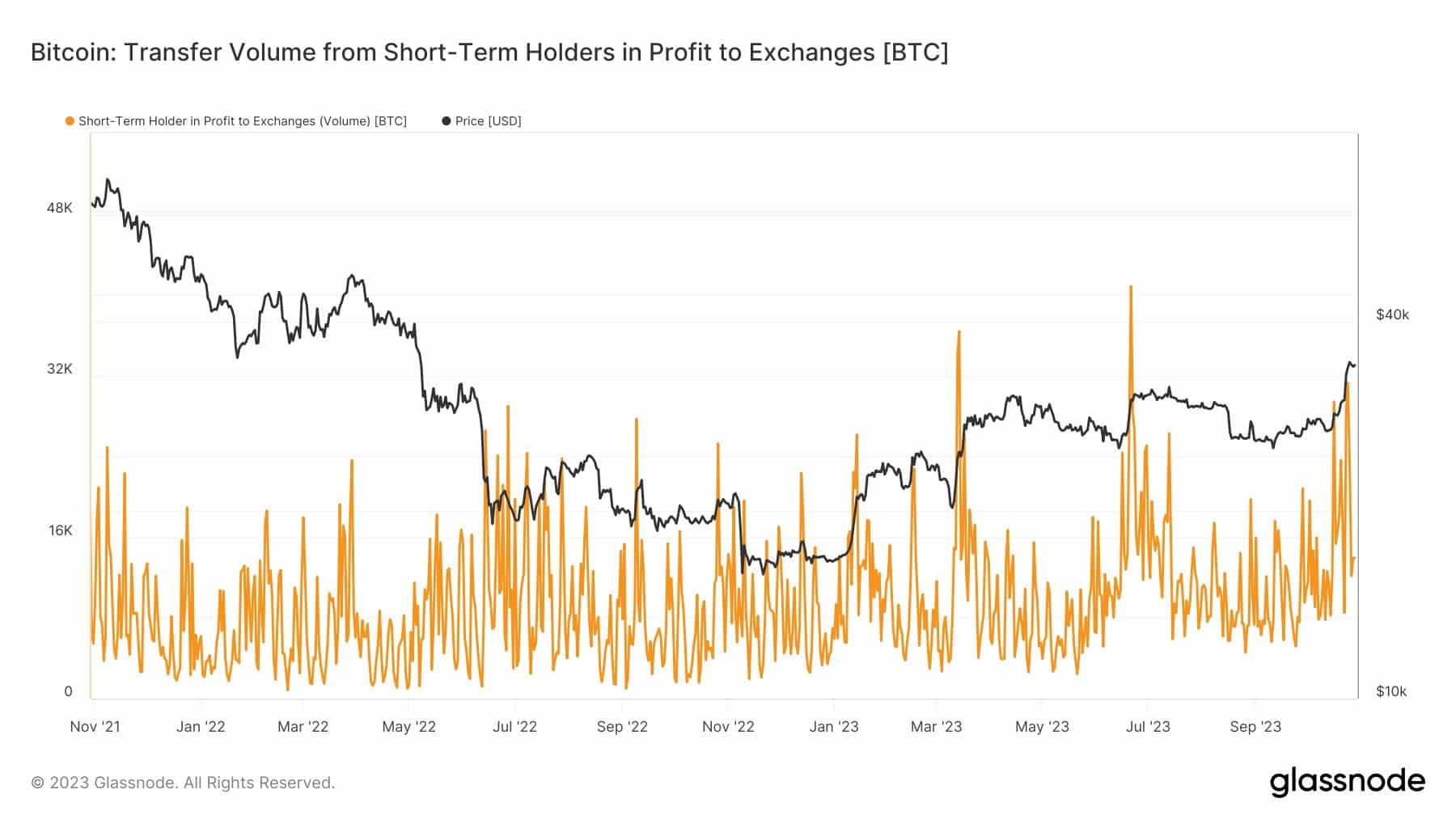

The price of Bitcoin could face losses if it starts to move too much. Bitcoin remained impressively above $34,000 for five days. However, some long-term holders (STH) decided to take profits, which was one of the biggest profit-taking events in the past two years.

Long-Term Expectations for Bitcoin

On the other hand, long-term holders (LTH) did not change their positions. The profit-taking event by STHs is significant this year, but it may not have much impact in the long run. The price of Bitcoin (BTC) attracts the attention of both individual and institutional investors, with an active options market and rising strike prices.

However, the profit-taking tendency among long-term investors may affect the future price movements of BTC. Bitcoin, which remained above $34,000, is facing fluctuations determined by changes in the options market and investor behavior.