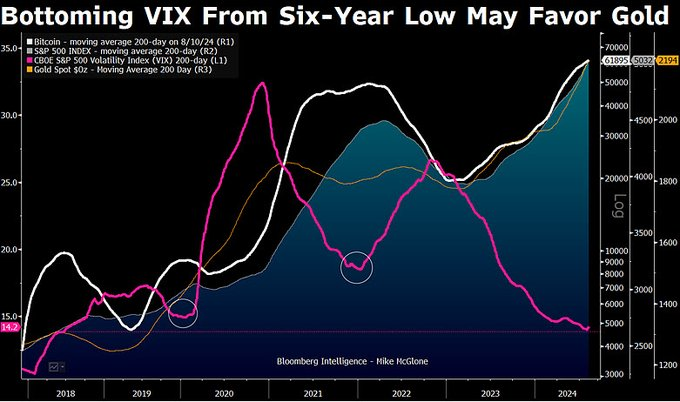

Bloomberg Intelligence’s Senior Commodity Strategist Mike McGlone evaluated the potential impacts of Bitcoin’s (BTC) recent performance on US stock markets. McGlone emphasized that Bitcoin has become a significant indicator in the realm of risky assets and is rapidly maturing, especially in the context of US exchange-traded funds (ETFs). According to him, this maturation process could exert significant pressure on stock markets.

Bitcoin’s Decline Threatens Stock Markets

In an August 10 post, McGlone stated that Bitcoin experienced a notable decline from its previous peaks, revealing vulnerabilities in the stock markets. As of August 10, 2024, Bitcoin was trading at around $60,000 for the first time since March 2021. The expert noted that during the same period, the S&P 500 index was at 3,900 levels, rising to 5,344 on August 9, 2024.

McGlone’s analysis suggested that Bitcoin’s brief drop below $50,000 could create an “excessive burden” on stock markets. He pointed out that the stock markets remaining at high levels despite challenges in the crypto market increased this pressure.

This situation indicates a potential discrepancy between Bitcoin’s performance and traditional risky assets, particularly the S&P 500. McGlone stated, “Falling Bitcoin might be creating an excessive burden for US stock markets to remain high.”

Bitcoin’s Increasing Influence Could Be a Risk Factor for Stock Markets

According to McGlone, the Bitcoin market is becoming a leading indicator for general market sentiment due to its 24/7 operation. As Bitcoin matures, especially with the increasing presence of ETFs, its movements will have a greater impact on other markets.

The commodity strategist highlighted that this situation is significant as it means that when Bitcoin struggles, it could create broader negative effects on stock markets, making it an important risk factor.

Türkçe

Türkçe Español

Español