Significant developments continue to emerge in the cryptocurrency market. In recent days, macroeconomic data from the US and Bitcoin sales by GBTC have caused a drop in Bitcoin’s price. During this period, the altcoin market also experienced significant losses. So, what can we expect next for Bitcoin? We examine this with detailed chart analysis and key levels.

Bitcoin Chart Analysis

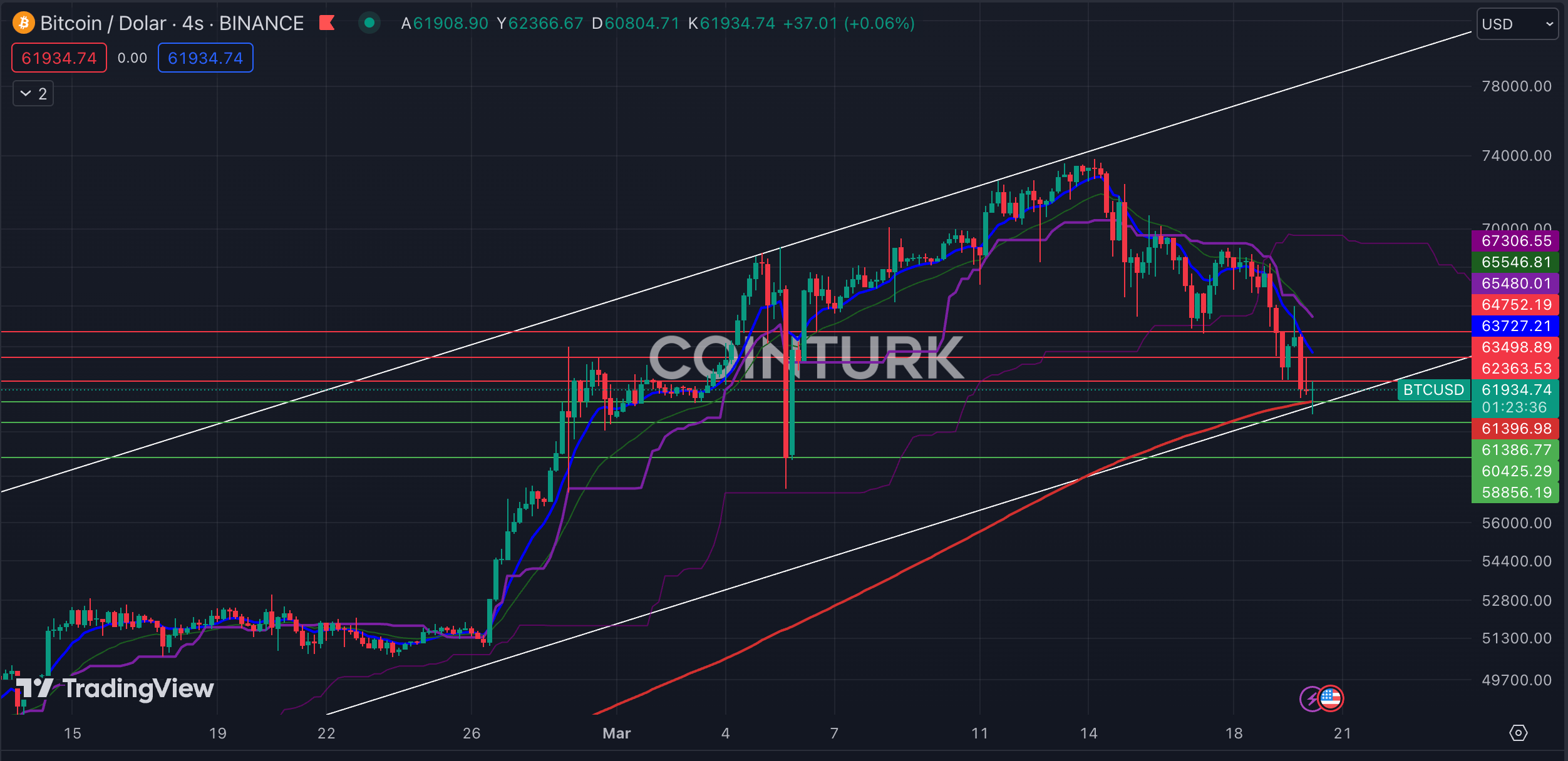

The first formation structure to note on the Bitcoin chart is the ascending channel formation. The absence of any support or resistance break within this structure provides important clues, especially for investors in the futures market. The fact that Bitcoin’s EMA 200 (red line) level acted as support in the recent price correction points to a positive trend in the long term.

The most important support levels to watch on the four-hour Bitcoin chart are; $61,386 / $60,425 and $58,856 respectively. A four-hour bar close below the $61,386 level, which intersects with the formation support line and EMA 200 level, will cause Bitcoin’s price to lose momentum.

The most important resistance levels to watch on the four-hour Bitcoin chart are; $62,363 / $63,498 and $64,752 respectively. A four-hour bar close above the $63,498 level, which intersects with the EMA 9 (blue line), will cause Bitcoin’s price to gain momentum.

Bitcoin Dominance Analysis

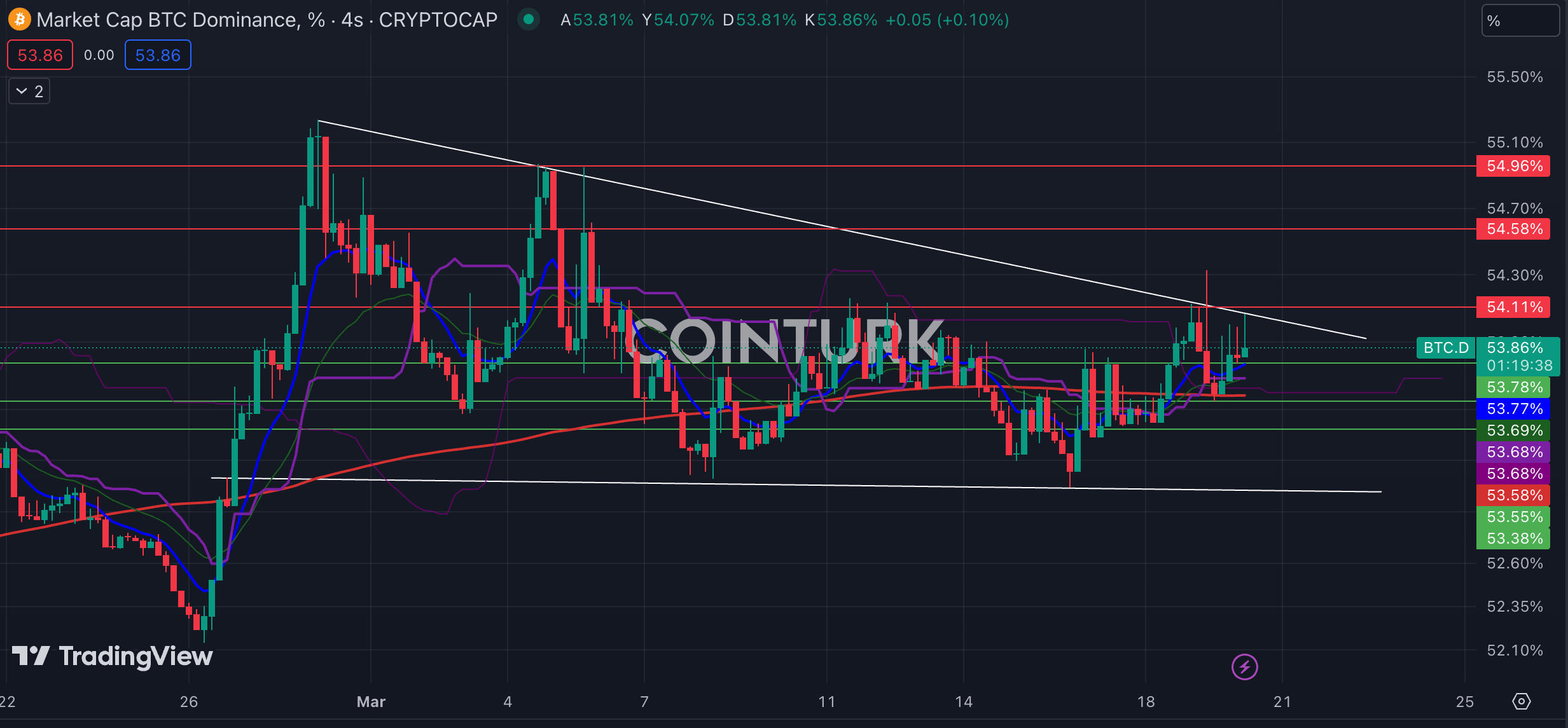

The four-hour BTC.D chart, which compares the crypto market value and Bitcoin market value, shows a narrowing wedge formation. After being rejected from the resistance line, the EMA 200 level acting as support indicates an important phase for Bitcoin. Any break above resistance could increase Bitcoin’s value while the altcoin market may lose momentum.

The most important support levels to follow on the four-hour BTC.D chart are; 53.78 / 53.55 and 53.38 respectively. A four-hour bar close below the 53.55 level, which intersects with the EMA 200, will allow the altcoin market to gain value against Bitcoin.

The most important resistance levels to watch on the four-hour BTC.D chart are; 54.11 / 54.58 and 54.96 respectively. A four-hour bar close above the 54.11 level, which intersects with the formation resistance line, will cause Bitcoin to gain value against the altcoin market.

Türkçe

Türkçe Español

Español