Bitcoin, which has been giving hope to investors with its recent performance, has started to make its investors think with the change in its price performance. After wandering around the $30,000 range for a while, Bitcoin fell to $29,000 and the profit-taking rates of investors decreased significantly. However, the increase in the number of wallets holding Bitcoin continues to attract attention.

Decrease in Wallet Count

According to the data of the blockchain data analysis firm Glassnode, the number of wallets in profit reached its monthly lowest value in the seven-day moving average (EMA 7). The data currently shows that more than 33 million wallets are in profit, and this number is decreasing day by day.

It is worth noting that the increase in the asset that increases the price performance also triggers the rise of Bitcoin. Bitcoin has managed to make a profit for over 72% of its investors so far. Bitcoin has provided the desired profit to short-term investors in particular.

Increasing Number of Bitcoin Holding Wallets

Despite the decrease in the price performance of Bitcoin and the profitability rates of investors, the increase in Bitcoin holding wallets attracts attention. According to another data published by Glassnode, the number of wallets holding at least 0.1 Bitcoin reached 4,430,706, reaching the highest level. The increasing numbers indicate that small-scale investors are increasing their holdings.

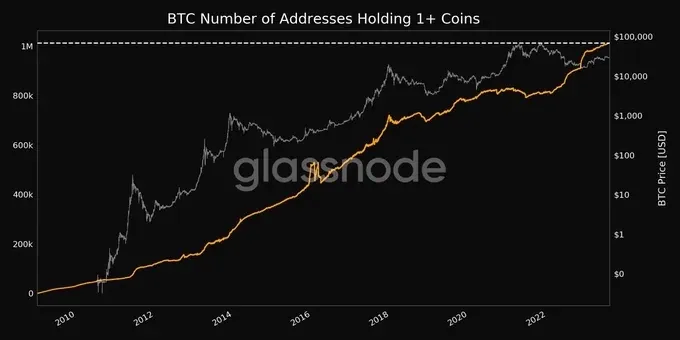

There is also an increase in the number of addresses holding multiple Bitcoins in their wallets. According to Glassnode data, this number reached 1,012,526, reaching a new peak.

According to the latest figures, the number of investors holding multiple Bitcoins in their wallets continues to increase every day. Despite the recent price decrease, it is noteworthy that investors are buying Bitcoin.

While the price of Bitcoin remains largely stable in the current market, it has recently experienced a slight decrease, which has led to various speculations. Additionally, this recent decrease has temporarily shelved the possibility of a bull season for Bitcoin if it reaches $31,000 levels.

However, this increase in the number of Bitcoin holding wallet addresses is a positive sign for Bitcoin and indicates that investors are significantly optimistic despite such minor declines. Bitcoin is currently trading at $29,422, down 1.26% at the time of writing this article.