Bitcoin  $118,178‘s price has rebounded to $93,000 following recent U.S. data, shifting from a slow rise to a rapid decline. The U.S. Dollar Index is reaching new heights, prompting cryptocurrency traders to experience days reminiscent of bear markets since hitting the all-time high of $108,000 for BTC.

$118,178‘s price has rebounded to $93,000 following recent U.S. data, shifting from a slow rise to a rapid decline. The U.S. Dollar Index is reaching new heights, prompting cryptocurrency traders to experience days reminiscent of bear markets since hitting the all-time high of $108,000 for BTC.

Fed and Cryptocurrencies

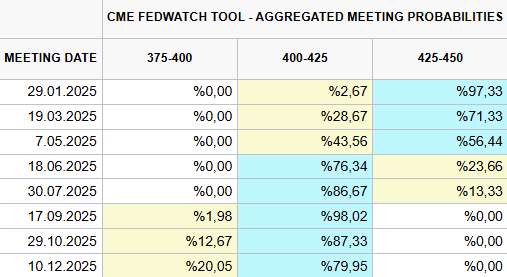

The market anticipates that the Federal Reserve’s meeting on January 29 will maintain interest rates, with a 97% probability of no changes. Furthermore, expectations for the first rate cut have been pushed back to September. In December, we heard that the Fed might implement two rate cuts by 2025, but recent strong employment data has led market expectations to drop to just one cut.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

For cryptocurrencies, the silver lining is that fear and panic often peak when the worst-case scenario is priced in. Markets tend to show tendencies to rebound from lows, and if BTC can hold above $91,500, it may enter a surprising upward phase.

What Happens Next?

BTC and the cryptocurrency market are beginning to accept a single rate cut for 2025. A positive aspect is the reality that things could potentially be worse. If we see a drop in inflation in the coming months or witness data indicating a decline in employment, the market may start to price in further cuts this year, potentially boosting cryptocurrencies.

The fact that BTC is maintaining a key level of $91,500 in a scenario where one of the worst-case outcomes has been priced in is encouraging. Crucial events that could reverse sentiment or heighten pessimism are set to unfold in the coming week.

For instance, on January 14, the U.S. Producer Inflation data will be released, and a reading below 3% would favor cryptocurrencies. The following day, we will see one of January’s most critical events with the U.S. inflation data. Expectations are set at 2.9%, compared to the previously reported 2.7%, while core inflation is expected to remain steady at 3.3%. A lower-than-expected CPI would significantly support the markets.

Since September 30, BTC’s price has seen a significant increase, reaching a new peak at $108,000. Achieving this rise despite a 10% increase in the dollar index is quite impressive. If it comforts you, the BTC price has doubled despite the rising DXY, signaling substantial potential. After some favorable inflation data, strengthening the forecasts for rate cuts, BTC may continue its movement toward the $150,000 target, with expectations for DXY to return to close below 108.5.

Türkçe

Türkçe Español

Español