BTC price is at $63,000, and it’s important to know that this doesn’t mean much to investors. Bitcoin bulls have faced several setbacks following unsuccessful attempts to break the $73,777 resistance. SEC is moving forward with more crypto cases. The stance of US politicians against crypto has hardened, and US inflation has stopped falling. How does everything happen all at once?

Bitcoin Commentary

The current time and price are extremely important. In January 2024, prices at $60,000 were tantalizing. Mid-2021, the $61,000 level had investors jumping for joy. And today, in mid-May 2024, a Bitcoin price of $63,000 only brings sleep to investors.

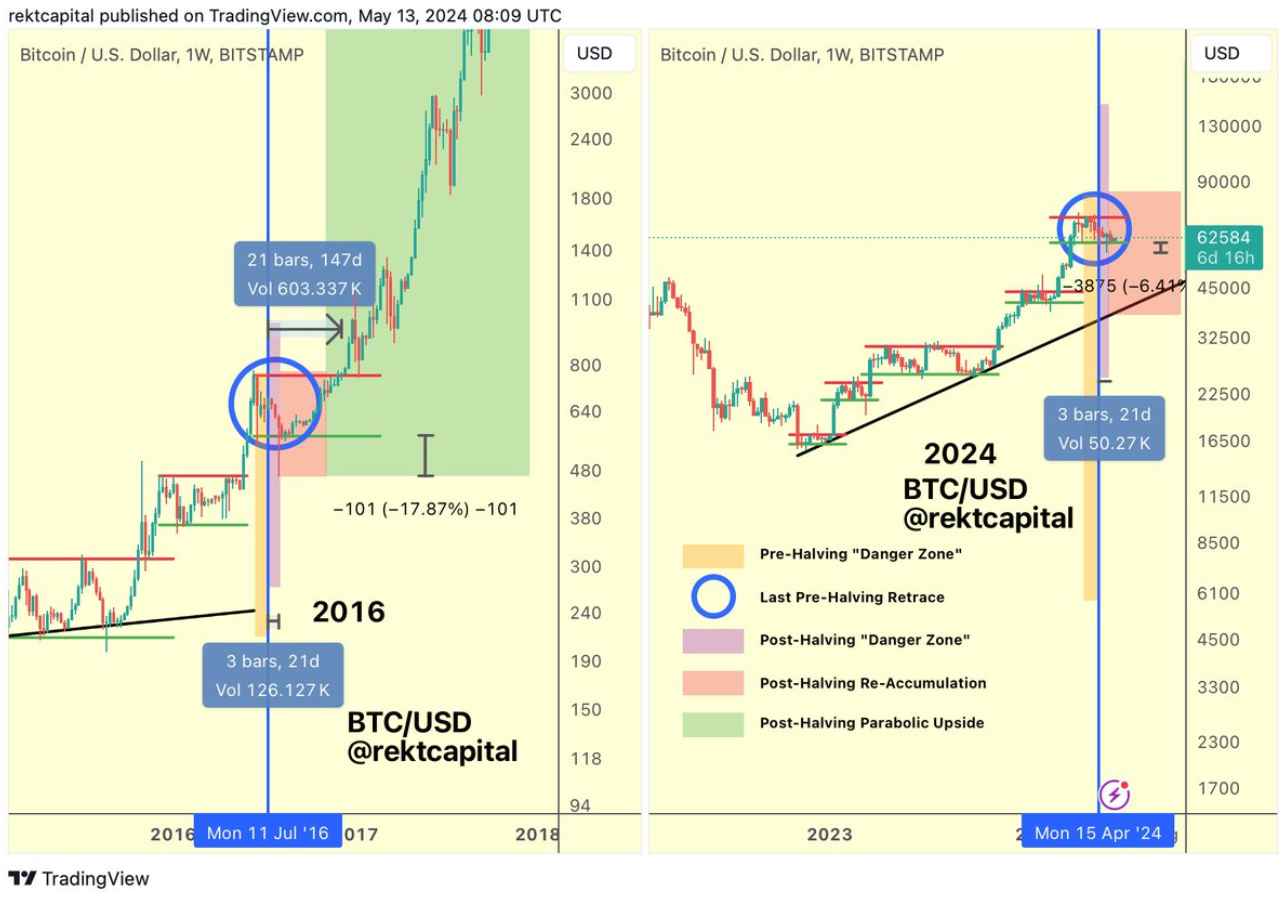

Technical analysts closely followed by investors, like Rekt Capital, mention that the momentum on the selling side is starting to slow down. According to this analyst, maintaining $60,000 could prepare the ground for a new rally.

On-chain analyst Axel Adler Jr is examining network data and sees no signs that the bull cycle is ending. Some investors are depressed because BTC has been stagnant for a few weeks, moving away from the usual first-quarter rise, but the bull peak has not yet arrived. Axel wrote;

“Despite all the negativity in the market, there is no signal in the on-chain data that the bull cycle is ending.”

Will Cryptocurrencies Increase?

There is still much time until the end of the month, but this week’s April inflation data could increase volatility. The first quarter data was very bad, but the last month’s employment data showed at least some relaxation on the labor front. On-chain analyst Binhdangg notes the weakening selling pressure among long-term investors and thinks the CPI data will be positive.

Crypto Dan wrote that demand through the ETF channel during this period could steadily strengthen the market compared to previous bull cycles.

“Therefore, the likelihood that we have reached the peak of this bull cycle is low, maybe we are only 20% along the way?”

QCP Capital argues that the price holding at $60,000 could trigger a new attempt towards $70,000. However, the direction until May 31 will largely depend on this week’s inflation data.

Türkçe

Türkçe Español

Español