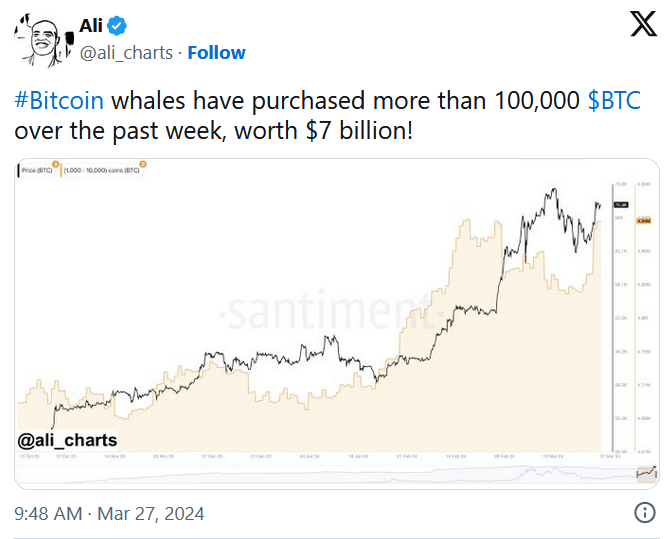

Bitcoin price has been experiencing extraordinary volatility lately, alongside aggressive investments by whales. Leading crypto investors have significantly increased their confidence in Bitcoin, the flagship of cryptocurrencies, by adding millions of dollars worth of BTC to their portfolios. Last week, whales invested about 7 billion dollars, adding over 100,000 BTC to their portfolios, once again demonstrating their strong belief in Bitcoin’s future.

Bitcoin Whales Make Strategic Investments

This investment by the whales highlights the deep trust in Bitcoin by the most important investors and contributes to a positive outlook for the future of the cryptocurrency Bitcoin. Transaction details were shared on platform X by analyst Ali Martinez, who drew attention to the whales’ purchasing activities on social media.

The aggressive investment move by these significant market participants signifies a strong endorsement of Bitcoin’s long-term value. Similar large-scale purchases have been known to cause significant changes in market prices in the past. This situation increases the likelihood of an upcoming bullish trend and leads to speculation about Bitcoin’s market trajectory.

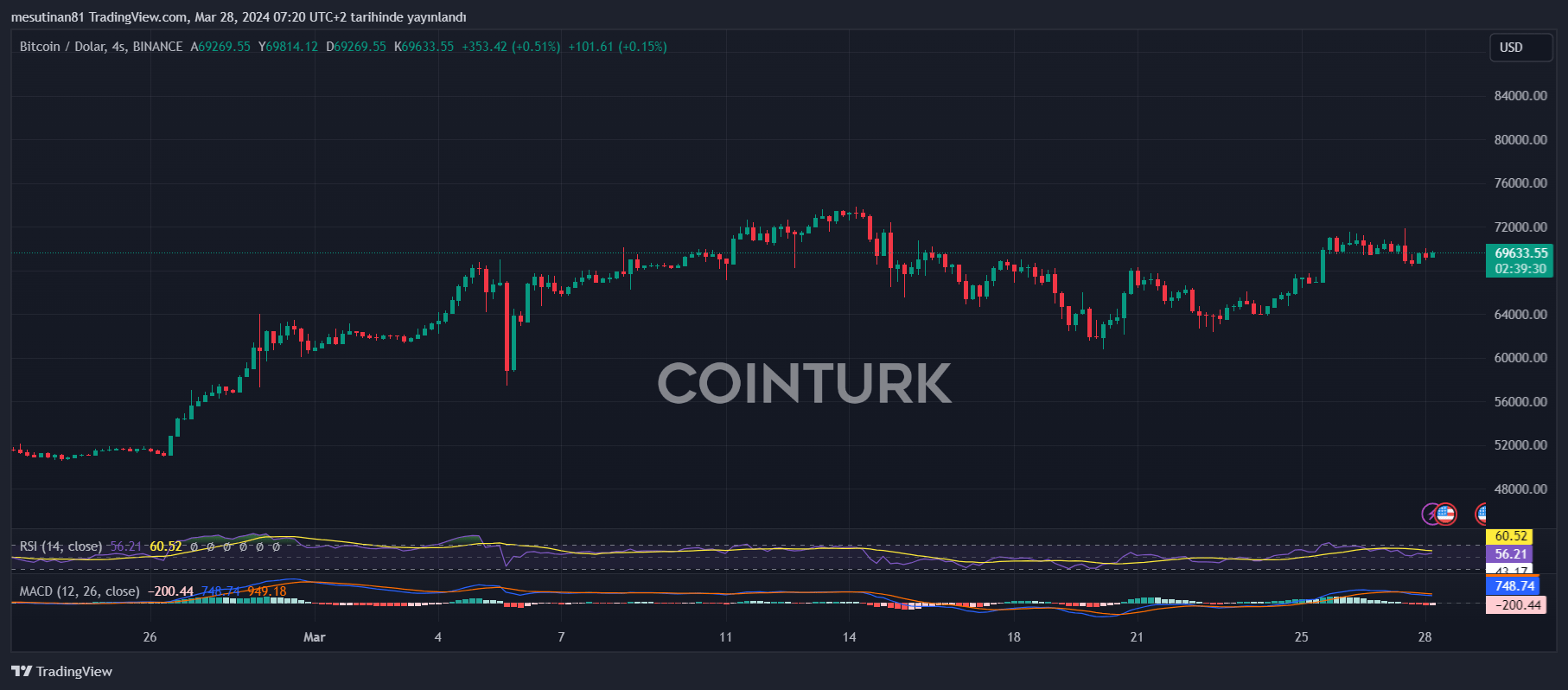

Despite this aggressive accumulation by whales, Bitcoin’s price has fallen below $70,000 in the last 24 hours, experiencing a decline. Bitcoin opened the day at $71,220 but fell to $69,448 during the day and eventually stabilized around $69,660.

What Do the Metrics Say?

The Moving Average Convergence Divergence (MACD) indicator is showing a downward trend, indicating a bearish inclination on the 4-hour chart. This movement, almost crossing the signal line, points to a possible decline in momentum in the near future.

Additionally, the histogram bars are flattening and approaching the zero line, suggesting an increased probability of a price decline. The RSI, at 60.48, is slightly above the midline, indicating that buying pressure may be potentially waning. This overbought condition points to a potential reversal and a downward price movement in the coming days.

If the downward trend continues, Bitcoin’s price is expected to target the 50% Fibonacci retracement level as an immediate support. On the other hand, if the bullish momentum resumes, the price could rise towards the 78% Fibonacci level and serve as the next significant resistance point above the $70,000 threshold.

Türkçe

Türkçe Español

Español