Bitcoin  $94,952 has finally surpassed the long-awaited resistance level of $67,400, reaching approximately $68,000 after two and a half months. Many market participants anticipated that breaching this threshold would open the door for new price peaks. Naturally, confidence in the cryptocurrency market has soared, yet a report by Santiment suggests that this upward momentum may slow down. What are the reasons behind the anticipated potential stagnation?

$94,952 has finally surpassed the long-awaited resistance level of $67,400, reaching approximately $68,000 after two and a half months. Many market participants anticipated that breaching this threshold would open the door for new price peaks. Naturally, confidence in the cryptocurrency market has soared, yet a report by Santiment suggests that this upward momentum may slow down. What are the reasons behind the anticipated potential stagnation?

Market Experiences Bullish Sentiment

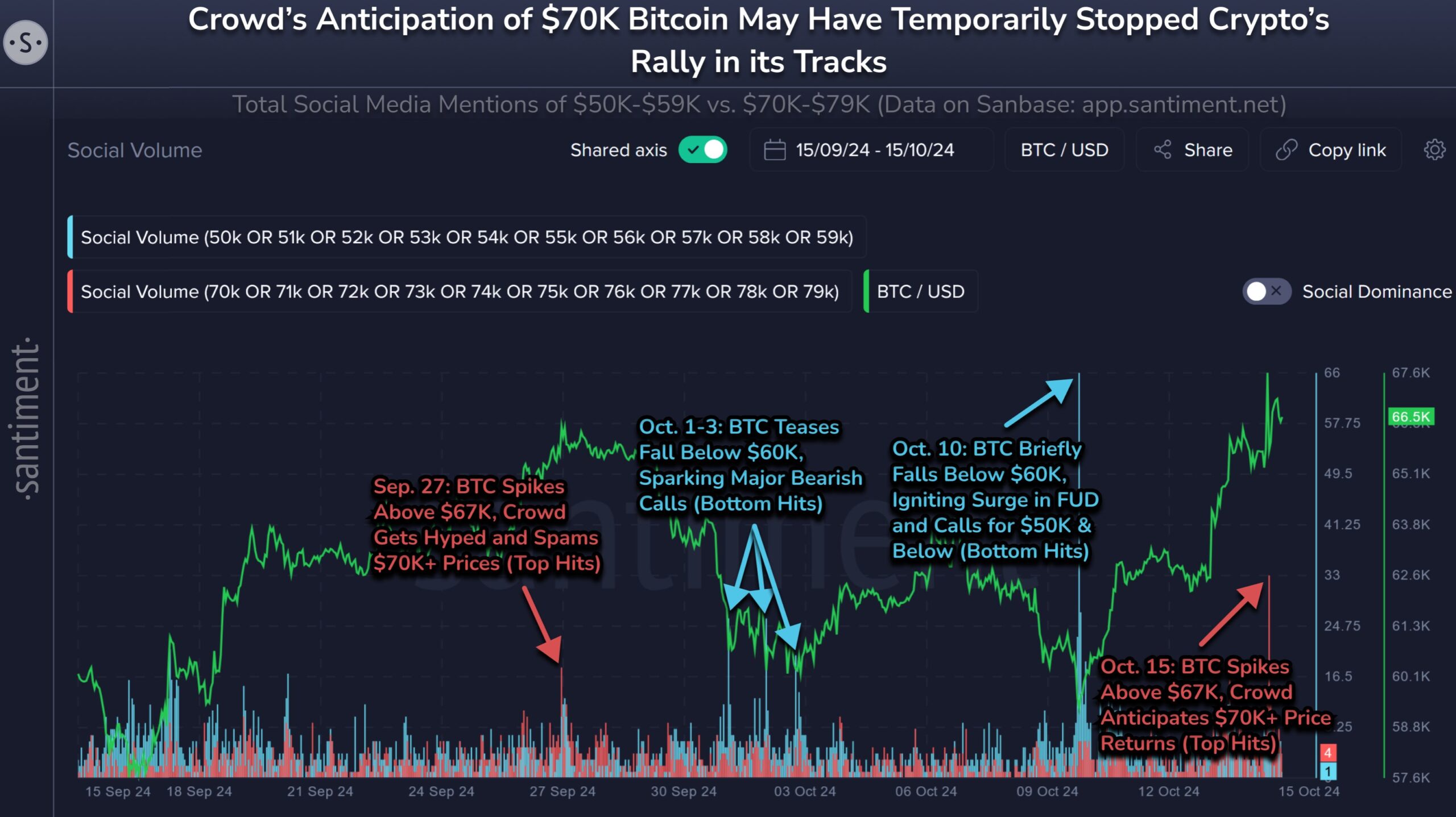

According to Santiment’s report, the market entered a significant bullish phase during the first two days of the week. The report indicates that this newly gained excitement might slow the current upward momentum of the market.

Santiment’s data reveals that such fluctuations correlate with social media interactions. Notably, negative social media posts surged when prices hit a low between $50,000 and $59,000, while positive shares peaked in the range of $70,000 to $79,000. This indicates that prices may fluctuate according to public sentiment.

Bitcoin opened on Monday at $65,853 and closed the day at $66,079. However, the upward momentum could not be maintained, with the close occurring at $67,066. While the current trading price is around $68,000, the danger is not yet over. Analysts emphasize that Bitcoin needs to maintain a one or two-day closing above the $67,400 to $67,500 threshold.

Market Moves Against Crowd Expectations

Santiment also noted that the cryptocurrency market tends to move contrary to crowd expectations. This suggests that when a large majority believes prices will rise, a decline may occur, and vice versa. This scenario highlights the importance of independent thinking while navigating the market.

The Santiment report indicates that investors should avoid falling into the crowd’s thought traps. In this context, understanding the recent stagnation in the Bitcoin market requires investors to stay clear of misleading influences created by social media and public sentiment.

Results derived from Santiment’s data provide insights into potential future market movements. Specifically, social media posts play a crucial role in determining when prices may hit lows or reach highs. Therefore, investors may benefit from closely monitoring such data.