Investors are eagerly awaiting the course of Bitcoin during this period, while analysts and experts continue to make various predictions. The influence of the US dollar index on Bitcoin and economic factors also complicate this period. This period is very exciting and intriguing to evaluate current developments and investment opportunities in the crypto market.

The Best Time to Buy Crypto Assets

According to data obtained from TradingView, Bitcoin surpassed $27,000 for the first time in September. Throughout the day, the price of Bitcoin increased by over 3%. Shortly before Wall Street’s weekly opening, investors observed an increase in the price of Bitcoin. Michaël van de Poppe, the founder and CEO of the trade firm Eight, summarized this increase as follows:

“The price of Bitcoin surpassed the $26,800 barrier and reached the highest level of $27,200. Since altcoins also woke up, it seems that the trend will be upward from here. It is still the best time to buy your assets.”

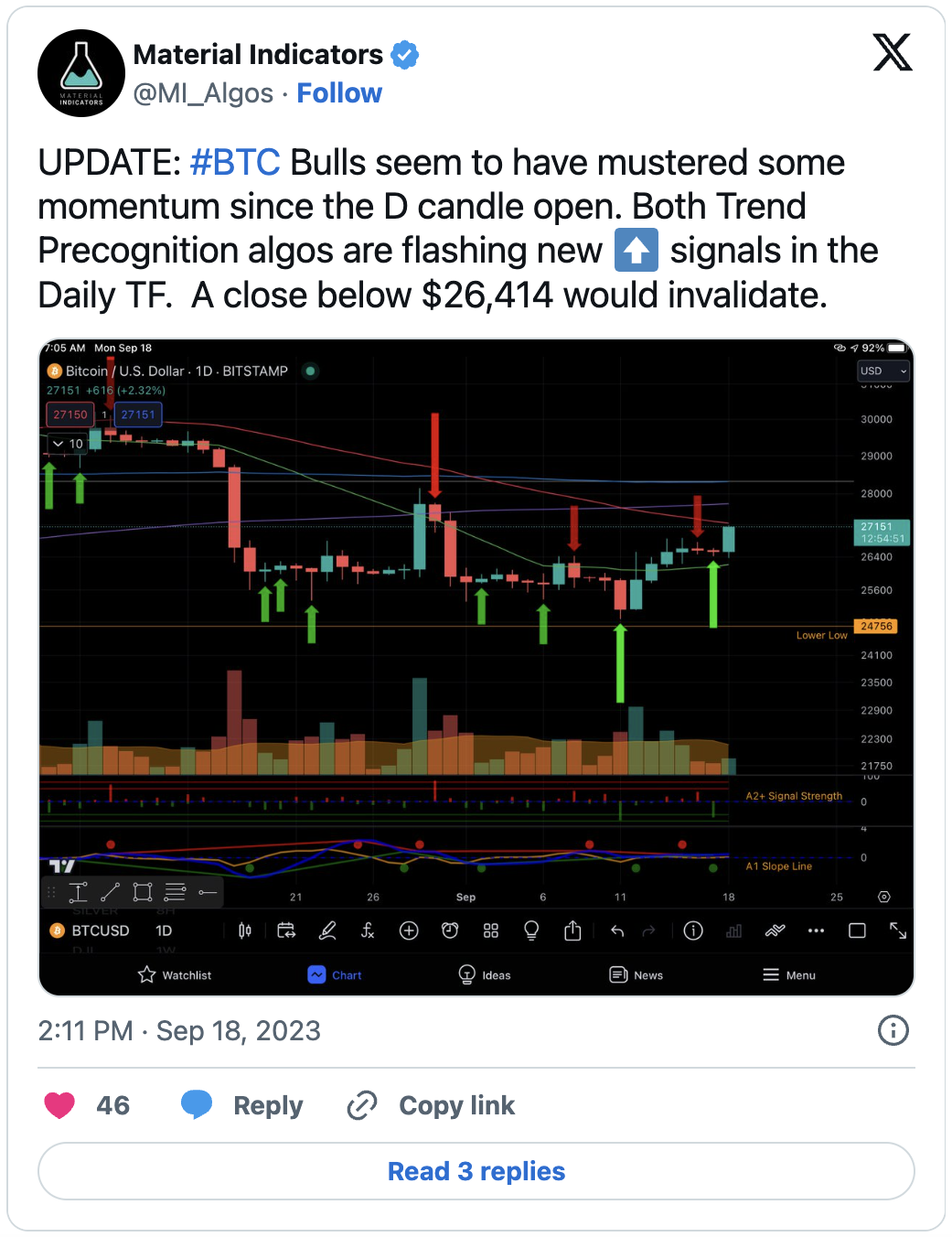

In addition to all this, the data monitoring source Material Indicators announced daily buying signals in trade tools. Followers were informed as follows:

“Bulls seem to have gained some momentum since the opening of the D candle.”

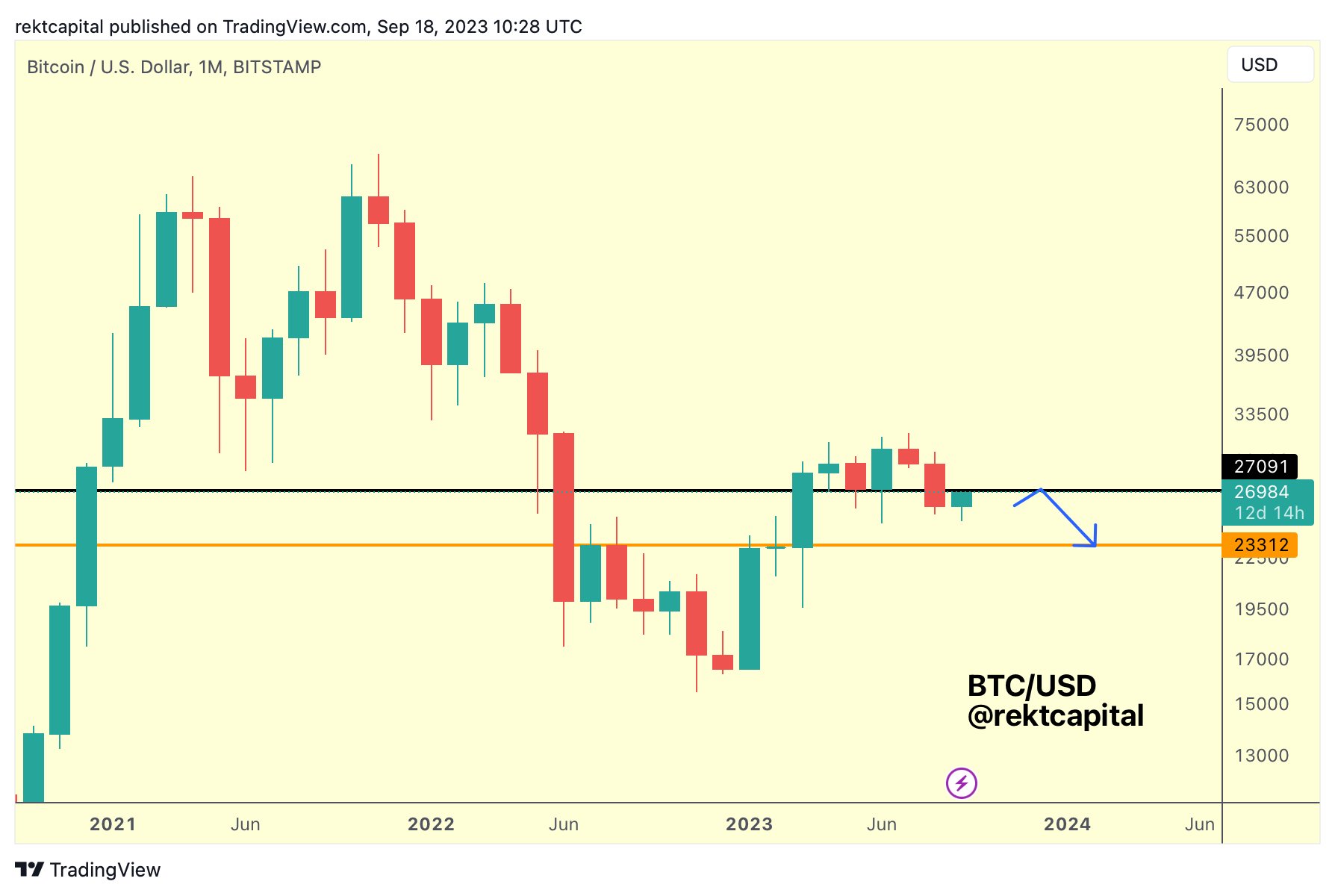

Rekt Capital, an investor and analyst who attracts attention with his posts on X, stated that bulls need to achieve higher levels and hold these levels until the monthly closing of September:

“Soon, $27,100 (black) will be revisited. This level served as support earlier this year, and unless BTC reclaims it with a monthly close above black, it can turn into a new resistance this month.”

Bitcoin Shows Strength for the First Time

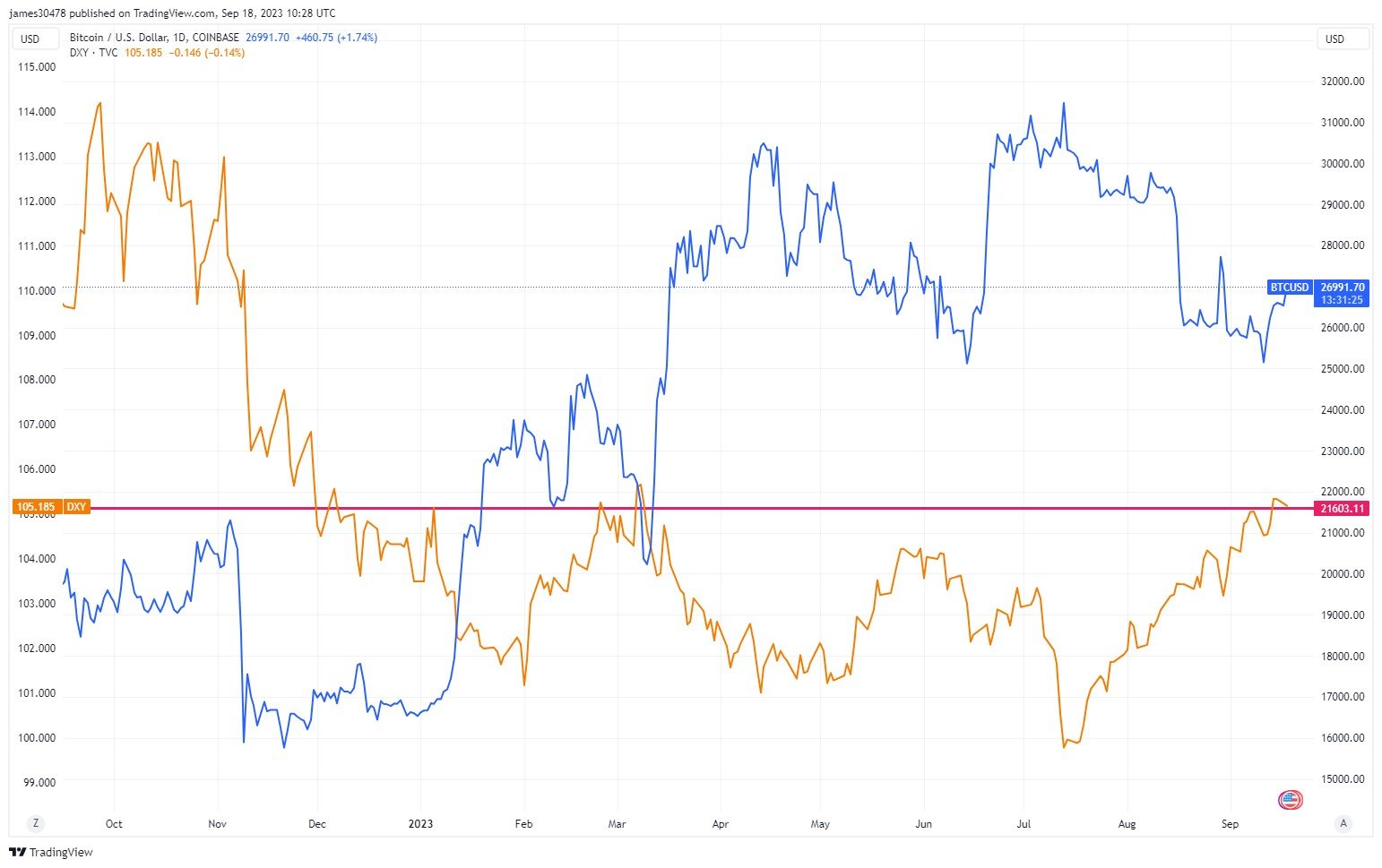

With the approaching announcement of the Federal Reserve’s interest rate decision on September 20, developments before this decision are at the center of the economic agenda. Despite claims that interest rates will not rise, the US dollar index DXY continued to strengthen throughout the day. The DXY index surpassed 105 for the first time since mid-March, despite its usually inverse correlation with the index.

However, despite this, the price of Bitcoin, which is generally inversely correlated with the index, did not show any signs of weakness. James Straten, a research and data analyst at CryptoSlate, made the following statements alongside a comparative chart:

“The last time DXY traded at the 105 level was in March when Bitcoin was trading below $20,000. The previous time was the fourth quarter of 2022, and Bitcoin was trading at $17,000.”