Bitcoin  $91,081 is currently amidst a critical test at over $117,000. For almost two months, BTC had struggled to surpass $120, but has now successfully of doing so. The fears of September’s negativity turned out to be unfounded, bolstering the hopes of investors for a strong final quarter. Yet, amidst this positive outlook, there lurk talks of a significant short-selling opportunity. What do the latest predictions from experts suggest?

$91,081 is currently amidst a critical test at over $117,000. For almost two months, BTC had struggled to surpass $120, but has now successfully of doing so. The fears of September’s negativity turned out to be unfounded, bolstering the hopes of investors for a strong final quarter. Yet, amidst this positive outlook, there lurk talks of a significant short-selling opportunity. What do the latest predictions from experts suggest?

Anticipating a Significant Crypto Downturn

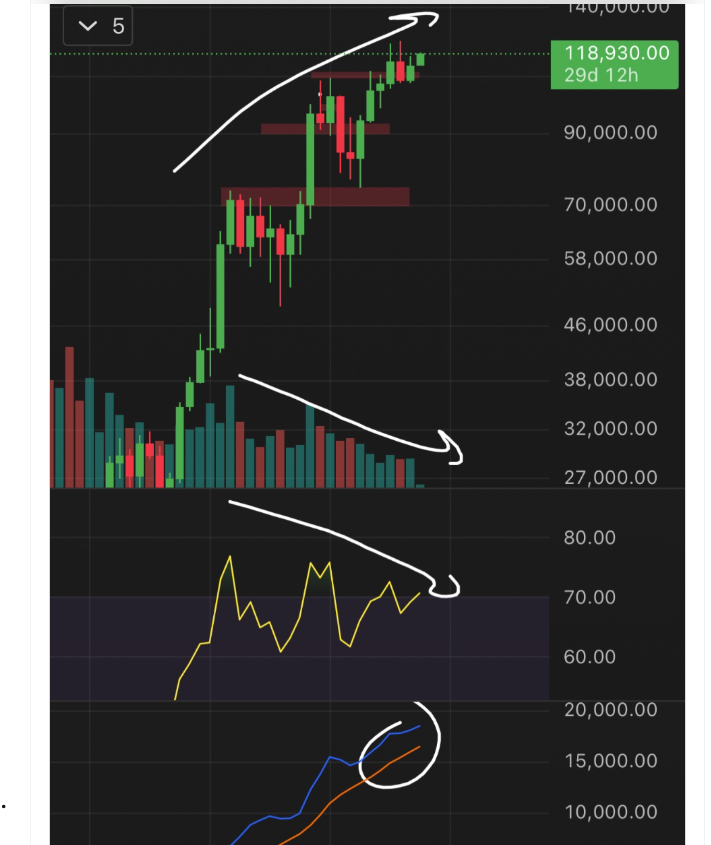

An analyst known as Roman Trading is cautioning about potential new all-time high attempts for BTC, but expresses concern over the risk outweighing the reward. While he acknowledges the possibility of BTC reaching $124,000 in the short term, his recent analysis points towards a critical long-term structural breakdown, forecasting an imminent major decline.

Should Bitcoin dive sharply below $100,000, the repercussions for altcoins could be catastrophic, with potential losses up to 50%.

“The trends on Bitcoin’s weekly and monthly charts are often ignored,” warns Roman Trading. He questions how long these bearish trends and lack of momentum can be overlooked. Furthermore, the volume analysis supports a looming weakness. With all these factors converging, caution is advised when holding cryptocurrencies during this volatile period.

If his predictions hold true, we could witness rapidly growing short positions, leading to bleak times ahead. However, considering most altcoins have yet to reach proper peaks, declining interest rates, and the emergence of new crypto reserve companies—factors collectively supporting a bullish trend—this long-term bearish scenario may not be as likely. Cryptocurrencies remain full of surprises, though.

Economic Indicators and Market Sentiment

For years, interest rates remained high and were increased swiftly. Amid changing conditions on the macroeconomic front, the status of employment will continue to exert downward pressure on interest rates, likely propelling the crypto market upward. The report highlights a notable dip in job vacancies within the construction sector, reflecting significant economic shifts.

“In August, job openings in the U.S. construction industry fell by 115,000 to 188,000, the lowest level since May 2017,” notes the report. The data indicates a 58.5% reduction from December 2023, with openings at their lowest since November 2015 classifying this decline among the most severe since the early 2000s.

These insights underscore the need for rate reductions, validating viewpoints once dismissed.

Litecoin (LTC): Navigating Short-term Opportunities

Efloud, a notably precise analyst, reveals a strategic play with LTC following recent price volatility. Having sold at $118 with a 13.4% gain, he plans to repurchase at the $108 level. In an environment where blue box resistance regions are seen as sell opportunities, double-digit short-term gains can be seized. Long-term investors will keep an eye on the anticipated LTC ETF approval, potentially signaling a surge of institutional interest.