In the wake of recent developments in June, individual investors are utterly perplexed, but what about the market’s seniors? Investors with portfolio sizes above a certain level are identified as whales. The majority of these have above-average market experience. The tendencies of these whales provide clear signals about the future price.

Bitcoin Whale Analysis

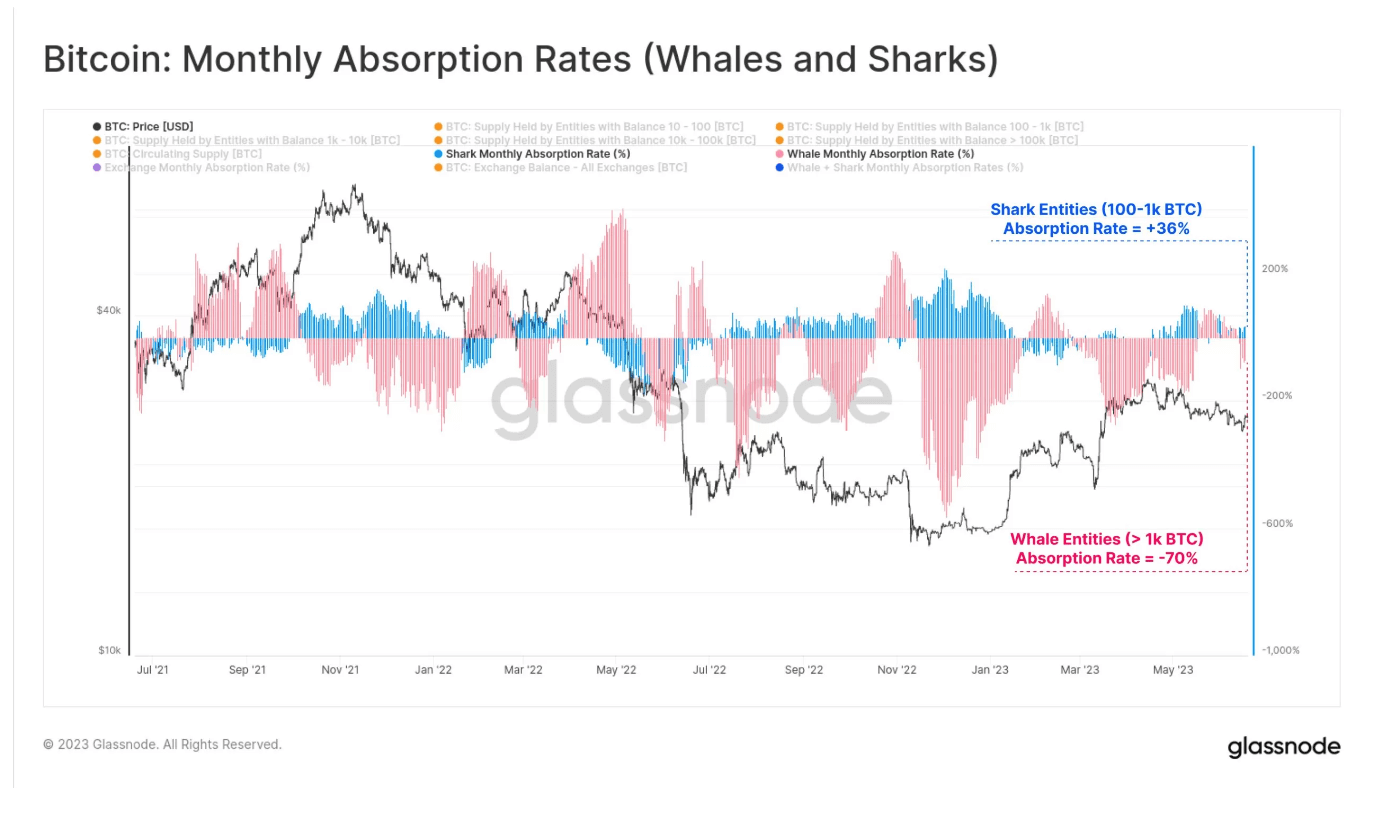

In the past few weeks, the Bitcoin price has triggered a chain reaction comprising various activities on different criteria. Among these, the accumulation trend is a significant factor that could greatly affect the future course. According to data provided by Glassnode, whales and sharks displayed different behaviors in their accumulation strategies during this price trend.

Data obtained from Glassnode shed light on various actions by different Bitcoin owners in the past few weeks. The data revealed a contrasting landscape where different groups made different moves.

Miners, experiencing a drop in their incomes, are selling more of their BTC assets. In contrast, wallets with a balance of less than 100 BTC showed a significant uptrend by actively increasing their assets. This group hoarded an astonishing 254% of the supply recently mined.

Shark assets, characterized by wallets holding 100 to 1,000 BTC, also witnessed positive balance changes. They absorbed a significant volume equivalent to 36% of the mined supply.

However, when it comes to whale assets, encompassing wallets holding over 1,000 BTC, they aligned with miners as net distributors.

Do Crypto Whale Movements Signal Buying?

Taken as a whole, the market appears to be undergoing a suppressed accumulation stage, clearly showing underlying demand despite current regulatory challenges. A remarkable trend emerged following the examination of the proportion of Bitcoin supply held on exchanges to the total supply. The supply on exchanges is rapidly decreasing. At the time of writing, the potential supply ready for sale on cryptocurrency exchanges is at a historic low of 5.60%.

This period shows a significant portion of the accumulated BTC has been withdrawn from exchanges. This situation indicates investors are positioning for a future price increase, expecting it.

In conclusion, the whale trend, supply hitting a five-year low on exchanges, and news flow sends more bullish signals for the price of BTC and cryptocurrencies.