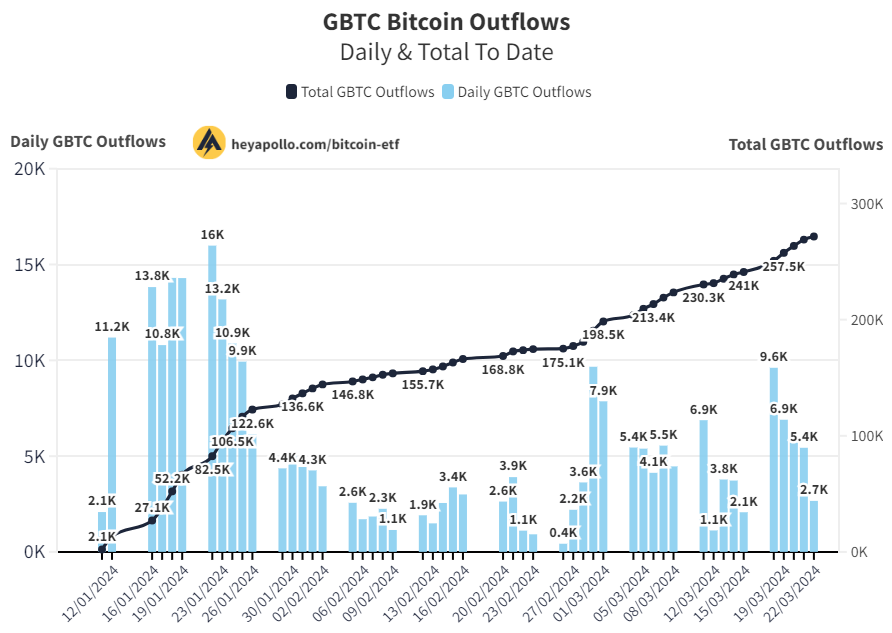

Bitcoin price has recently been affected by the spot Bitcoin exchange-traded funds (ETFs) in the United States. Last week, an anomaly occurred with five consecutive days of net negative outflows for the first time in their short history. This was reportedly due to record outflows from Grayscale Bitcoin Trust, influenced by the moves of the bankrupt crypto lending firm Genesis.

What’s Happening on the ETF Front?

Lately, commentators are hoping for a return to business as usual. Over the weekend, Maple Finance’s capital markets and growth director Quinn Thompson posed an intriguing question:

“What do you think market participants will do when ETF flows turn positive again?”

Thompson pointed out that despite the net outflows caused by the GBTC fund, the largest ETF providers maintained their inflows and concluded that new buyers were not selling. Thomas Fahrer, CEO of the crypto-focused review portal Apollo, shared his thoughts on the matter this week:

“GBTC sold 31,000 Bitcoins last week and the price dropped by 1%. There is incredible demand to overcome this selling pressure.”

Macro Economic Data and Bitcoin

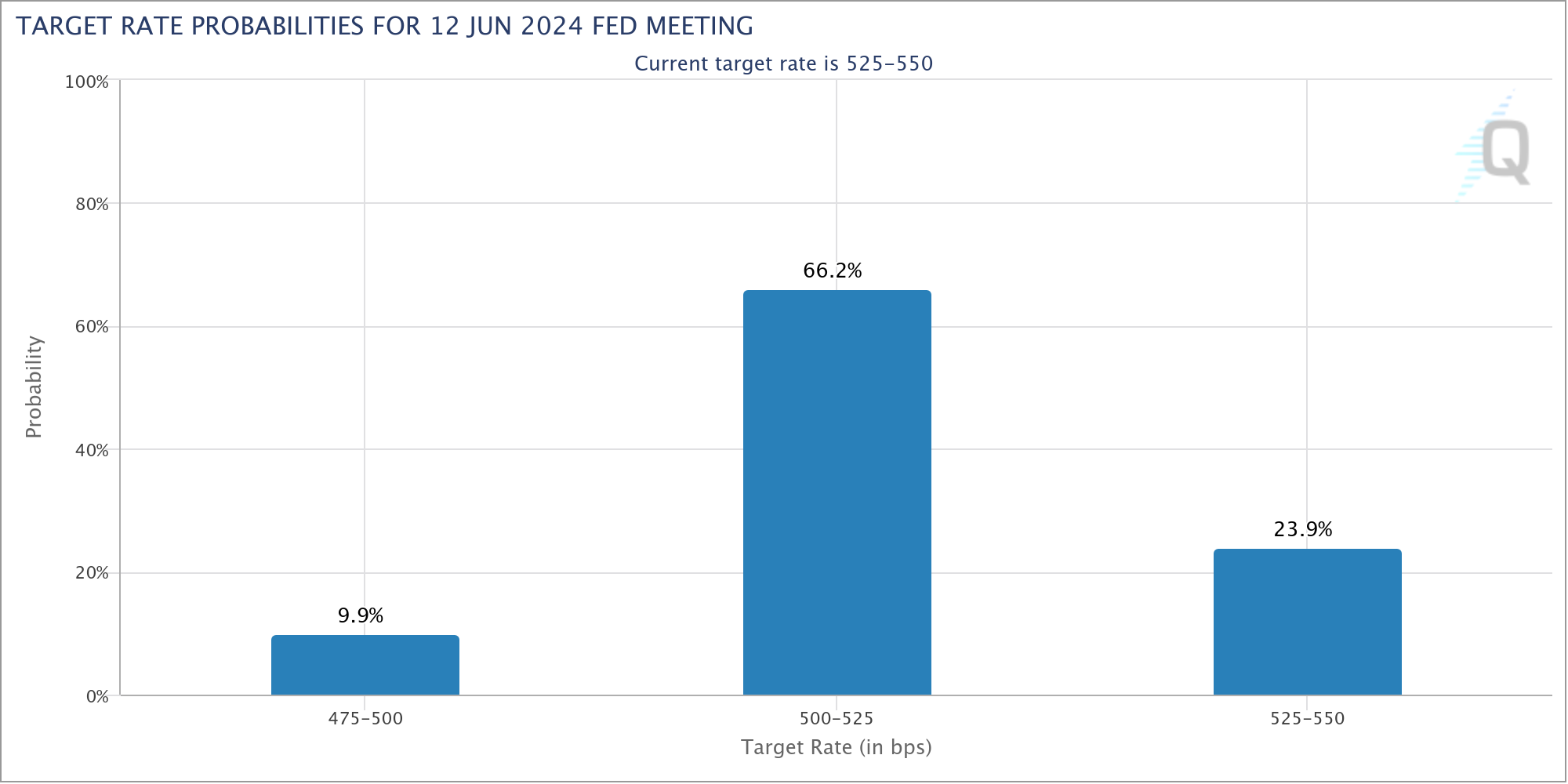

This week, the Personal Consumption Expenditures (PCE) Index leads the US macro data. Known as the Federal Reserve’s preferred inflation data, the PCE follows last week’s decision to not lower interest rates. Although markets were already prepared, Fed Chairman Jerome Powell’s later language ignited bets on consecutive rate cuts before year-end.

According to the latest data from the CME Group’s FedWatch tool, the probability of an interest rate cut in May was 13.7%, previously below 10%. For June, this rate is estimated at 66%.

This week Powell will speak again, potentially reinforcing these beliefs. However, Powell’s conference on March 29 coincides with a Friday holiday when markets are closed. The Kobeissi Letter, a trade source, stated:

“After two hot inflation reports this month, all eyes are on the PCE inflation report.”

Meanwhile, financial commentator Tedtalksmacro, emphasized that the $1.2 trillion US spending package announced last week laid the groundwork for further rises in risk assets and shared the following in a post:

“The Fed confirmed QT will slow down soon. Interest rate cuts are coming by the end of the year. You need more Bitcoin.”

Türkçe

Türkçe Español

Español