Bitcoin market has been experiencing volatile days lately. Recent data shows that the price of Bitcoin, the leading player in the cryptocurrency world, continues to have high levels of volatility. Bitcoin, which exceeded $26,400 and pleased investors, soon fell below $26,000, increasing uncertainty in the market.

Bitcoin Offers a Return to $24,400

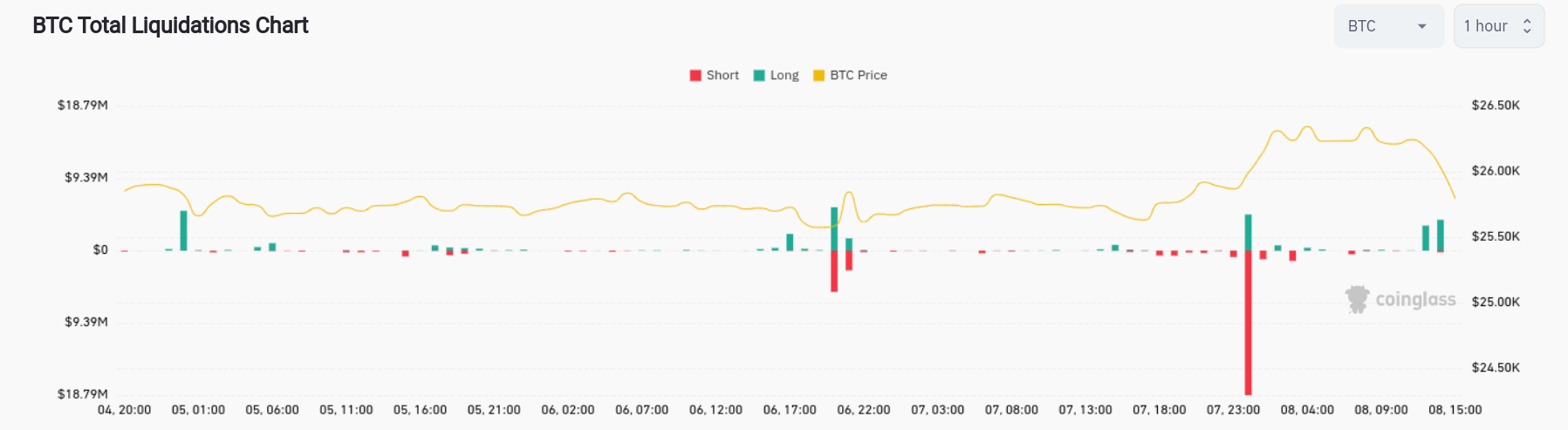

Data taken from TradingView indicates that BTC price movements have liquidated both short and long positions. Bitcoin gained upward momentum the other day, resulting in a rise above $26,400 after the daily close. Subsequently, the decline brought the BTC/USD pair back below $26,000.

The result was a punishment for futures traders who chased the market up and down. According to the data from crypto analysis source CoinGlass, short liquidations reached a total of $23.5 million on September 7th, while the long liquidation value on September 8th is still unknown. Popular investor Skew wrote in a tweet, “Short positions were hunted as expected” in a part of the night market news.

Another popular investor, Daan Crypto Trades, highlighted the importance of regaining lost ground since August and shared the following statement with X subscribers:

“Bitcoin finally managed to surpass the opening level of September after multiple tests. Now it is testing these levels again. The real question is, will it provide support as much as it has shown resistance? We are having a ‘Green’ September in the hands of the bulls.”

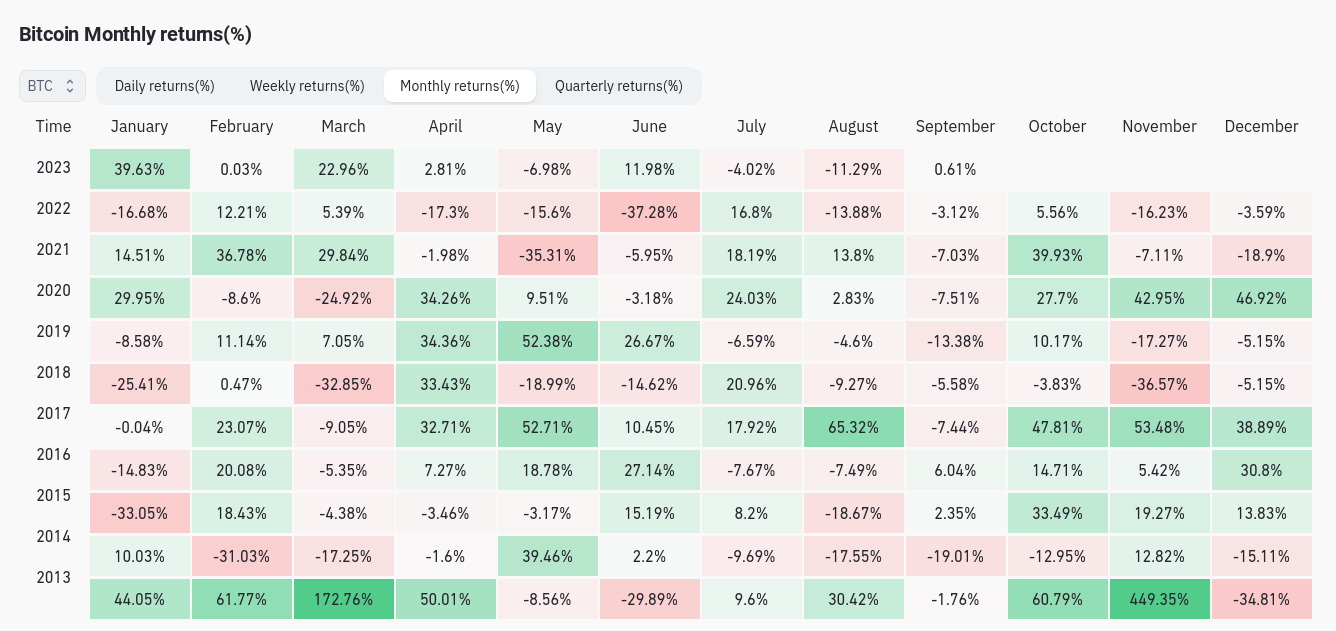

CoinGlass data confirms that September is inclined to create a drop of around 10% in BTC prices and distort market expectations for 2023.

BTC Price Reinforces the Last Correction

Popular investor Crypto Tony shared with his followers that breaking the resistance line of $26,600 is necessary. With an explanatory chart, he added the following:

“A nice rally from the $25,600 low range, but no follow-up to the highest levels of the range, so we are still stuck in the middle range.”

“I won’t enter Bitcoin unless we surpass $26,600.”

After returning to a familiar range since the first week of September, the BTC/USD pair continues to maintain the 200-day exponential moving average (EMA), which is currently at the $25,674 level.

Michaël van de Poppe, the founder and CEO of Trade firm Eight, commented on Bitcoin’s interaction with the 200-week EMA in previous cycles, stating that the market is in the middle of this “last” BTC price drop:

“Technically speaking, we can only focus on the price movement in 2019, but that doesn’t provide a clear situation. We can relate the current market to the 2015 situation with this cycle.”

Türkçe

Türkçe Español

Español