Bitcoin (BTC) has experienced a historical performance, with significant moments in its relatively brief past. Notably, Bitcoin has not only received approval from the SEC for US spot BTC exchange-traded funds (ETFs) but also enjoyed an incredible surge, reaching $64,000 within 50 days.

Current State of Bitcoin

Since the beginning of 2023, Bitcoin (BTC) has seen a 40.11% increase, climbing from $44,000 to $61,937 at the time of writing.

One stock, in particular, has capitalized on this ascent: MicroStrategy (NASDAQ: MSTR), led by Michael Saylor. Contrary to those who anticipated a price drop and potential harm to companies following the ETF approvals, BTC has instead facilitated MicroStrategy’s rise.

Now, with the upcoming halving event, which historically has led to significant increases in Bitcoin’s value, the possibility of Bitcoin reaching $100,000 is being considered, raising curiosity about how high MSTR’s stock could potentially climb.

MicroStrategy Stock Outlook

To predict where MicroStrategy’s stock could head, it’s essential to examine its correlation with Bitcoin’s price movements.

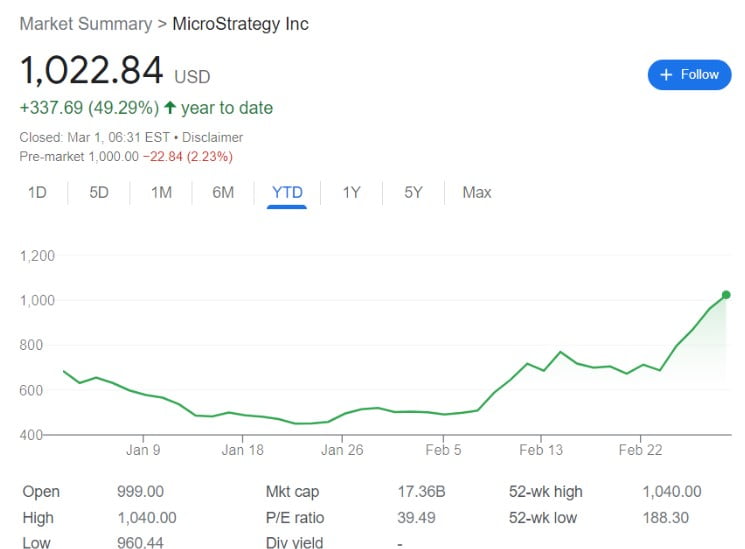

Looking back to when the ETF was approved, MSTR’s stock initially dropped by 20% within the first 48 hours. However, following its subsequent rise, it became evident that MicroStrategy had outperformed Bitcoin in 2024.

During the period when BTC rose by 40.11%, MSTR’s stock increased by 49.29%. This suggests that in 2024, for every 1% increase in Bitcoin’s value, MSTR’s shares rose by approximately 1.23%.

What Could MSTR’s Value Be If BTC Hits $100,000?

For Bitcoin’s price to continue its trajectory and reach $100,000, it would need to increase by an additional 61.58%, which equates to a further price gain of $38,063.

While such an increase might seem improbable at first glance, it’s noteworthy that Bitcoin has risen by $10,000 in just the last five days alone.

Considering that MicroStrategy’s shares have outperformed Bitcoin and assuming a similar parallel rise in the near future, MSTR’s stock could potentially increase by 75.67% if Bitcoin’s price reaches $100,000. This would also bring MicroStrategy’s shares closer than ever to surpassing their all-time high, potentially between $1,796.82 and $3,000.

Türkçe

Türkçe Español

Español