Following the initial announcement of tariff rates, Bitcoin  $91,081‘s price surged to $88,500 but quickly began to decline. At the time of writing, the cryptocurrency was trading at $85,300. The recent tariff policies introduced by Trump, alongside individual tariffs for specific countries, have created an atmosphere of fear and panic in the market, though the numbers provided have not alleviated these concerns. This article delves into the details of the U.S. tariff list and other relevant information.

$91,081‘s price surged to $88,500 but quickly began to decline. At the time of writing, the cryptocurrency was trading at $85,300. The recent tariff policies introduced by Trump, alongside individual tariffs for specific countries, have created an atmosphere of fear and panic in the market, though the numbers provided have not alleviated these concerns. This article delves into the details of the U.S. tariff list and other relevant information.

Last-Minute Updates on Cryptocurrencies

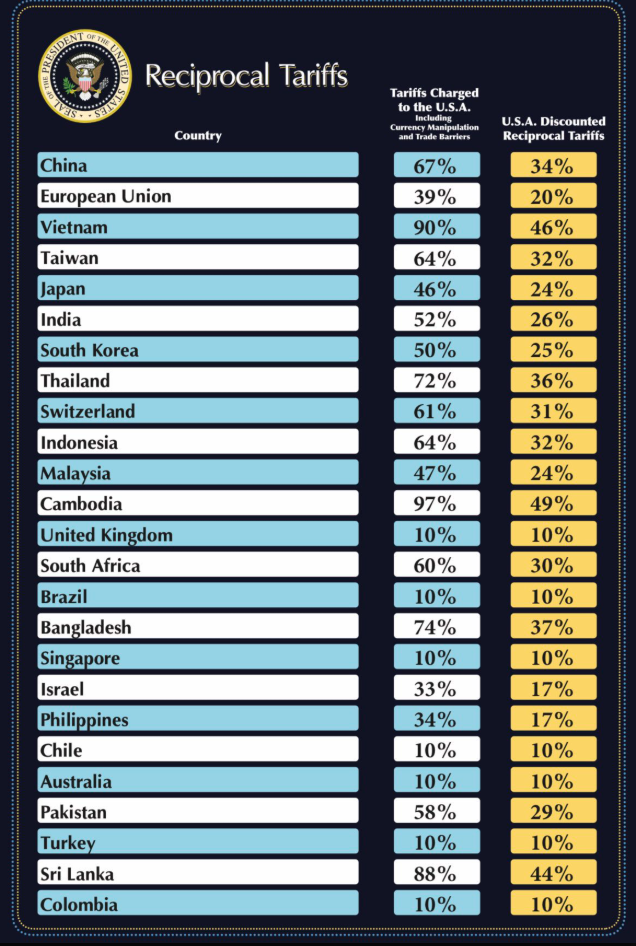

Currently, the main advantage is the clarity brought by the uncertainty being resolved. Trump had previously indicated that there would be no revisions to the announced tariffs, which have now been made public, imposing a universal 10% tariff across the board. Below, we present the U.S. tariff list for your review.

U.S. Tariff Rates: The tariff rates (including currency manipulation and trade barriers) are listed on the left, while the “discounted counter-tariff” that the U.S. will apply is shown on the right. A significant tax was announced for China, with a 20% rate for the EU. The expectation from the U.S. is for trade partners to lower their tax rates. Should they fail to reduce rates and retaliate, they can expect counteractions corresponding to the retaliation rates.

What about the situation with cryptocurrencies? The U.S. will impose a tax equal to half the rate applied by any country. This situation is quite clear, and the uncertainty has finally been resolved. The BTC price initially reacted positively to the announcement of the 10% base tax but fell afterward, which is not surprising.

If the $84,000 level can be maintained as support, an uptrend in cryptocurrencies could begin. With Trump’s vague announcements now curtailed, fear will gradually stabilize, allowing markets to digest these rates. Overall, this news cycle is the lesser of two evils for cryptocurrencies, signaling the potential for recovery in the medium term.

Retaliation is not expected; however, if China, the EU, and others initiate significant retaliatory actions, they will also receive equal counteractions from the U.S. It may be more logical for them to lower tax rates instead of engaging in a conflict, and such moves could lead to further increases in cryptocurrency values as we hear more about these actions.