Bitcoin (BTC), after trading between $59,000 and $61,000 for the past two weeks, surpassed $61,000 early today. Investors are focused on the speech by US Federal Reserve (Fed) Chairman Jerome Powell at Jackson Hole today at 5:00 PM GMT, which could create significant market movements.

Cryptocurrency Market Shows Signs of Recovery

While major cryptocurrencies remained relatively stable, Cardano (ADA) and Avalanche (AVAX) made notable gains. Cardano’s ADA rose by 3%, while Avalanche’s AVAX jumped by 10%. The rise in AVAX followed Franklin Templeton‘s addition of AVAX as a network option for its OnChain US Government Money Market Fund (FOBXX). FOBXX, launched in 2021, was introduced as the first money market fund to use a public blockchain for recording transactions and ownership.

Meanwhile, US-listed spot Bitcoin exchange-traded funds (ETFs) continued a six-day streak of gains with $64 million in inflows. Among these funds, market leader BlackRock’s IBIT ETF attracted the highest inflow with $75 million. Some analysts view the slowdown in overall ETF inflows as a negative signal for the market.

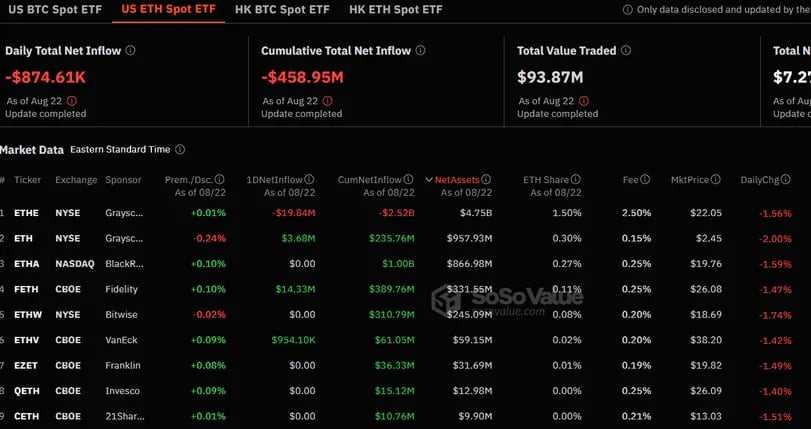

On the other hand, spot Ethereum (ETH) ETFs faced record outflows in their first month after a poor start. These ETFs saw $800,000 in outflows on Thursday alone, with a total of $458 million in outflows since their launch on July 23.

All Eyes on Powell’s Speech

Currently, global markets, along with cryptocurrencies, are focused on the hints Fed Chairman Jerome Powell might give during his speech at Jackson Hole. Powell is expected to confirm a step towards lowering interest rates next month. Such steps generally create a positive sentiment among investors as low-cost borrowing encourages growth in risky markets.

However, some analysts remain cautious. SOFA Insights President Augustine Fan told CoinDesk, “Powell may want to create some maneuvering space against the four rate cuts priced in by the end of the year. The Jackson Hole meeting tends to be a ‘risk-positive’ event, so we can expect investors to be more willing to buy on dips.”