Bitcoin (BTC) has shown an increase of 9.31% in the last 24 hours, surpassing $57,000 for the first time since November 2021. According to experts, the cryptocurrency market reacted to MicroStrategy’s purchase of 3,000 Bitcoin throughout February, bringing their total Bitcoin holdings to 193,000.

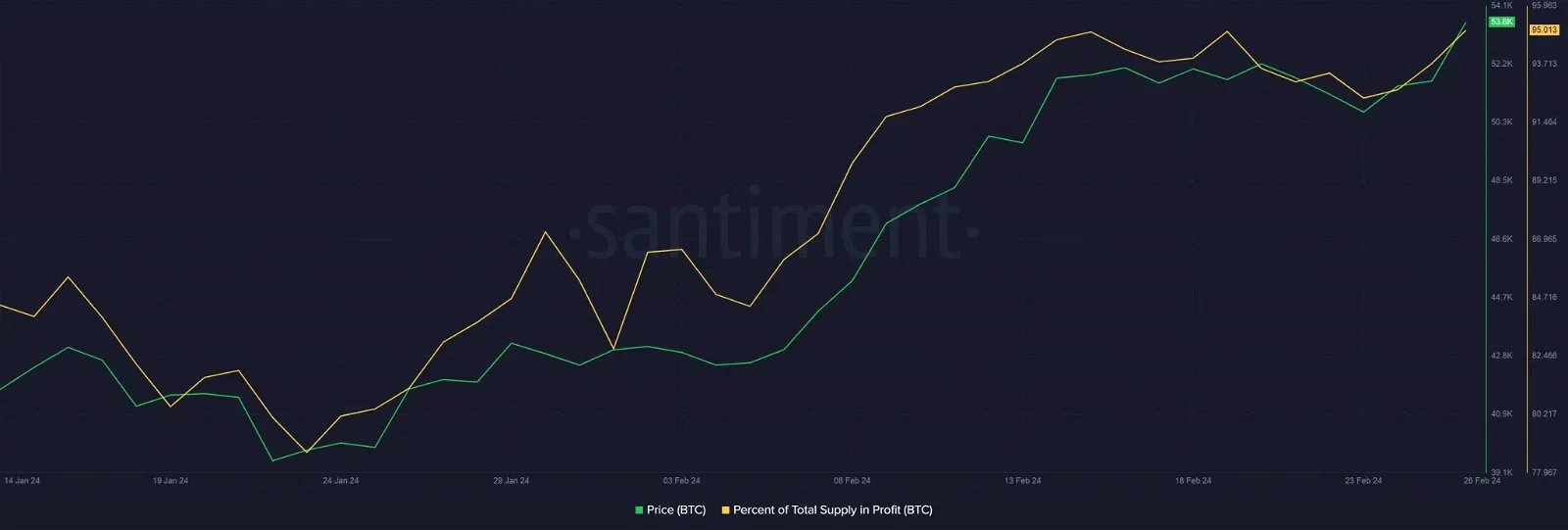

Bitcoin Data Insights by Santiment

The world’s largest cryptocurrency has risen over 200% from its lowest point during the 2022 crypto winter, when sentiment towards cryptocurrencies hit rock bottom. Despite challenging times, Bitcoin now stands as one of the most profitable tokens to include in an investment portfolio. According to analytics firm Santiment, approximately 95% of the current supply is in profit.

The cryptocurrency network, with a target of $69,000 set by experts, is nearing 100% profitability. Renowned crypto market analyst Ali Martinez characterizes this stage as the “hope phase” of market psychology, where investors begin to believe in the continuation of the rally. A researcher at CryptoQuant predicts a macro correction when Bitcoin’s profitable supply exceeds 96%, basing his forecast on historical trends and stating:

I think we can assume that the price will soon rise to the $55-60 thousand level, even create a new ATH, followed by a market correction and the start of a bull rally.

Bitcoin Futures Market

According to data from another crypto analytics firm, Coinglass, this rally led to an 8% increase in open interest (OI) in the Bitcoin futures market. Moreover, OI, an indicator of the total money invested in the derivatives market, was at an all-time high (ATH) of $25.51 billion at the time of writing. According to the website 21milyon.com, the leading cryptocurrency was trading at $56,000 at the time of writing, and experts are pinning their hopes on the magical figure of $69,000. Consequently, Bitcoin’s recent surge past $57,000 has sparked hope among investors, while MicroStrategy’s purchases and expert predictions could support the rally.

Türkçe

Türkçe Español

Español