In the last 20 days, Bitcoin (BTC) has lost four percentage points of its dominance in the cryptocurrency market, igniting an altcoin season. This loss of dominance could mean that significant cryptocurrencies are performing better than the leader and absorbing capital.

The Rush to Altcoins Begins!

Especially if these events spread over a broader time frame, they are known as altcoin rallies or altcoin seasons. Cryptocurrency investors often transfer a portion of their gains to these altcoins, hoping to profit from high volatility and trigger an altcoin season. The Bitcoin Dominance Index (BTC.D) is one of the most used indicators to signal this season. The index is calculated by dividing Bitcoin’s market value by the total capitalization. Therefore, a decline in BTC.D could mean that investors are putting more capital into other cryptocurrencies than BTC.

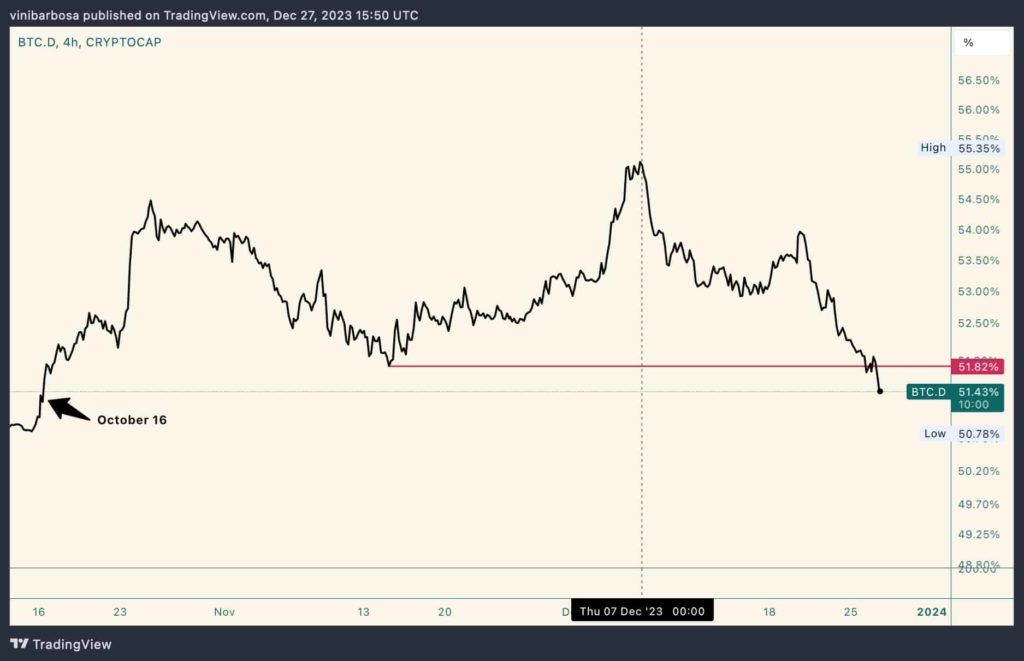

When the article was written, the index had retreated to 51.43% after reaching its lowest level in November at 51.82%. Bitcoin’s dominance had not been this low since October 16. This situation could mark a turning point after peaking at 55.35% on December 7. Additionally, the total cryptocurrency market value 2 Index reached its highest level in several years at 796.955 billion dollars. This particular index measures the capitalization of the cryptocurrency market excluding Bitcoin.

Critical Index in Cryptocurrencies

The index has shown an increase of 55.57% since October 16, recording an increase of 283.564 billion dollars during this period. At the beginning of 2023, the market value of all cryptocurrencies excluding BTC was 468 billion dollars, indicating an increase of 70%. Recently, Solana (SOL) has taken the lead in the altcoin season with an impressive price increase of 1,072% since the beginning of the year. BNB Chain (BNB) has climbed to the 4th position among the most valuable cryptocurrencies, dethroning BNB and other DeFi competitors.

Furthermore, Bitcoin Cash (BCH) may seem like the trigger for the mentioned dominance decline of its main competitor. Alternatives like Elon Musk’s artificial intelligence Grok’s mentioned low limit for valid payment in X are also becoming a focal point. However, it is important to understand that altcoins have lower liquidity and higher volatility. These characteristics expose investors to even higher risks, so they should be cautious when investing in altcoins.

Türkçe

Türkçe Español

Español