The cryptocurrency market was severely impacted when Bitcoin (BTC) failed to pass the $30,000 test, dropping as low as $26,000. This steep decline resulted in a market-wide withdrawal, negatively impacting most cryptocurrencies. However, during this broad consolidation, certain altcoins managed to maintain their strength. But what is the current situation for major players like ADA Coin, Solana Coin, and XRP?

XRP, ADA Coin and Solana Coin Latest Status

Looking at the overall price conditions, the scenario for XRP, ADA Coin, and Solana Coin appears relatively positive. XRP is bracing itself for developments in the lawsuit, while there are certainly technical advancements on the Cardano (ADA) front. As for Solana (SOL), the FTX storm seems to be far from over.

XRP, Ready for the Storm

In the past 24 hours, XRP has seen a 5% increase, making it the highest gainer among the top 10 cryptocurrencies. This surge can be attributed to the ongoing legal battle between Ripple and the SEC. Recent developments in the Ripple lawsuit are encouraging for XRP investors. Judge Torres rejected the SEC’s request to seal documents relating to senior executive Hinman. Despite the SEC’s desire to keep these documents private, critical papers will now be disclosed. This news prompted a surge for XRP on May 16, and the positive effect is still noticeable. If the SEC loses this case, a new storm may begin for XRP.

Hydra OK for ADA Coin!

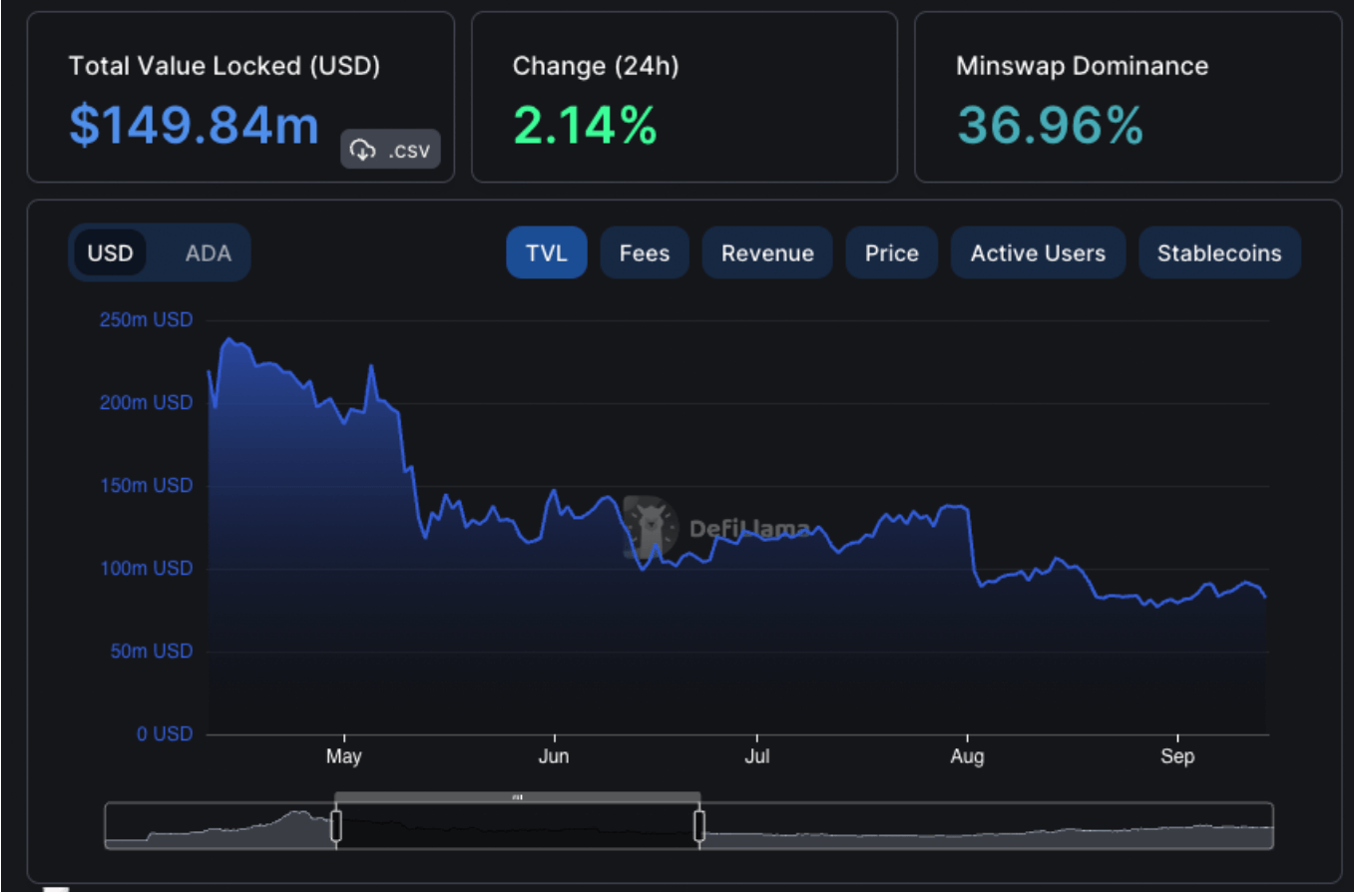

As for ADA Coin, the Cardano team is diligently working on technical updates. Important steps have been taken ahead of the Cardano Summit 2023, set to occur between November 2-4. The ADA team has launched the Hydra update, a layer 2 scalability solution. The value of total assets in the Cardano-based DeFi world is also steadily increasing, recently reaching $149 million.

SOL Coin is Going Horizontal

The situation for SOL Coin, however, is quite static, with SOL being one of the most stable altcoins in the past 24 hours. As SOL attempts to shake off the effects of the FTX storm, it has suffered a significant blow in network adoption, implying more time is needed. If SOL drops below the crucial $19.85 support level, a significant withdrawal may be seen. A potential upward target could be the $21.83 mark, which represents the 50-day SMA point.