Bitcoin (BTC) surpassed the $64,000 level, reaching $64,268 and setting a new annual record. This increase coincides with the Tether Treasury creating 1 billion USDT. The move sparked widespread speculation and intense interest in the cryptocurrency sector.

The Impact of USDT on Bitcoin

Whale Alert, a blockchain analysis platform, reported the creation of USDT on Sunday. As a result, it sparked a discussion about the potential effects on Bitcoin‘s price. Historical data suggests a correlation between Tether’s minting actions and significant increases in Bitcoin’s value.

In January, Tether issued 2 billion USDT over ten days, coinciding with a notable increase in Bitcoin’s price, also fueled by expectations of a spot Bitcoin exchange-traded fund (ETF). This trend led some to speculate about future Bitcoin price volatility.

Expert Opinion on Bitcoin

Amid market speculation, Tether CEO Paolo Ardoino provided clarity. He explained that the 1 billion USDT was allocated not for immediate market impact but for future issuance demands and chain swaps. The senior analyst stated the following:

One billion USDT inventory was replenished on the Ethereum network. Remember, this is an authorized but unregulated transaction, meaning this amount will be used as inventory for future issuance demands and chain swaps.

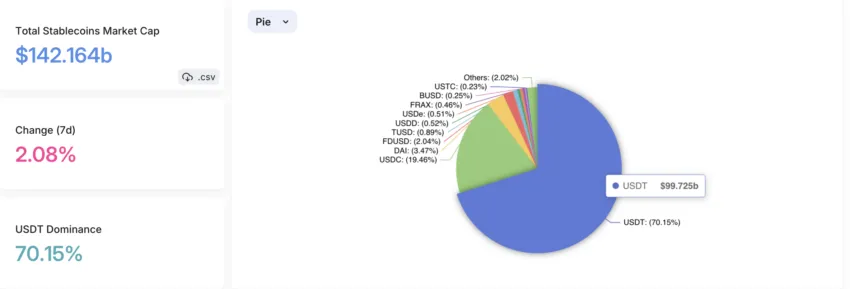

Ardoino’s statement highlights the operational complexities of blockchain technology. It shows how cryptocurrency units can move across multiple blockchains to meet market demands and increase liquidity. Tether is on the verge of reaching a market value of 100 billion dollars. With over 70% market share according to DefiLlama, Tether’s dominance in the stablecoin market is clear. Consequently, the speculation linked to Tether’s creation of 1 billion USDT following Bitcoin’s record-breaking rise and the 2 billion USDT issued in January has sparked intense interest in the cryptocurrency market. Tether CEO’s statements emphasize the stablecoin market’s dominance and the operational complexities of blockchain technology.

Türkçe

Türkçe Español

Español