The cryptocurrency Bitcoin continued to underperform in May, and it even recovered from a terrible low. It still hasn’t moved away from the $60,000 level, so investors‘ legitimate concerns persist. Is what’s coming an opportunity for cryptocurrency investors? What should investors expect now?

Will Bitcoin (BTC) Rise?

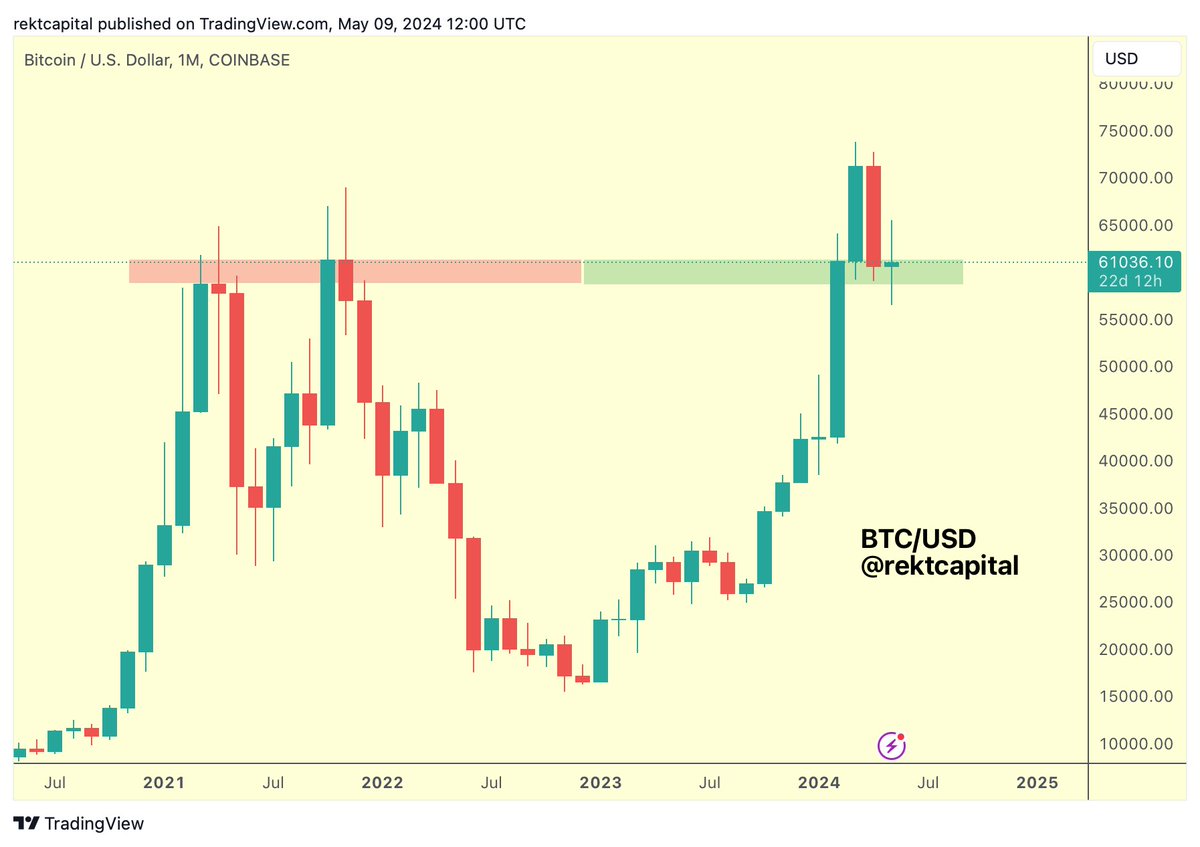

Bitcoin’s price bottomed out at $60,630 in the last 24 hours and was found buyers at $62,350 at the time of writing. Popular analysts are struggling to predict which direction will break out from the current narrow range. Which way? A chart shared by crypto analyst Rekt Capital shows that the area that acted as resistance when BTC reached its all-time highs is being tested.

The analyst remains hopeful due to the price maintaining a key level despite halving sales.

“On a monthly timeframe, Bitcoin is still retesting the old All-Time High main resistance area (red) as new support (green).”

Analyst named Moustache also shared a three-day chart, speaking optimistically about the price lingering in the ATH region. According to Moustache, this situation has only occurred twice before: in 2017 and 2020. And in both periods, the upward trend was maintained followed by new peaks.

“After reclaiming the line in 2012, 2016, and 2020, Bitcoin was just getting started. This will go much higher.”

Cryptocurrency Commentary

According to data provided by Santiment, Bitcoin whales continue to see dips as entry opportunities. This means a big opportunity could soon come to investors’ feet. If BTC indeed starts a quick recovery process as expected, this could offer massive profit realization opportunities in rapidly devalued altcoins.

“Wallets holding 1K-10K $BTC have collectively reached a new peak by accumulating ~$941M worth of BTC.”

Data from CryptoQuant indicates that the BTC balance on exchanges has dropped by 6.54% in the last 90 days. This suggests that more investors are focusing on long-term goals. Despite so much negativity on the macroeconomic front and the SEC’s tight grip on crypto, current market conditions may not be that bad.

Türkçe

Türkçe Español

Español