Amidst the market’s prolonged consolidation and Bitcoin‘s persistent struggle within the $40,000 to $45,000 range, there is a glimmer of optimism. BTC appears ready to achieve its first weekly golden cross, a historically positive price movement harbinger and a significant bullish signal. While Bitcoin enthusiasts eagerly anticipate a potential bull run, they scrutinize technical indicators and historical patterns.

Golden Cross Revealed: A Bullish Omen for Bitcoin’s Future

Bitcoin’s technical analysis is currently drawing attention, indicating that the first weekly golden cross is about to be completed soon. This formation occurs when the 50-day moving average crosses above the 200-week moving average, symbolizing a strong long-term bullish sentiment.

Market observers expect the golden cross to occur this week, provided that Bitcoin maintains its stability without significant declines before December 25th.

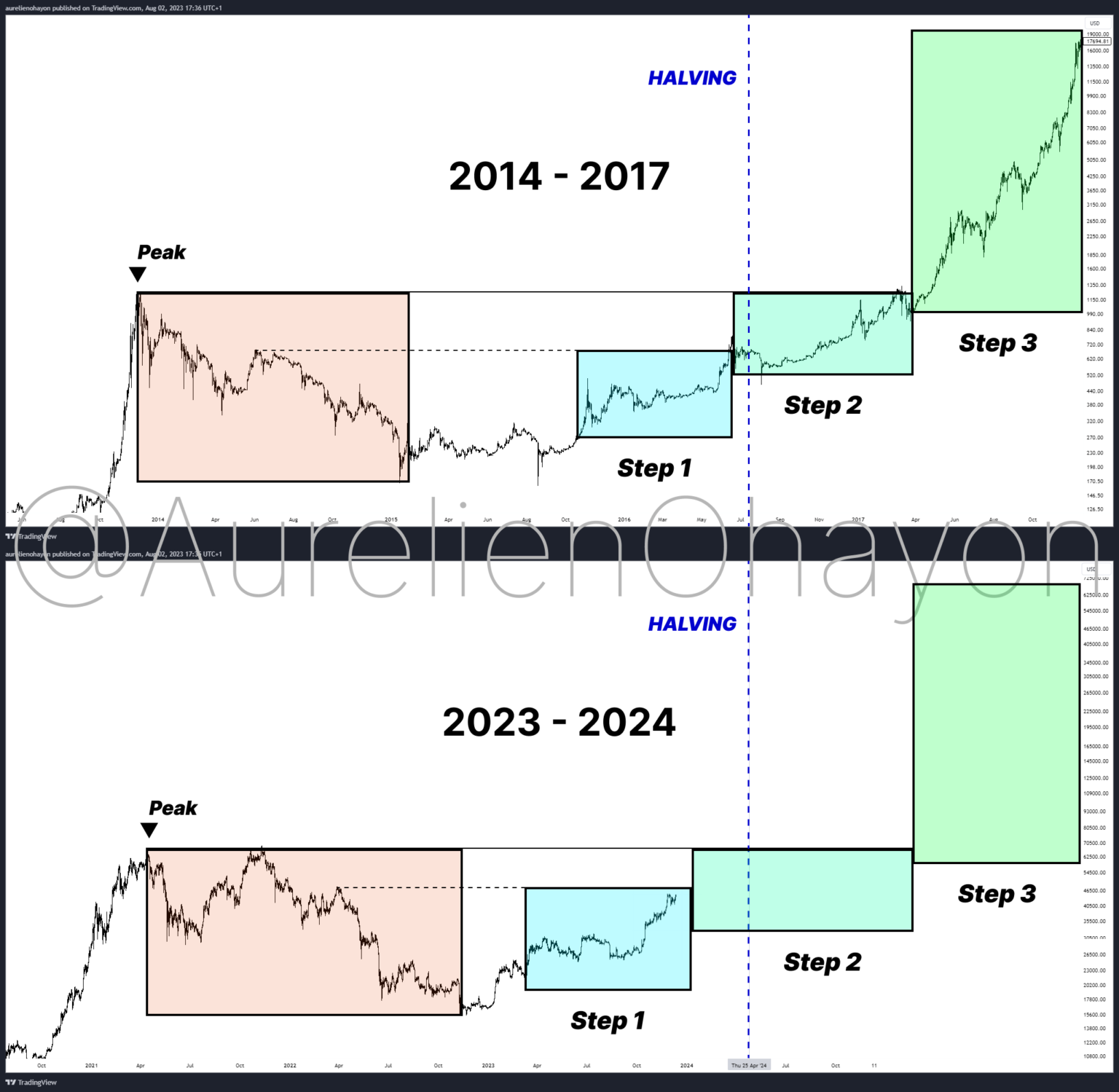

Bitcoin’s Potential Bull Run: Insights from Historical Formations

Historical data reveals a compelling connection between the 50-day and 200-week moving averages, typically marking the beginning of bullish periods for digital assets.

Crypto analyst TAnalyst’s views on December 22nd highlight the historical significance of this formation, pointing to a potential repeat. With the Bitcoin halving expected to occur in 2024, market participants speculate that this event could trigger a new market cycle.

Current Situation and Technical Analysis

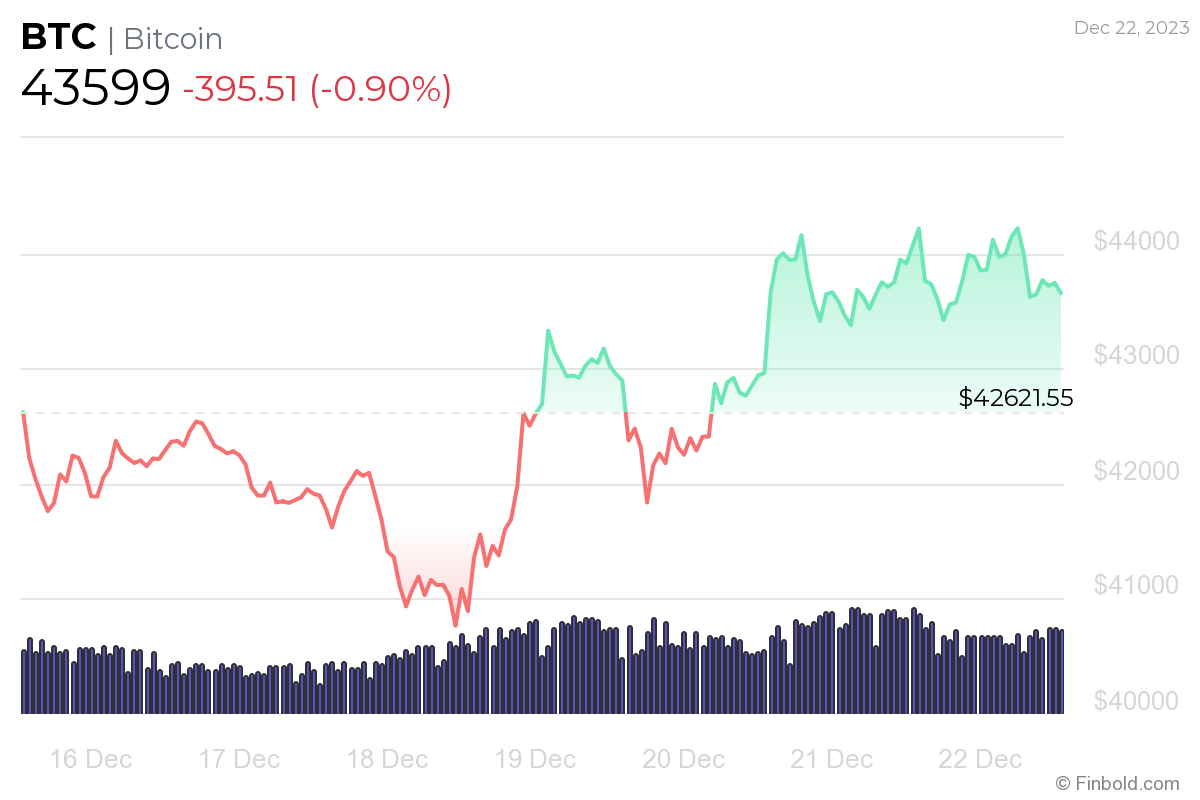

As of writing, Bitcoin is trading at $43,599, indicating a marginal decrease of 0.90% in the last 24 hours. Despite this short-term fluctuation, the cryptocurrency has a weekly gain of 2.29% and an impressive monthly increase of 19.23%.

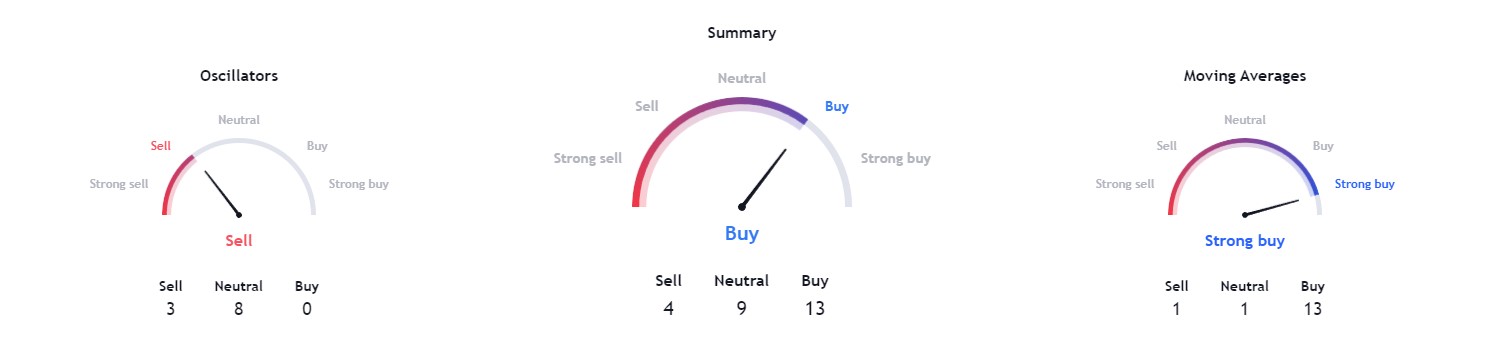

TradingView’s technical indicators present a mixed picture. Daily measurements show a buy signal with 13 points, while oscillators indicate a sell signal with 3 points. These indicators leave the crypto community in anticipation, wondering whether the positive signals will translate into an upward trajectory for Bitcoin.

As the golden cross emerges in Bitcoin, investors continue to be hopeful for a potential bull run. The convergence of technical indicators and historical patterns adds to the intrigue surrounding Bitcoin’s future price movements. As the market holds its breath, the significance of this golden cross could become a pivotal moment in Bitcoin’s journey and lay the groundwork for a promising period ahead.

Türkçe

Türkçe Español

Español