is approaching the planned halving in April, and the cryptocurrency market has witnessed encouraging signals showing a strong recovery in Bitcoin’s network health. Fundamental indicators such as record-breaking hash power and decreasing BTC balances in exchanges paint a positive picture for the leading cryptocurrency.

Record-Breaking Bitcoin Hash Power Indicates Strong Mining Activity

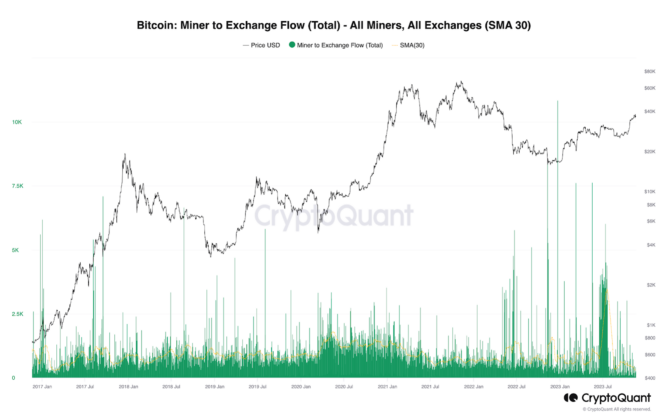

Bitcoin’s hash power has soared to unprecedented levels, reaching 500 exahashes per second. This milestone underlines the current high level of mining activity, highlighting the network’s resilience and security. Notably, analyses by CryptoQuant on the blockchain show that outflows from known miner wallets to exchanges have reached the lowest point in the last seven years.

The decrease in cryptocurrency movement from miner wallets to exchanges indicates that miners are taking a cautious stance in the open market. Speculations have emerged that miners are strategically limiting their BTC sales while awaiting potential Bitcoin ETF approvals to maintain their operations.

As the halving event draws closer, the doubling of production costs could drive miners to hold onto their cryptocurrencies and explore alternative financial strategies to cover expenses.

BTC Balances in Exchanges Decrease Amidst Market Turmoil

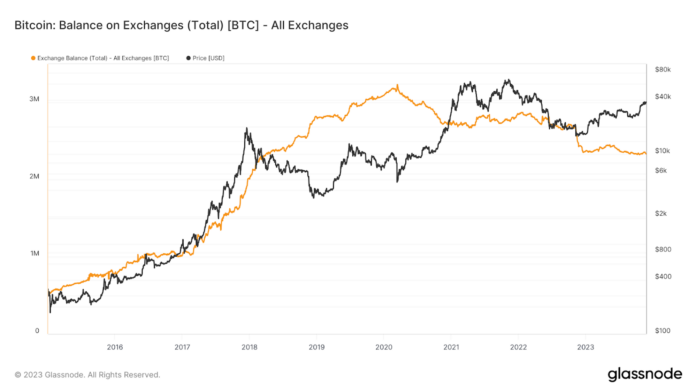

Despite recent challenges, including withdrawal suspensions and legal actions against major cryptocurrency exchanges, Bitcoin balances on exchanges have trended downwards. On-chain analyses by Glassnode emphasize that major exchanges collectively hold 2.322 million BTC, representing the smallest available BTC pool since April 2018.

The downtrend in BTC reserves on exchanges contrasts sharply with the peak recorded in March 2020, when the reserves reached a total of 3.321 million BTC following the cross-market crash triggered by the onset of the COVID-19 pandemic.

Recent incidents, such as Binance‘s record $4.3 billion fine and the suspension of withdrawals from exchanges like Poloniex and HTX following a hack attack in November, have further contributed to the decrease in BTC balances on exchanges.

The Road Ahead: Anticipated Corrections

While Bitcoin’s network health is showing positive signs, market participants are advised to observe potential corrections in the evolving landscape. Although major crashes are less likely, corrections could occur, considering the absence of Black Swan events and significant whale manipulations.

Investors should stay alert, considering the potential impact of the upcoming halving event on Bitcoin’s market dynamics and adjust their strategies accordingly. At the time of writing, Bitcoin has broken an important resistance level of $38,000 and is trading at $38,174.

Türkçe

Türkçe Español

Español