Bitcoin, entered an uncertain period following the Wall Street opening on April 9, with warnings that macro data could lead to further price declines. Data from TradingView showed that the BTC/USD pair dropped below $69,000 as Wall Street made a comeback. Bulls continued to lose momentum in their effort to gain more ground towards the all-time high of $73,800.

Why Is Bitcoin Falling?

BTC/USD trading source Material Indicators analyzed order book data, highlighting whales attempting to lower prices to enter new long positions in the futures market. The analysis indicated that the target timeframe was the pressure from the United States Consumer Price Index (CPI) to be announced on April 10:

“We frequently see this behavior around economic reports. If the inflation figures released on April 10 are higher than expected, they could likely extend the downward movement. However, in such scenarios, it’s common for whales to maintain the dip and then capitalize on the upward liquidity gap they create for a relatively quick upward movement.”

An attached graph showed the nearest strong bid liquidity wall at $66,500 on the world’s largest exchange, Binance. Popular investor Rekt Capital commented on the weekly chart:

“Bitcoin is currently rejecting the highest level of this blue range at $71,300. Bitcoin is thus stuck between the old all-time high of $69,000 as support and the recent highest level (resistance) of $71,300 from two weeks ago. There is room here for forward consolidation.”

Developments in the ETF Space

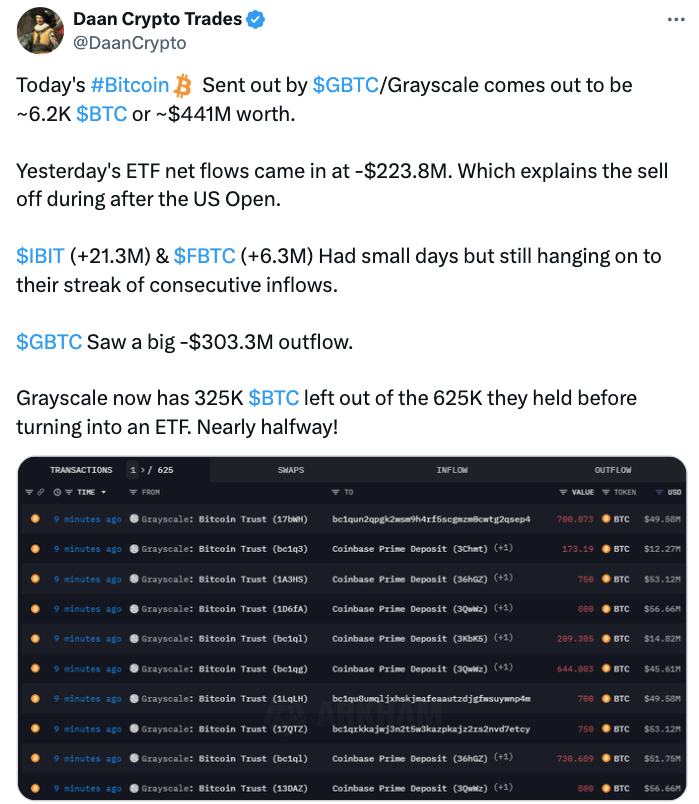

Meanwhile, the pressure among spot Bitcoin exchange-traded funds (ETFs) continues. Data emerging on April 9 showed a significant outflow, mostly from the Grayscale Bitcoin Trust (GBTC), with a net outflow of $200 million. This caught market observers off guard, and preliminary data for April 10 indicated an acceleration in GBTC outflows.

According to figures from crypto data analysis firm Arkham shared by popular investor Daan Crypto Trades with X, GBTC outflows reached approximately $434 million worth of 6,200 Bitcoin over the past few weeks, marking the largest dollar amount in that period.

Türkçe

Türkçe Español

Español