The year 2024 started off extremely well, and the calendar for the first quarter was very promising for cryptocurrencies. We are experiencing the result of that now. With the halving event coming up in April, the markets are expected to sail to even greater peaks. So, how high could Bitcoin rise by April? What are the predictions?

Bitcoin (BTC) Performance

The king cryptocurrency is currently about 340% above its November 2022 low. While most investors were expecting deeper lows during that chaotic period, those who bought the fear at the right moment, especially in altcoins, made massive gains. Looking back four months from February 15, we see that the price of BTC has increased by 92% during this period.

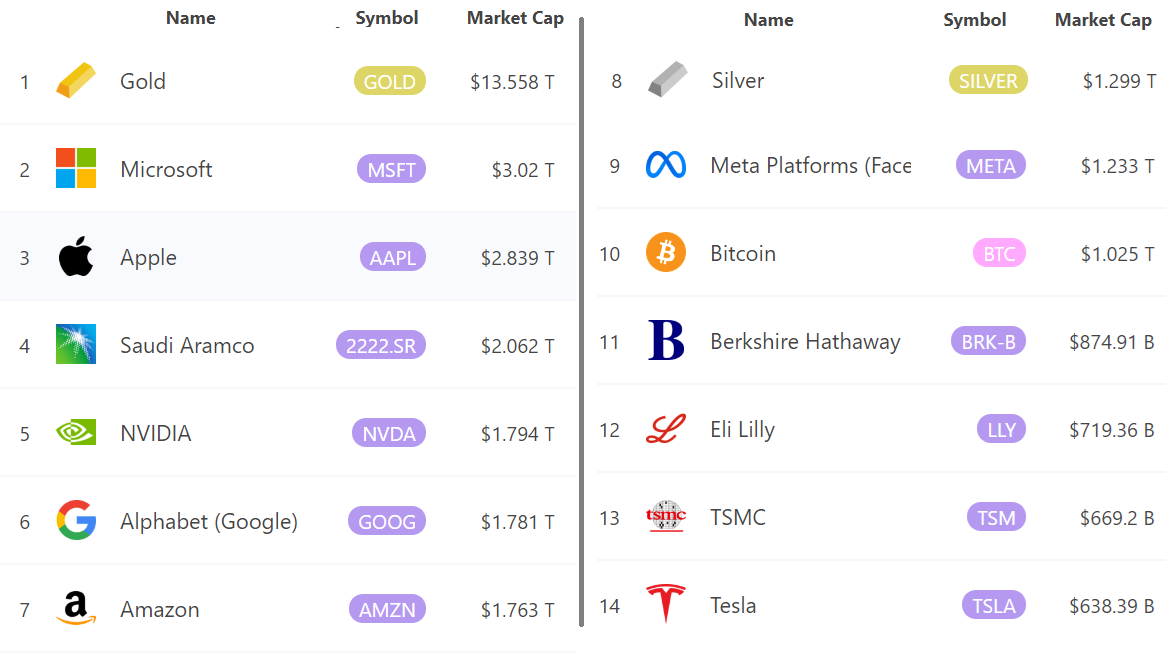

With a market value exceeding 1 trillion dollars, BTC is now among the top 10 most valuable tradable assets. Even Berkshire Hathaway, with a market value of 875 billion dollars, is smaller than Bitcoin in comparison to Warren Buffet’s wealth.

Bitcoin Halving Prediction

If the BTC price can rise about 34% from its current level, it will reach $70,000 and its market value will increase by 350 billion dollars. In this scenario, it would surpass assets like silver and the pound. But is such a peak (1.35 trillion dollars) possible by April?

Investors might think more gains are possible since the price has already increased over 300% from the low, but they may be mistaken. BTC last saw this level in November 2021 (around the $69,000 peak). However, the Federal Reserve’s interest rates were not at this level back then. Moreover, the rapid decline in inflation suggests a need for cautious macroeconomic moves, possibly until June.

Spot Bitcoin ETF entries are strong, but at some point, they will need to level off. The total net entry is around 4 billion dollars, and the cumulative BTC reserve has reached 35 billion dollars. This is equivalent to 3.5% of BTC’s market value. On the gold front, ETF reserves total 210 billion dollars, which corresponds to 3% of the cumulative value. Of course, this isn’t a definitive ceiling for BTC, but professional investors take such things into account, and 3% is not a negligible figure.

A new ceiling around $70,000 is possible, but surpassing that in the halving period may not be feasible for BTC. The good news is that Microsoft and Apple have crossed the 3 trillion dollar threshold. We can now talk about a 3 trillion dollar ceiling for BTC’s market value because it’s becoming psychologically similar to the 1 trillion dollar mark of 2021. Back then, a 1 trillion dollar valuation for an asset (technology-focused, just like BTC) was transitioning from a dream to reality.