Bitcoin recently showed significant price movement, surpassing $70,000 and causing excitement in the cryptocurrency community. This price increase represented a rise of over 4% in the past week, indicating strong bullish momentum for Bitcoin. As of the latest data, Bitcoin is trading at $71,091.06 with a market value exceeding $1.4 trillion.

Ali Martinez Warns Bitcoin Investors

Despite this bullish performance, a sell signal was detected on Bitcoin’s chart. A well-known crypto analyst, Ali, highlighted this in a tweet, indicating a potential price drop. However, this signal did not significantly affect Bitcoin’s price, which remained strong above $71,000.

This stability is also supported by CryptoQuant data showing a decrease in Bitcoin’s exchange reserves. This trend indicates high buying pressure as investors hold onto their cryptocurrencies rather than selling them.

Strong Buying Sentiment Among U.S. Investors

Additionally, U.S. investors show strong buying sentiment for Bitcoin, evidenced by the positive Coinbase premium. This premium reflects Bitcoin’s higher price on Coinbase compared to other exchanges, indicating strong demand among U.S. buyers. The combination of high buying pressure and strong demand supports the idea that Bitcoin’s upward trend may continue.

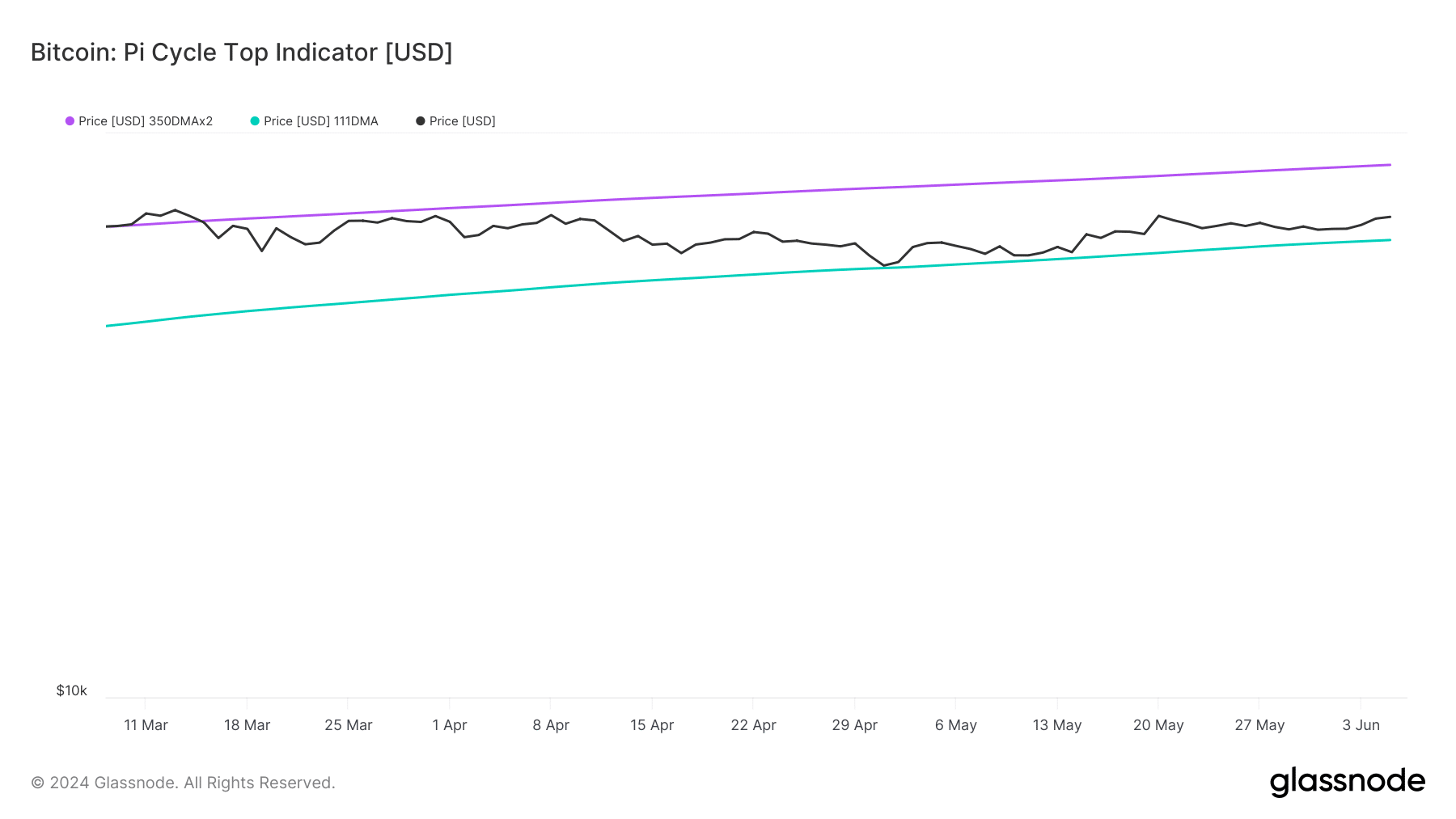

Further analysis of data from Glassnode provides more insights into Bitcoin’s potential price movement. The Pi Cycle Top indicator, using the 111-day moving average and twice the 350-day moving average, suggests that Bitcoin has not yet reached the market peak. This means Bitcoin’s price could continue to rise and reach $87,000 before experiencing a major correction.

Metrics Indicate Bullish Trend

Bitcoin’s dual CDD (Coin Days Destroyed) metric being green indicates that long-term holders are not significantly moving their cryptocurrencies. This behavior generally signals confidence in further price increases, as these holders expect higher valuations in the future. Additionally, the increase in Bitcoin’s funding rate shows that long-position traders are dominant and willing to pay short-position holders, reinforcing the bullish sentiment.

Technical analysis of Bitcoin’s daily chart shows a bullish trend in the MACD indicator, indicating potential upward price movement. The Relative Strength Index (RSI) is also above the neutral mark, suggesting that Bitcoin is not yet overbought and still has room for growth.

Türkçe

Türkçe Español

Español