Bitcoin‘s price continues on a negative trajectory following the release of high PCE data today, unable to breach the $26,600 mark. Altcoin investors are experiencing increased losses amidst this environment of uncertainty. A study of four critical data points can potentially shed light on the direction cryptocurrencies might take. Now, let’s discuss the short and medium-term expectations.

Cryptocurrency Commentary

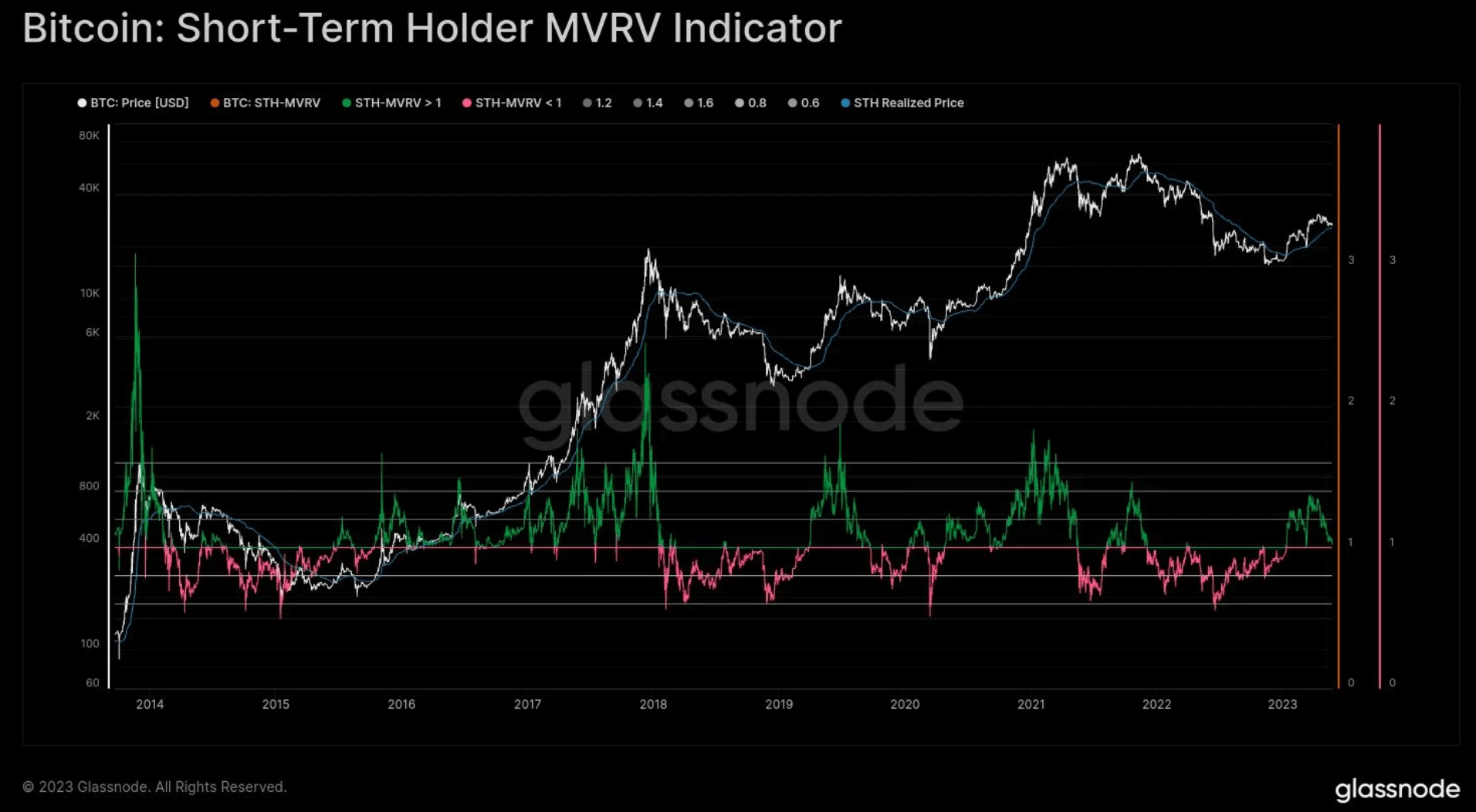

Checkmate, Glassnode’s head on-chain analyst, drew attention to a reckoning in his market evaluation on May 26th. BTC/USD, struggling near significant trend lines, increasingly worries long-term market participants this month. Short-term investors (STH) holding BTC for less than 155 days could see their profits wiped out.

Checkmate argues that this is a necessary correction for the continuation of the 2023 bull rally. The STH-MVRV is currently at 1,022, and the value of 1.0 is roughly equivalent to $26,500.

In bull markets, this level should provide solid psychological support. We may trade below this level, but a swift recovery will be necessary to justify upward continuity.

While the price is currently below this region, according to the analyst, a quick surge should start from here.

Will Bitcoin Rise?

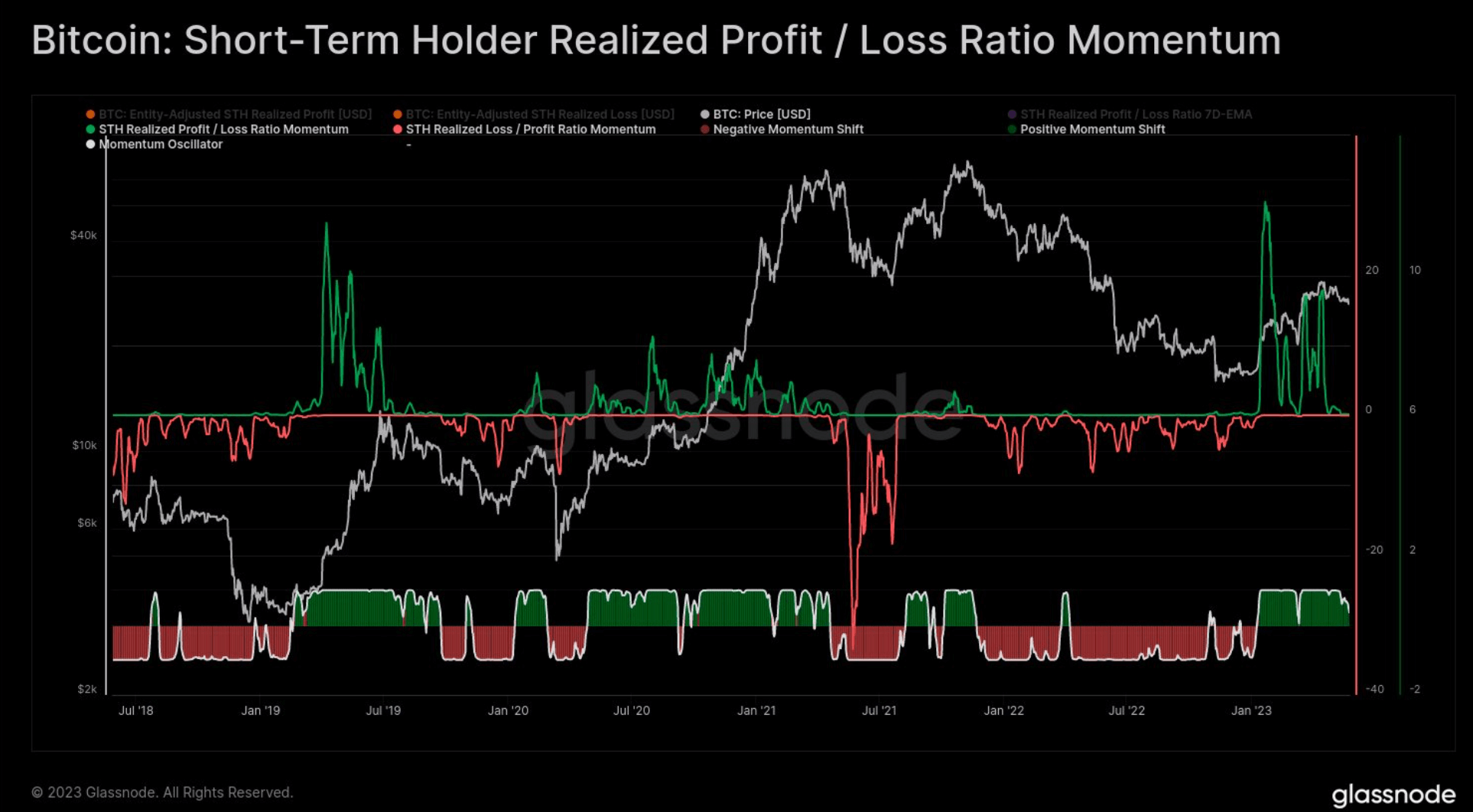

As defined by Glassnode, STH-SOPR is a “sold price versus paid price” metric that measures the profitability of spent outputs. This metric has already turned negative, and we see that short-term investors are beginning to feel the loss.

Losses for STH can ONLY be provided by local top buyers, and intuitively, we want to see top buyers selling local bottoms. This is what creates the FOMO bounce reaction.

Momentum is retracting from its “green” phase, which has been ongoing since Bitcoin‘s price recovery began in January 2023.

STH Profit/Loss momentum is a tool designed to detect rapid changes in market regime and trend. It is highly sensitive. If this thing starts to turn red, it will be an early signal that a deeper correction is in play. Consistently, it has indicated a trend reversal before the first break occurs.

Lastly, Checkmate draws attention to coin inactivity. He suggests that if the bulls truly want a surge, they must mobilize their assets.

Historical data suggests that unless we encounter significant chaos, Bitcoin’s price, along with cryptocurrencies, can initiate an upward movement.